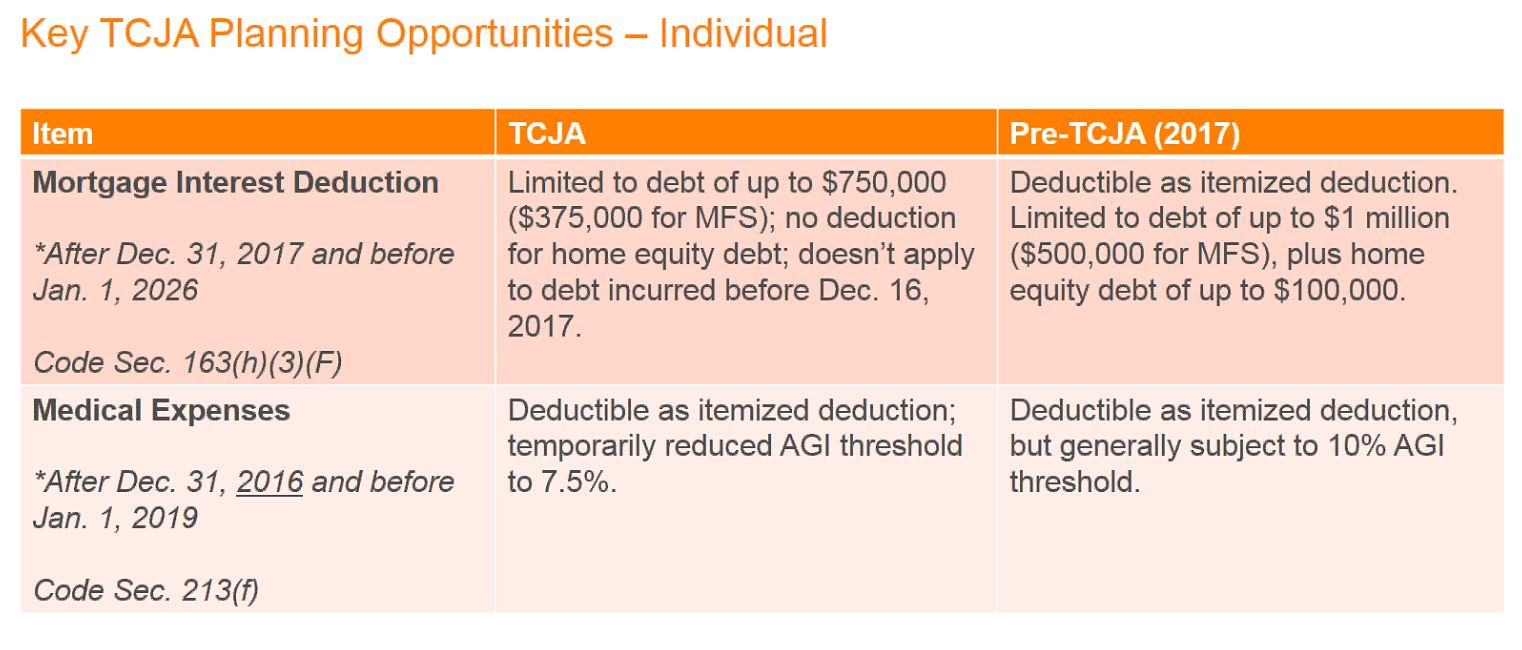

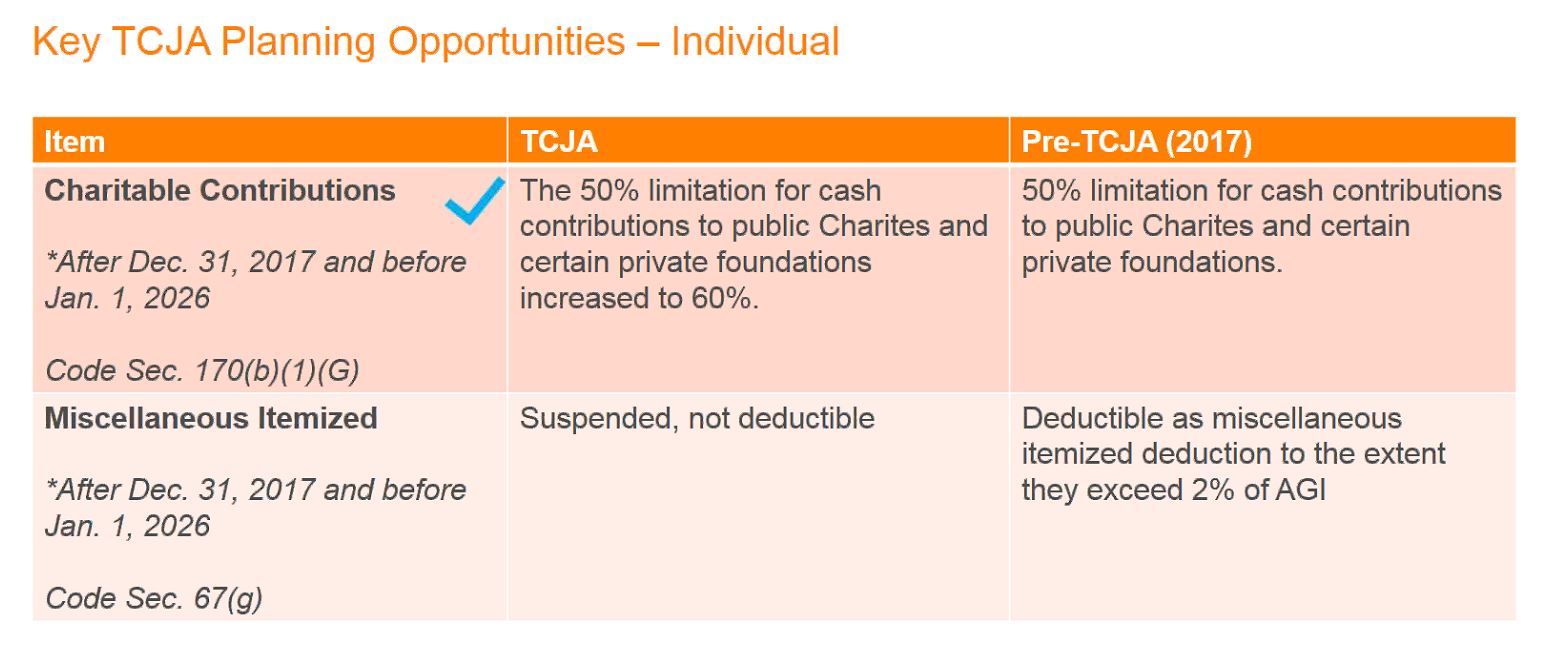

