Corporate inversions – the new buzz word of the statist

You see the term in everything from the Wall Street Journal to the Huffington Post. It’s the newest buzzword of the statist crowd. Corporate inversion is the in-vogue term for a company merging with a foreign corporation or relocating outside the US for tax or economic reasons. To see why this is happening, just click the chart at the end of this post.

What is particularly galling is that Washington is trying to push this as an unpatriotic move by business. Indeed, it has been called un-American by leading politicians.

Every once in a while, I find someone who can say it better than I can. Here’s a revealing quote from David Brunori of the Tax Analysts Blog.

“Please spare me from another story about unpatriotic,greedy,immoral companies failing to pay their fair share in taxes. Yes, companies invert as part of their tax planning strategies. Yes, inversions cost the federal government about $2 billion annually, which would cover lunch for our defense contractors. But talk about blowing an issue out of proportion. The inversion “emergency” pales in comparison with the overall problems with the American system in general and the corporate tax system in particular.

Companies invert because the stupid tax laws provide an incentive to do so. A company’s decision to invert is no different from an individual’s decision to live in a state without an income tax or to buy a house rather than rent to take advantage of a tax break. Yet there are people who actually make the moral and patriotic arguments against inversions. The “it may be legal but that doesn’t make it right” argument is laughable. The patriotic argument — usually made by people who had better things to do than serve their country — is even more laughable. People and companies engage in tax planning because they want to keep more of their money. Invoking the Good Book or channeling Nathan Hale won’t change that.”

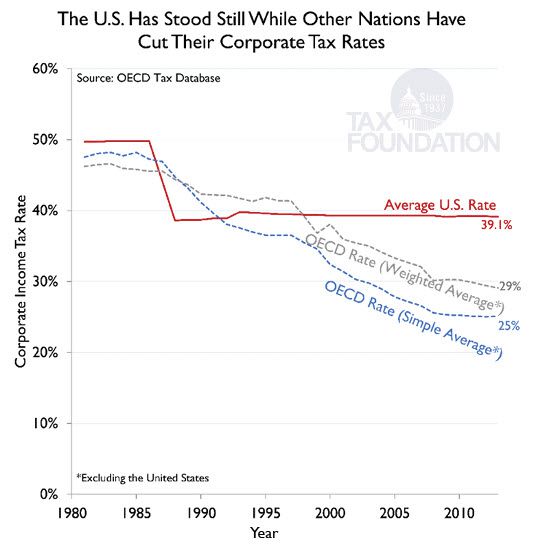

It’s an axiom of life that the more you tax something the less of it you get. The chart below (click for a enlarged view) reflects a tax on productivity in our American business community. Thus if you place a punative tax (via higher rates than other countries) on productivity, what is the logical result?

With my friends who love to talk about inversion, I’d ask a variation of the author’s quote below.

“Do you claim 100% of your mortgage interest on your tax return? If so, why? Does that make you unpatriotic?”

[blockquote quote=”“A company’s decision to invert is no different from an individual’s decision to live in a state without an income tax or to buy a house rather than rent to take advantage of a tax break.” ” source=”David Brunori Tax Analysts Blog” align=”right”]

[Editor’s Note:] Subsequent to the publication of this post. President Obama has gone on record as blaming the accounting profession for this problem! Last time I checked we didn’t get to write the tax code- that’s the job of those in Washington. Check our blog in the next few days for Part II of this post where we’ll demonstrate just how flawed that logic is. And speaking of CPAs and tax planning, kudos to the President’s tax preparer for taking the maximum SEP-IRA deduction on his personal tax return for his book royalties. I guess legally saving taxes wasn’t unpatriotic in that case, Mr. President?