Some folks will see a 74% increase in the tax rates in 2013-(from the WSJ)

We’re not kidding about the higher part as the new capital gain rates (remember the “capital” in capitalism). Just put your mouse over the picture to see proof that capital gains could go as high as 25% in 2013 ( a 67% increase)! The Wall St Journal says it best in their July 2, 2012 article.

We’re not kidding about the higher part as the new capital gain rates (remember the “capital” in capitalism). Just put your mouse over the picture to see proof that capital gains could go as high as 25% in 2013 ( a 67% increase)! The Wall St Journal says it best in their July 2, 2012 article.

Get Ready for the New Investment Tax

(Link to the entire article)

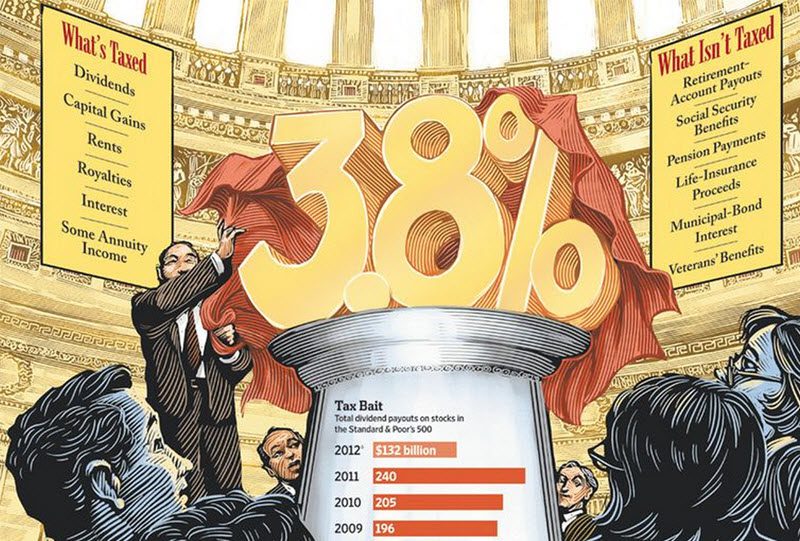

How does the 3.8% tax on investment income work?

It applies to most joint filers with adjusted gross income above $250,000 and single filers with adjusted gross income above $200,000.

Adjusted gross income is the number at the bottom of the front page of form 1040; it includes interest, dividends, capital gains, wages and retirement income plus results from partnerships and small businesses, but it doesn’t include subtractions for itemized deductions such as mortgage interest and charitable gifts, or personal exemptions.

The new levy is complex, but in effect it is a flat tax on investment income above the $250,000/$200,000 threshold. Note that while the tax applies only to investment income above the threshold, other income—such as wages or Social Security—can raise adjusted gross income, making investment income more vulnerable to the tax.

How is “investment income” defined?

Absent guidance from the IRS, experts believe the tax applies to dividends; rents; royalties; interest, except municipal-bond interest; short- and long-term capital gains; the taxable portion of annuity payments; income from the sale of a principal home above the $250,000/$500,000 exclusion; a net gain from the sale of a second home; and passive income from real estate and investments in which a taxpayer doesn’t materially participate, such as a partnership.

The tax doesn’t include payouts from a regular or Roth IRA, 401(k) plan or pension; Social Security income; or annuities that are part of a retirement plan. Also not included are life-insurance proceeds; municipal-bond interest; veterans’ benefits; Schedule C income from businesses; or income from a business on which you are paying self-employment tax, such as a Subchapter S firm or a partnership.

What are some examples of when the tax would and wouldn’t apply?

Example 1: A married couple filing jointly has $400,000 of adjusted gross income—$240,000 of wages plus $160,000 of investment income composed of interest, dividends and net gains from the sale of raw land. Because they have $150,000 of investment income above the $250,000 threshold, they would owe an extra 3.8% of that amount, or $5,700, in tax.

Example 2: A retired couple filing jointly has no wages but does have taxable IRA payouts of $100,000, plus pension and Social Security payments totaling $60,000. They also have dividends and taxable interest of $40,000, plus $40,000 from the sale of two investments. They owe nothing, because their income is below the $250,000 threshold.

Example 3: A single taxpayer earns $60,000 of wages but nets a windfall of $180,000 from the sale of a long-held investment. Because she has $40,000 of investment income above $200,000, she owes $1,520 of extra tax.

Example 4: A single taxpayer has income of $220,000, but all of it comes from Social Security benefits and pension and regular IRA payouts. None of the income is subject to the 3.8% tax.

How would the 3.8% tax apply to the sale of a principal residence?

It would apply if the net gain on the sale exceeds the $500,000 exclusion for joint filers ($250,000 for singles) and the taxpayer’s income also exceeds the adjusted gross income threshold.

For instance, suppose a couple bought a residence long ago for $100,000 in a high-cost city such as New York or San Francisco. In 2013, when they have wages of $100,000, they sell the home for $1.5 million. After subtracting the $100,000 cost of the home and the $500,000 exclusion, they have investment income of $900,000. That plus their wages puts them $750,000 over the $250,000 AGI limit, and they would owe $28,500 in extra tax.

If, however, a single person bought a house many years ago for $50,000 and sells it for $350,000 next year, after subtracting the $50,000 cost and the $250,000 exclusion, the investment income is $50,000. If this taxpayer has $150,000 or less of other income, no extra tax will be owed. But if he earns $150,000 of wages and has $20,000 of dividends and interest, then he would owe extra tax on $20,000, or $760.