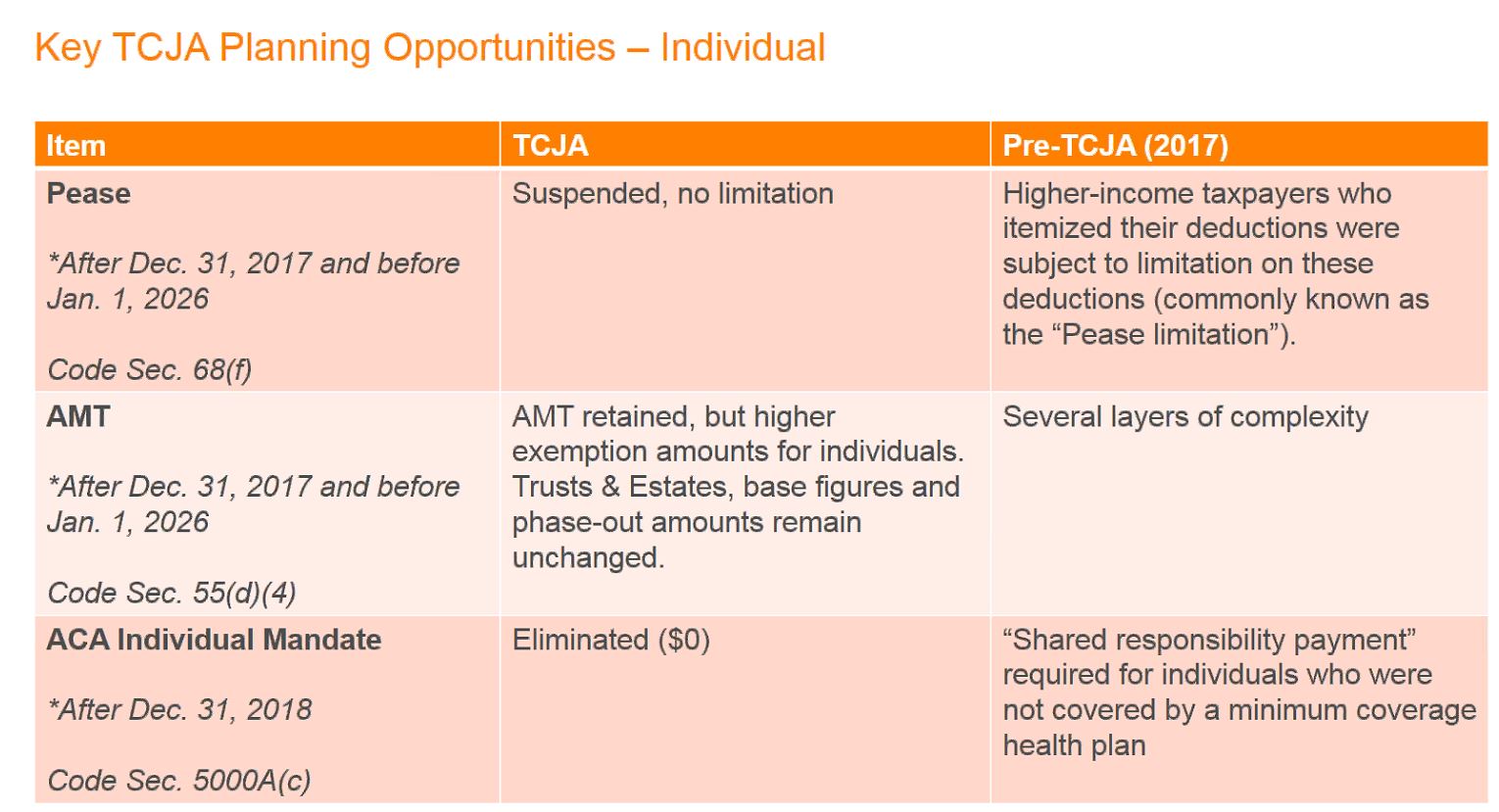

