The theory of relativity is in the tax code

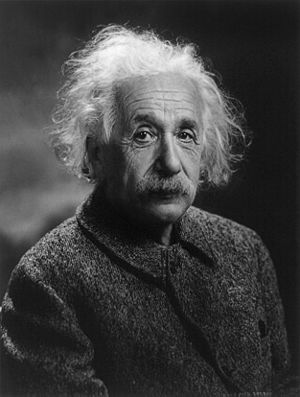

This is not the theory discovered by Einstein, but the one that states that certain tax advantages may be disallowed if you sell an asset to someone (or a company) that the tax code calls a “related party.”

Simply put, selling a capital asset at a loss to any of the following entities will cause the loss to be disallowed.

- Children or grandchildren

- Parents or grandparents

- Brothers or Sisters

- A company that is more than 50% controlled by you (directly or indirectly)

Although there is no current loss allowed, there is still a tax benefit remaining.

Clients can email us for more information.