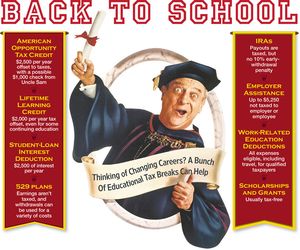

Even Rodney may need an advanced degree to understand this.

Not only are there several different types of tax credits and deductions for education, but

they can vary according to status within college (Freshman,Senior, etc.) and your level of income.

This article from the Wall Street Journal gives

a basic overview of what’s available.

As always, contact us before acting on this or any tax credit.

A brief explanation of these credits and what they cover is

listed below.

[ Note that with the exception of the student-loan interest deduction, taxpayers are prohibited from “double-dipping,” or taking more than one tax break for the same expenses.]

American Opportunity Tax Credit. This is one of the best benefits for those who qualify. It’s a dollar-for-dollar tax offset of up to $2,500 per student per year, for up to four years of undergraduate (but not graduate) education for students enrolled at least half-time in a degree program.

Up to $1,000 of the credit is “refundable,” meaning the family can get a check for that amount from Uncle Sam if no tax is due. If the taxpayer writes a tuition check in December for the spring semester, the credit may be claimed for that year’s taxes.

The credit can be used for books, supplies and equipment as well as tuition, but it can’t be claimed by anyone with a felony drug conviction.

For 2011, the benefit fully phases out at $90,000 of adjusted gross income (AGI) for most single returns and $180,000 for most joint returns. If the family can’t claim the credit and the student has earned income, some advisers suggest running the numbers to see if the student qualifies for the credit on his own.

Lifetime Learning Credit. While less generous than the American Opportunity Tax Credit, this is a useful tax offset of up to $2,000 for tuition and fees per year per family. It applies to graduate as well as undergraduate education, plus continuing-education courses taken to acquire or improve job skills.

The credit fully phases out at $122,000 of AGI for most joint returns and $61,000 for most single returns.

Qualified Tuition Programs (“529 plans”). 529 plans are often the best education benefit for taxpayers who don’t qualify for other breaks, in part because there are no income phaseouts. Individual donors (often parents and grandparents) may put up to $65,000 per beneficiary into a 529 plan once every five years, without gift tax consequences.