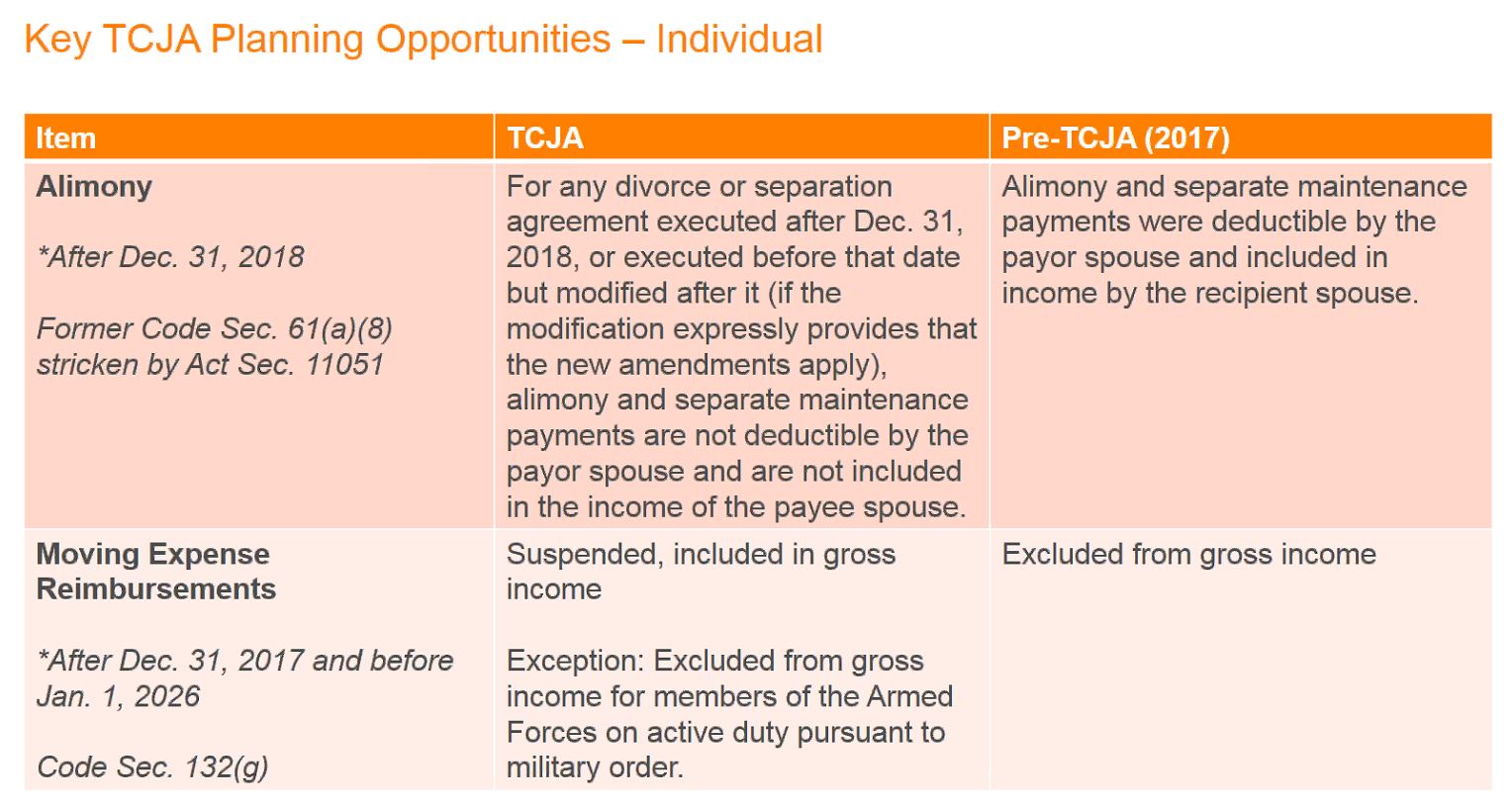

Cliff notes of the new tax law

