Hitting the target with the Business Income Deduction

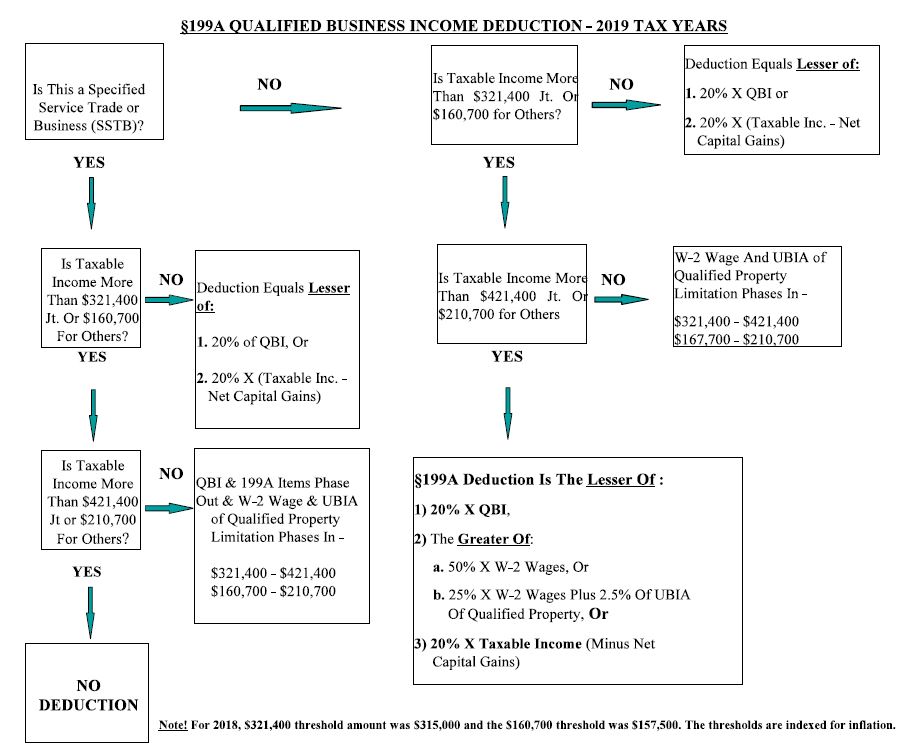

The new deduction of 20% of qualified business income (QBI) has been a source of confusion for clients (and accountants as well). But given that this is a deduction that you can obtain without spending additional money from your business, it’s well worth some effort to understand. You can find what defines a SSTB (see the first box below) at this link. Follow the yellow-brick road with the chart below, and you may find a financial reward at its end.

xhttp://sstb

x

x

What is a Qualified Trade or Business?

In General

Section 199A defines a qualified trade or business by exclusion; every trade or business is a qualified business other than:

- The trade or business of performing services as an employee, and

- A specified service trade or business

This second category of disqualified businesses serves the same purpose as the first, to prevent the conversion of personal service income into qualified business income. This latter category, however, takes aim at business owners, rather than employees, prohibiting the owner of a “specified service business” from claiming a Section 199A deduction related to the business.

Section 199A(d)(2) defines a specified service business in reference to Section 1202(e)(3)(A), which includes among the businesses ineligible for the benefits of that section:

…any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees.

Section 199A modifies this definition in two ways: first, by removing engineering and architecture from the list of prohibited specified services businesses, before then amending the final sentence to reference the reputation or skill of one or more of its “employees or owners” rather than merely its “employees.”

Section 199A(d)(2)(B) then adds to the list of specified service businesses any business which involves the performance of services that consist of investing and investing management, trading, or dealing in securities, partnership interests, or commodities.