IRS-Based Scams

[icon image=”megaphone” align=”left” width=”45″]

[alert style=”danger” close=”false”]

[Editor’s Note]

Update – All the information below the next parargraph is from an older post with examples of IRS-based scams.

The newest breach of your tax return data from the IRS’ computers is detailed by CNN Money at this link.

I’m just guessing, but I suspect the 60 million in IRS bonus money didn’t go to the IT Department; and unlike the data compromised with Target and Home Depot, you’ve no legal recourse here.

We have three words of advice for all clients – “Credit Freeze Now!”

Clients who need help on how to do this can contact us. [/alert]

IRS internet scams are famous (or infamous) and have been around a long time. The post below is a warning of these e-mail and call scams that we published months ago.

However, among professional con men there’s an old saying – “there’s no scam like an old scam.” What they mean by this is that the basic appeal of the con is the same although the technology to deliver the scam may improve.

Nowhere is this more true than with scams that appear to be emails from the IRS. We’ve reproduced below some examples of the most infamous tricks used during the past few years.

Just remember one rule: The IRS will never, ever initiate contact via email. Some high-level Revenue Agents have a business email, but it’s used for incoming items only.

Let’s review what the scam emails look like so you’ll be ready for them:

[icon image=”megaphone” align=”left” width=”45″]

[alert style=”danger” close=”false”]

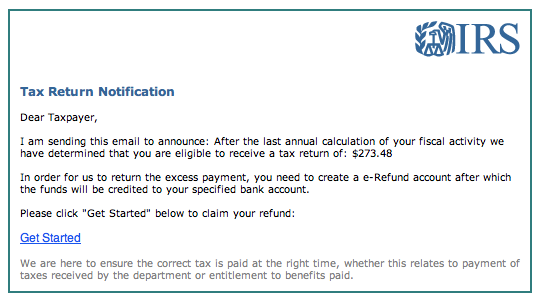

This one is an example of the “we changed your return and you’re due a refund” ploy.

It has been around for 2 years or so and attempts to elicit your banking information.

[/alert]

[icon image=”computer” align=”left” width=”45″]

[alert style=”danger” close=”false”]

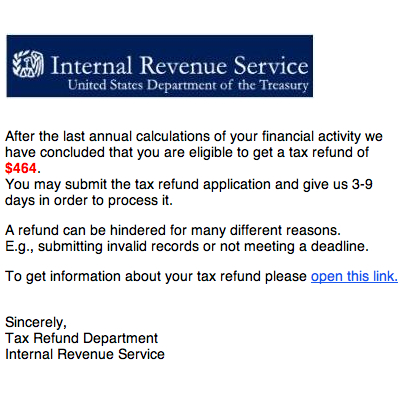

This scammer opts for the subtle approach. His goal is to get you to click on his computer-infecting virus link.

The virus will then proceed to send your confidential information to his website.

[/alert]

[icon image=”bullseye” align=”left” width=”45″]

[alert style=”danger” close=”false”]Lastly, there is the “you are in non-compliance, but we’ll give you 14 days” scam. The purpose is the same. When you click on the link, your computer is taken over by a bot that transmits your banking logins and other passwords to the sender of the email.[/alert]

| l |

|

Now that you know what the tricks look like, you can avoid getting taken.

You should always delete these emails, empty the Recycle Bin, and run a virus scan immediately when you receive anything like the above.

If you have friends or business colleagues that could benefit from this knowledge, use this link to share this article with them.