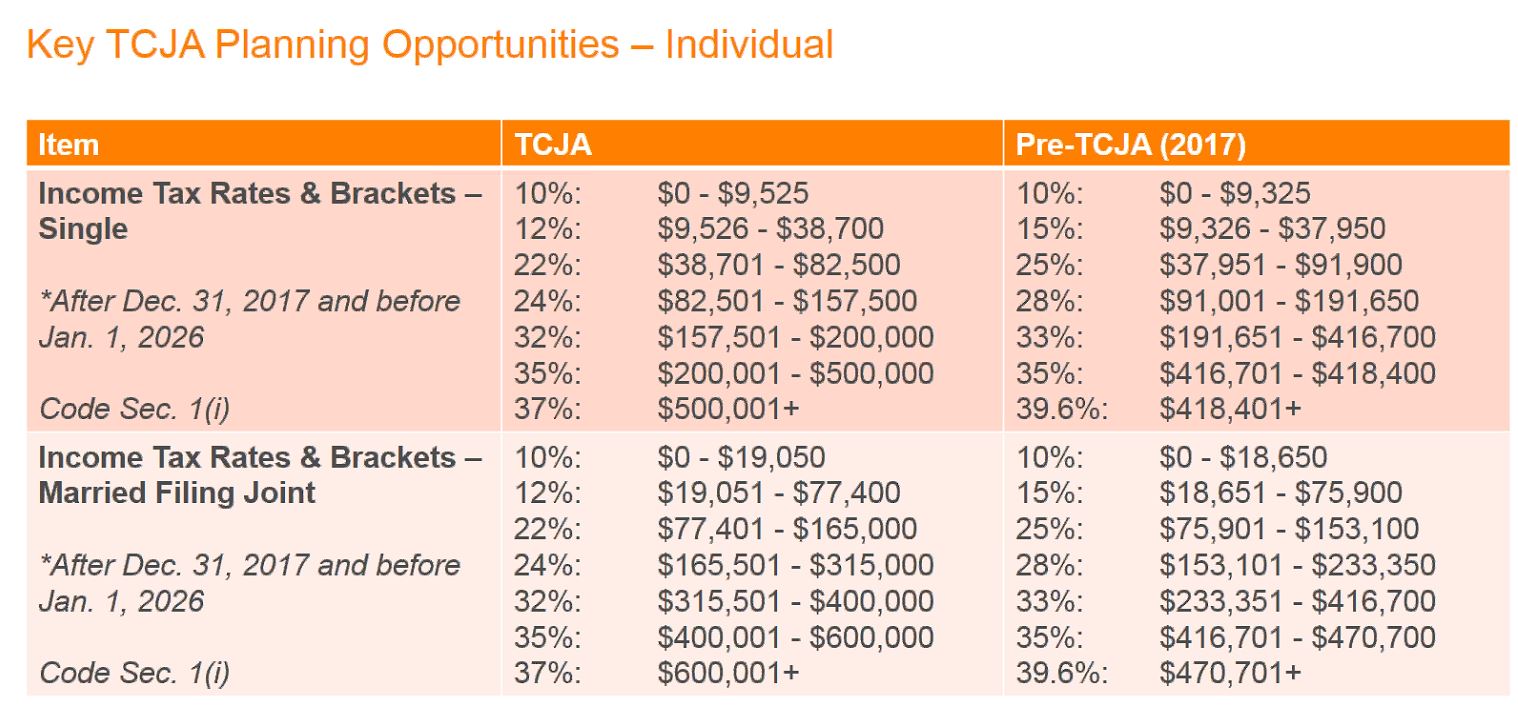

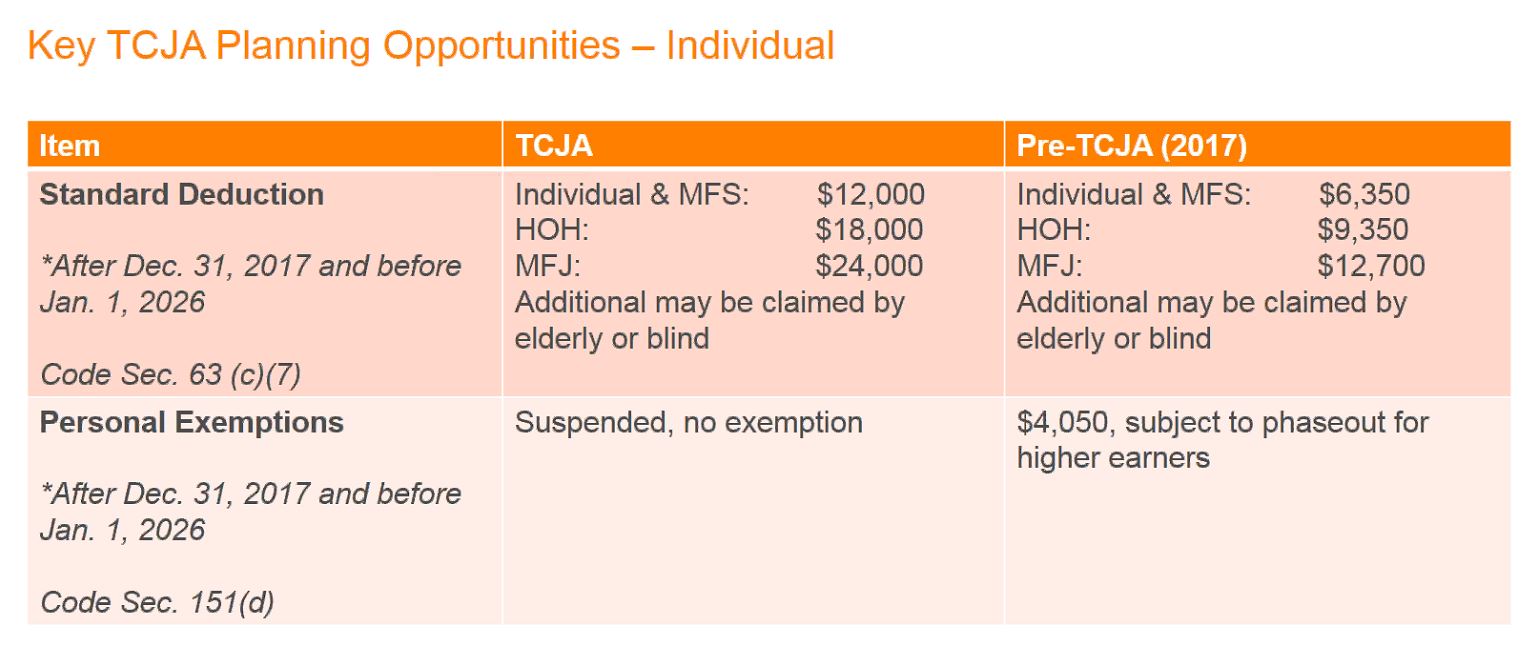

