Hidden traps in Obamacare for 2013

On a regular basis we are finding these little hidden gems in the Affordable Care Act that no one is talking about. For example, the requirement for businesses with HRA’s set up to help their employees with health care costs to file IRS Form 720 by July 31, 2013, and pay $1 per each employee in additional tax for establishing this employee benefit.

Or how about this one: one of the concepts behind the health care act was that by establishing exchanges small businesses could shop for competitively priced insurance. Great idea, but on April 3rd the administration announced that for 2014 only 1 insurer would be allowed in the exchange for small businesses this somewhat destroys the competition idea!

Or there is always the small business health care credit. When included in the 2010 affordable care act, it was touted as the solution for small business employers to provide health insurance to employees by receiving a 35% federal tax credit. Sounds good doesn’t it and it sure continues to get a lot of press. The reality came to light in May when the IRS announced that less than 5% of the estimated credits had actually been used. The reason is simple the calculation of the credit is so incredibly complex that when combined with the fact that no credit is available for business owners, their family, or highly paid employees and that the cost of accumulating the information far exceeds the amount of the credit just ask any small business tax professional. If you doubt this, just click here for some proof!

The above credit is supposed to increase to 50% in 2014. Now on paper that also sounds good and overcomes some of the previous cost/benefit arguments. However, what is not being mentioned is the fact that to get the 50% credit, the business must cancel their existing insurance and buy new insurance from the exchange in 2014! Yes, that would be the exchange that now only has 1 non-competitive insurance provider!

Many of us have recommended and continue to recommend a special fringe benefit to our clients known as the Health Reimbursement Arrangement (HRA). This fringe benefit is particularly useful now for all employees and for many small businesses as a result of the Affordable Care Act (ACA).

For example, an employee now needs to exceed 10% of AGI in most cases to have deductible medical expenses, and at that level they still need to make enough income to then pay 30-40% of it out in various federal, FICA and state income taxes in order to have the money left to pay the medical expenses. This means that most Americans do not qualify for any medical deduction at all; and even if they do, they all are using after-tax money.

A simple solution that we have recommended for years has been for an employer to establish an HRA. The HRA works for even the smallest sole proprietorship in many cases, but that discussion is best left to another day. Suffice it to say the HRA was and still is one of the absolute best health care and tax planning tools available today.

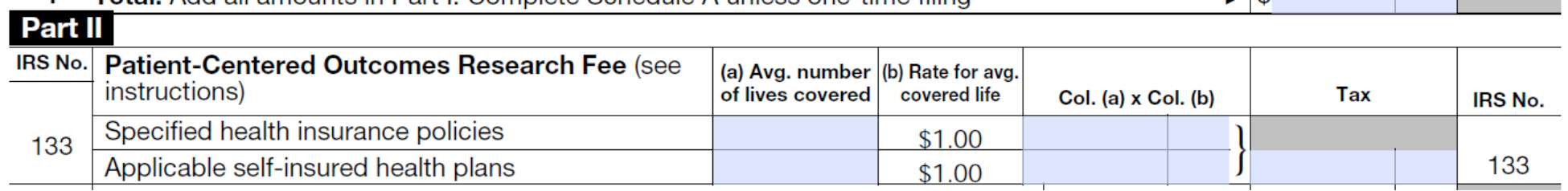

The problem is one that was hidden deep in the 2,700 pages of the ACA. An HRA generally must file a Form 720 excise tax form and pay a fee by July 31, 2013. As a result of a provision of ACA known as the Patient-Centered Outcomes Research Institute Fees (PCORI), most insurers and self-insurers will have to pay an annual $63 reinsurance fee to this institute, per covered employee. This is not the fee we are talking about in this alert although a few of you have heard of this fee.

What we are alerting everyone to is the other hidden research fee that requires small businesses to file Form 720 and pay $1 per covered person by July 31, 2013 using IRS Form 720. Hidden in the 12/5/2012 final regulations from IRS is the provision applying the $1 per employee research fee and the Form 720 filing requirement to most HRA employer-sponsors.

Here is the summary: Although a few employers may have both an HRA as well as a self-insured general health insurance plan and are not subject to this additional special research fee, our clients generally do not offer self-insured health insurance plans. The bad news is that very few, if any, clients are self-insured for general medical insurance purposes. Our clients purchase conventional insurance from insurance companies and are subject to the additional special research fee if they sponsor an HRA. Therefore most if not all of our clients are businesses that are required to pay the research fee directly to the institute if they maintain a normal HRA as well as a conventional group insurance plan. (And yes, this means that these employers may be paying both the $63 per employee reinsurance fee to the health insurer as well as the $1 per employee research fee to the institute.)

So how is the fee paid? Using Form 720, the employer is required to file the form for plan years ending on or after October 1, 2012 by July 31, 2013! Do you want even more bad news? It goes to $2 per head next year. When preparing Form 720, enter the number of covered employees calculated in the 720 instructions in Part II at Code 133 as applicable self-insured health plans; multiply by $1 each, and file and pay by 7/31/2013.

Is there any more bad news? Yes if the employer sponsors a health flex spending account, it is required to pay the $1 per person fee on Form 720 as well, unless the flex account is limited to dental, vision, etc.

Is there any good news here? Yes. If your HRA only reimburses for dental, vision, accidents or a few other obscure items, your HRA is considered to consist solely of “excepted benefits” and is not subject to either the $1 per head research fee or the $63 per head reinsurance fee. The same is true for the health FSA.

Accurate and timely tax planning is more important than ever. Don’t hesitate to contact us for help.