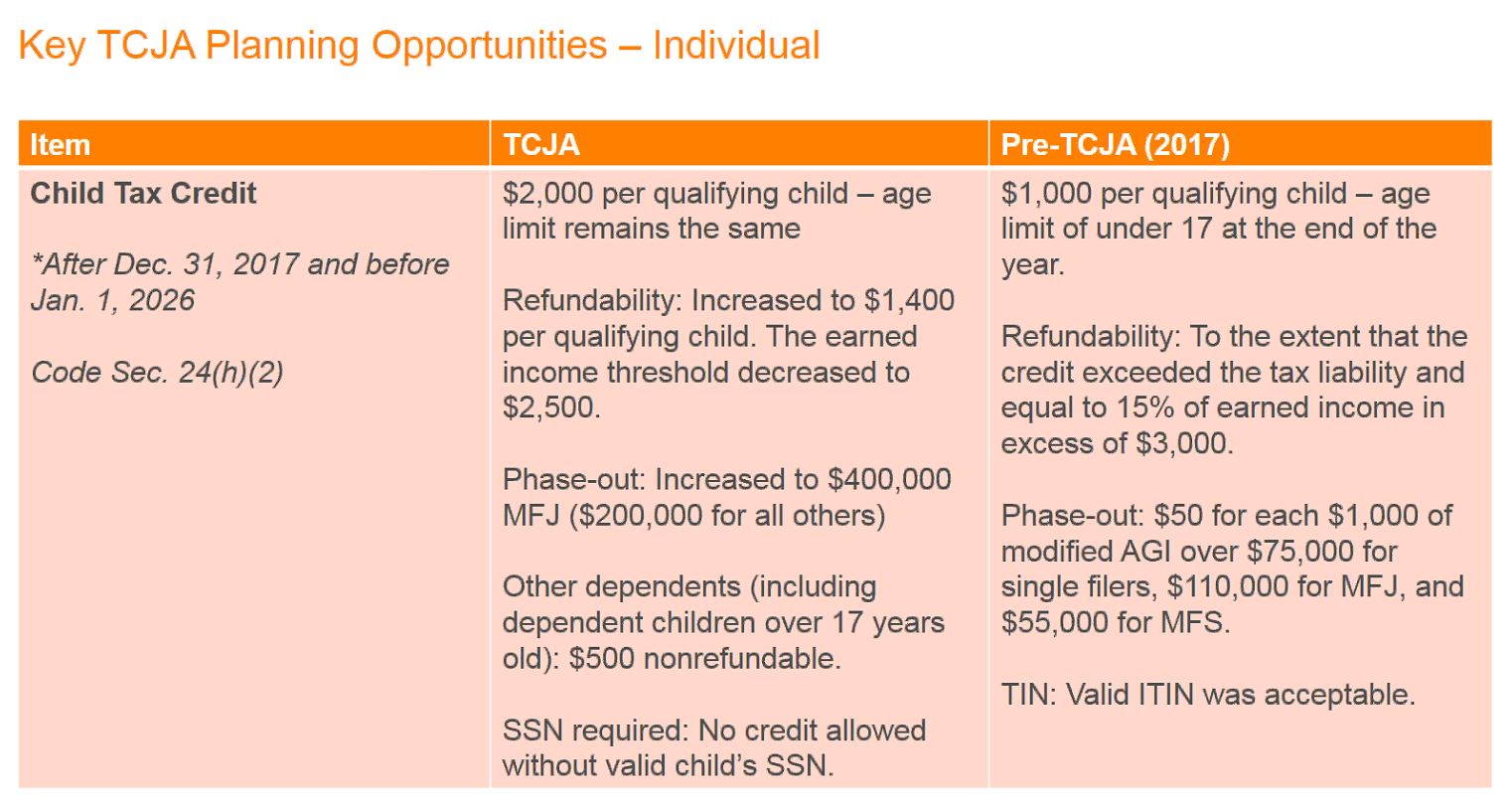

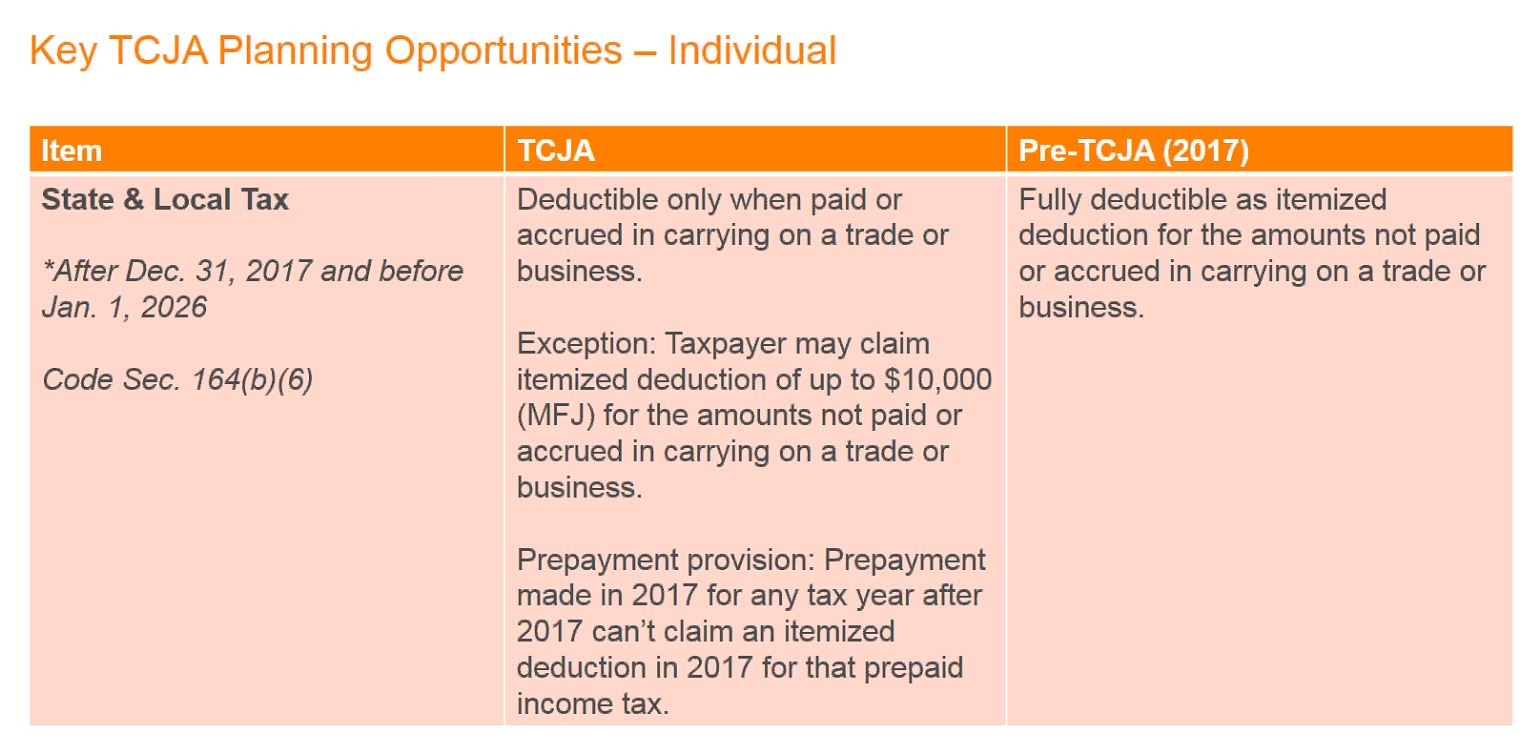

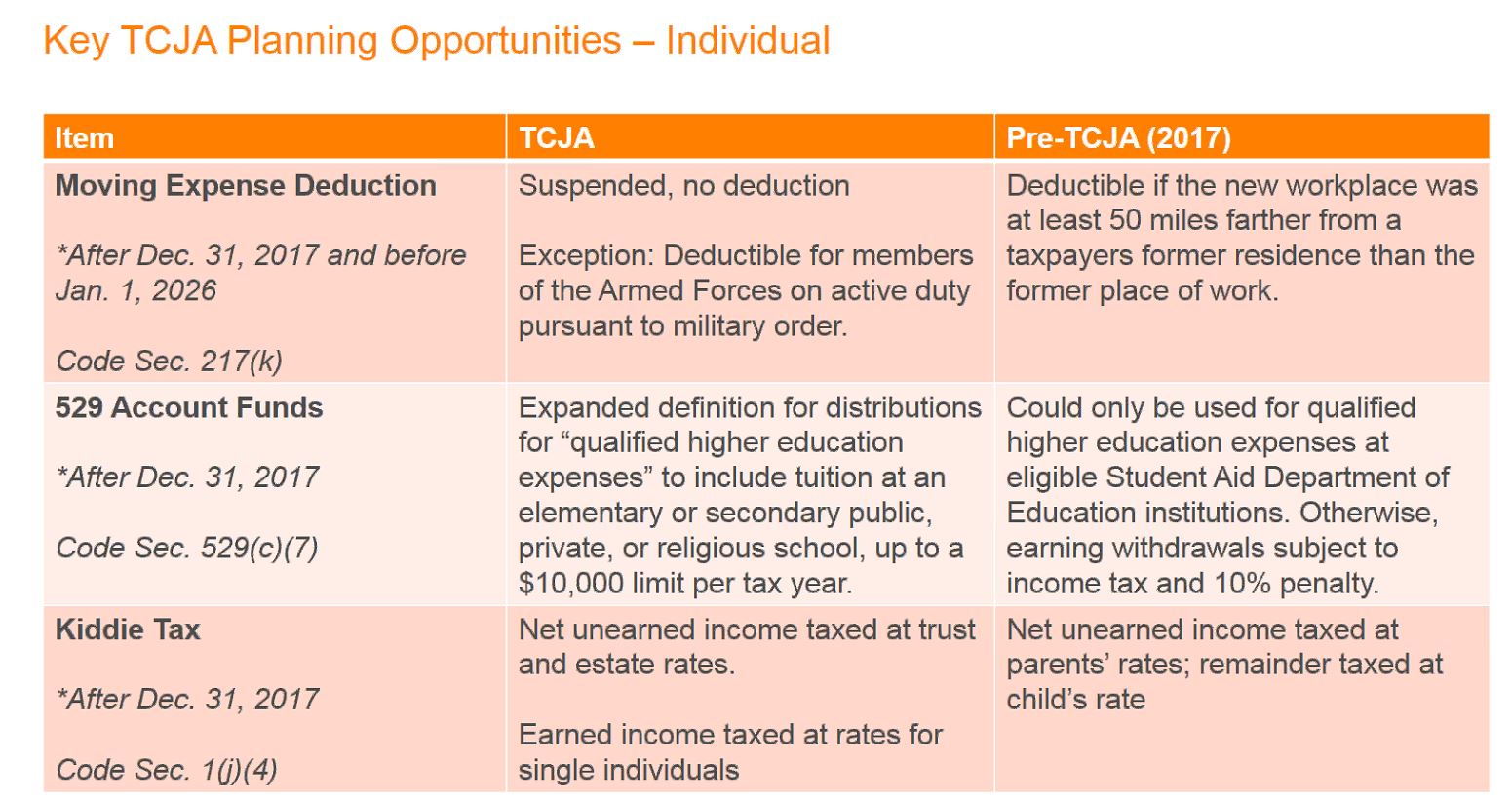

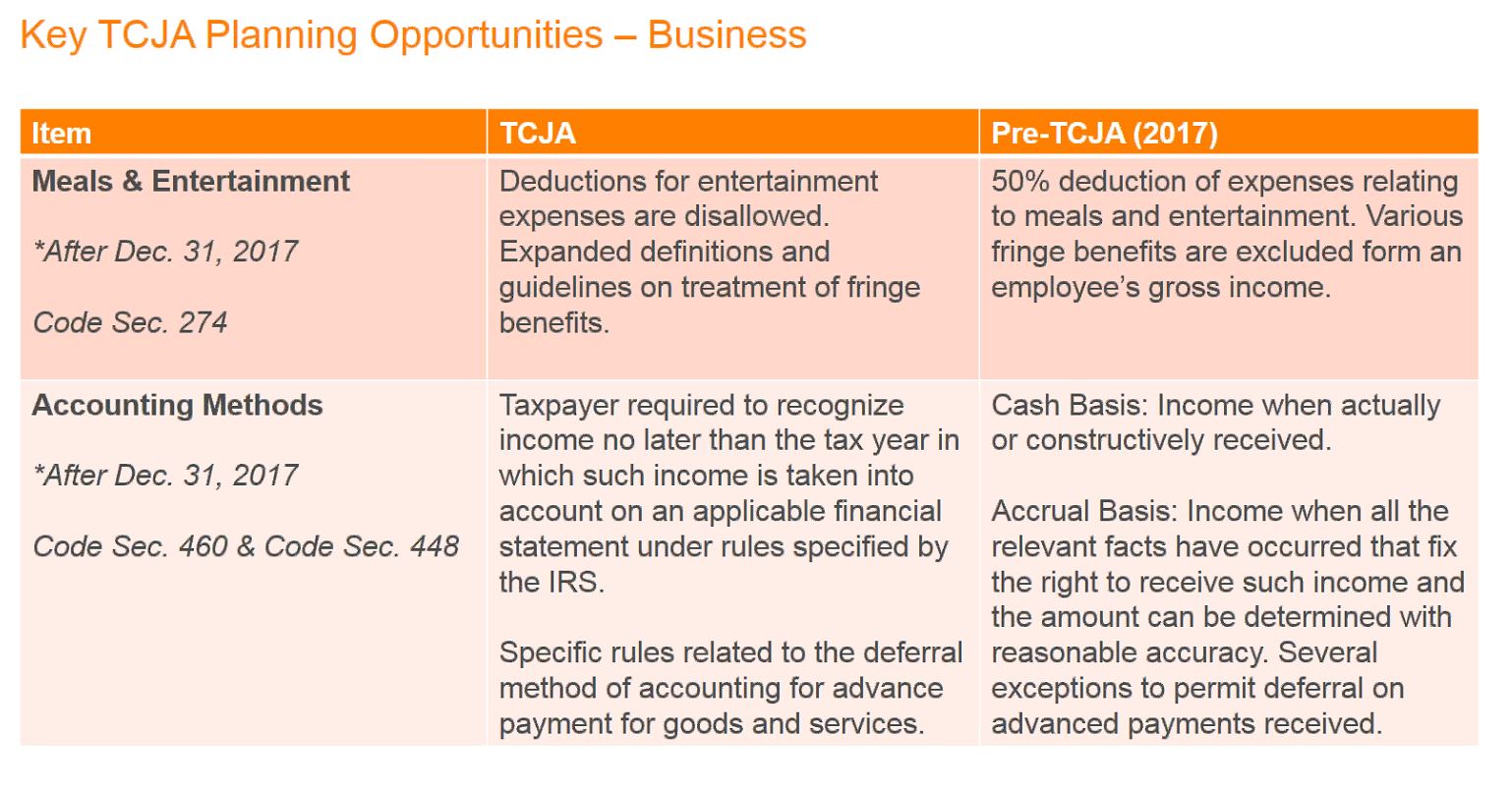

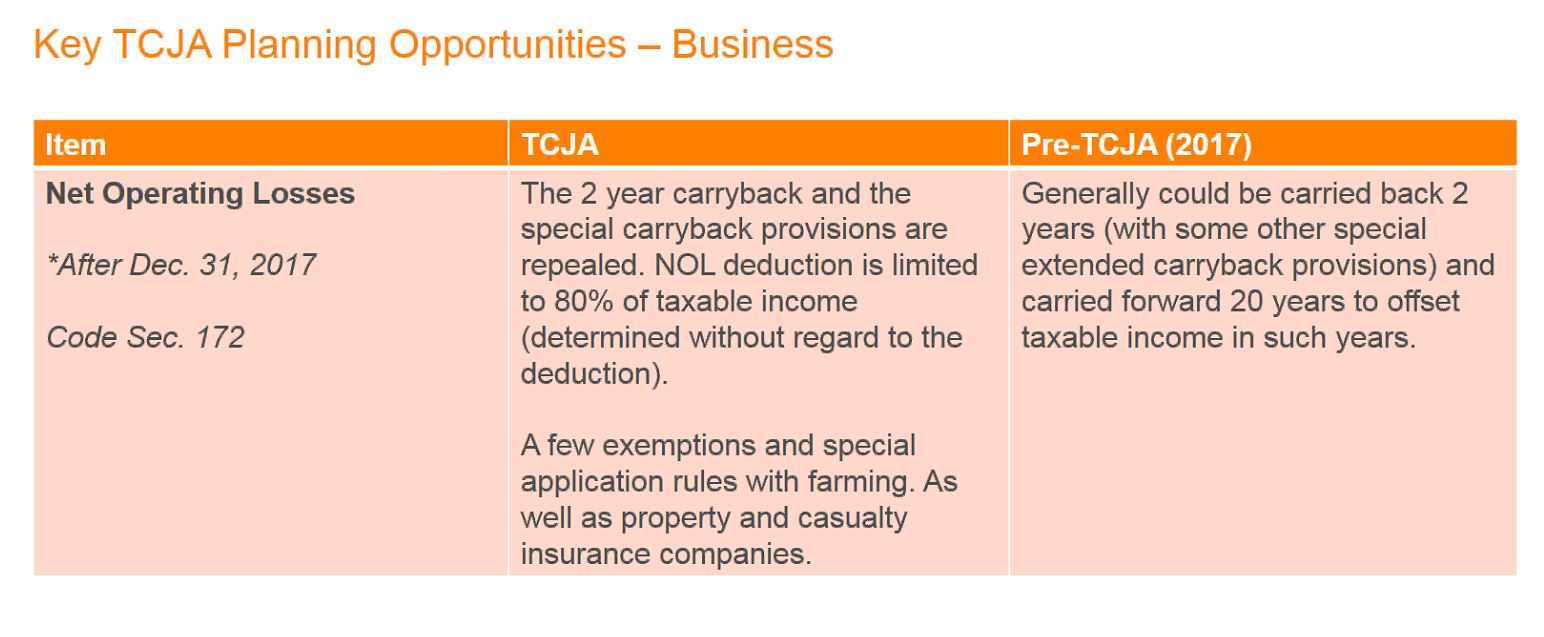

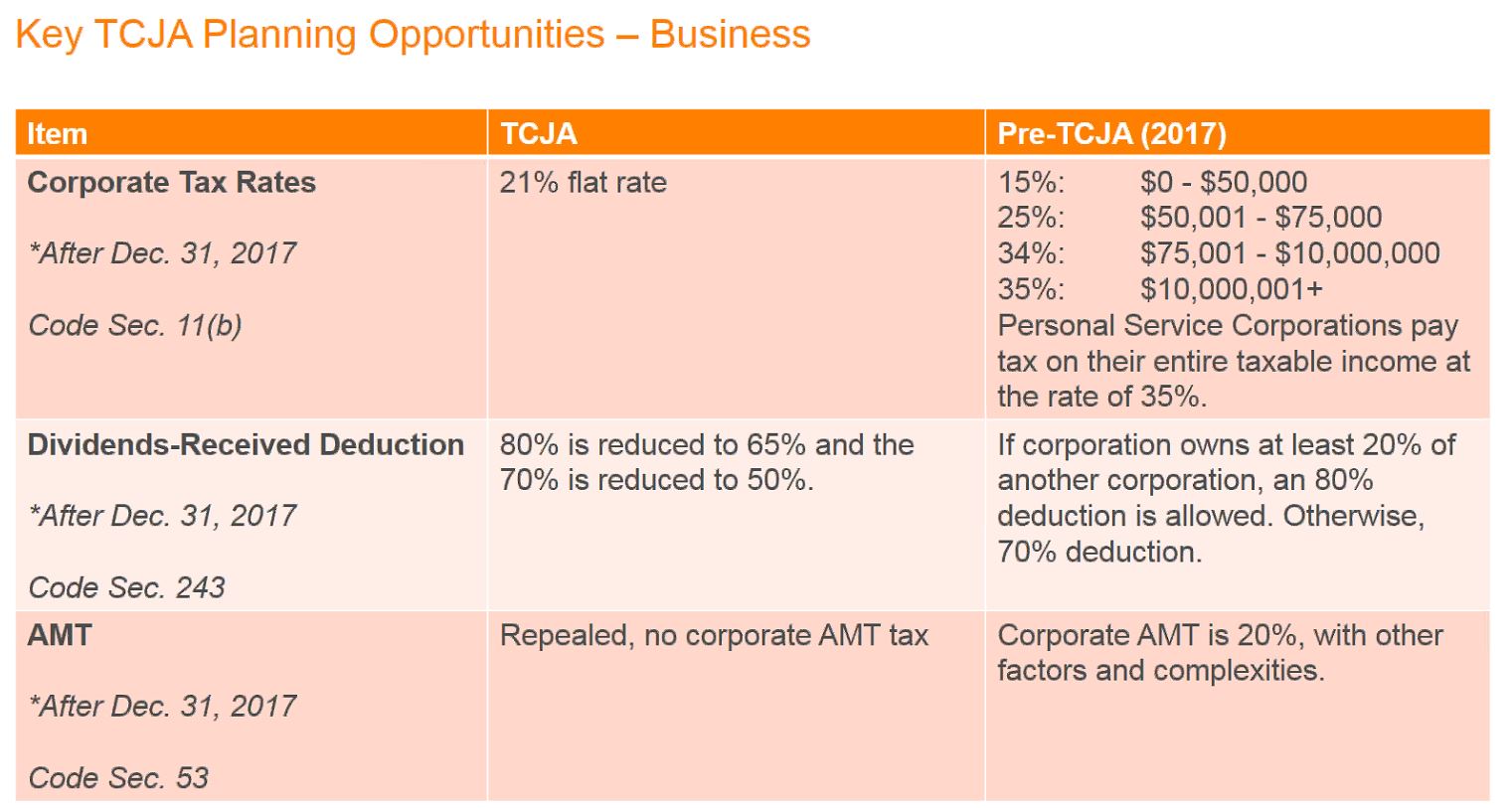

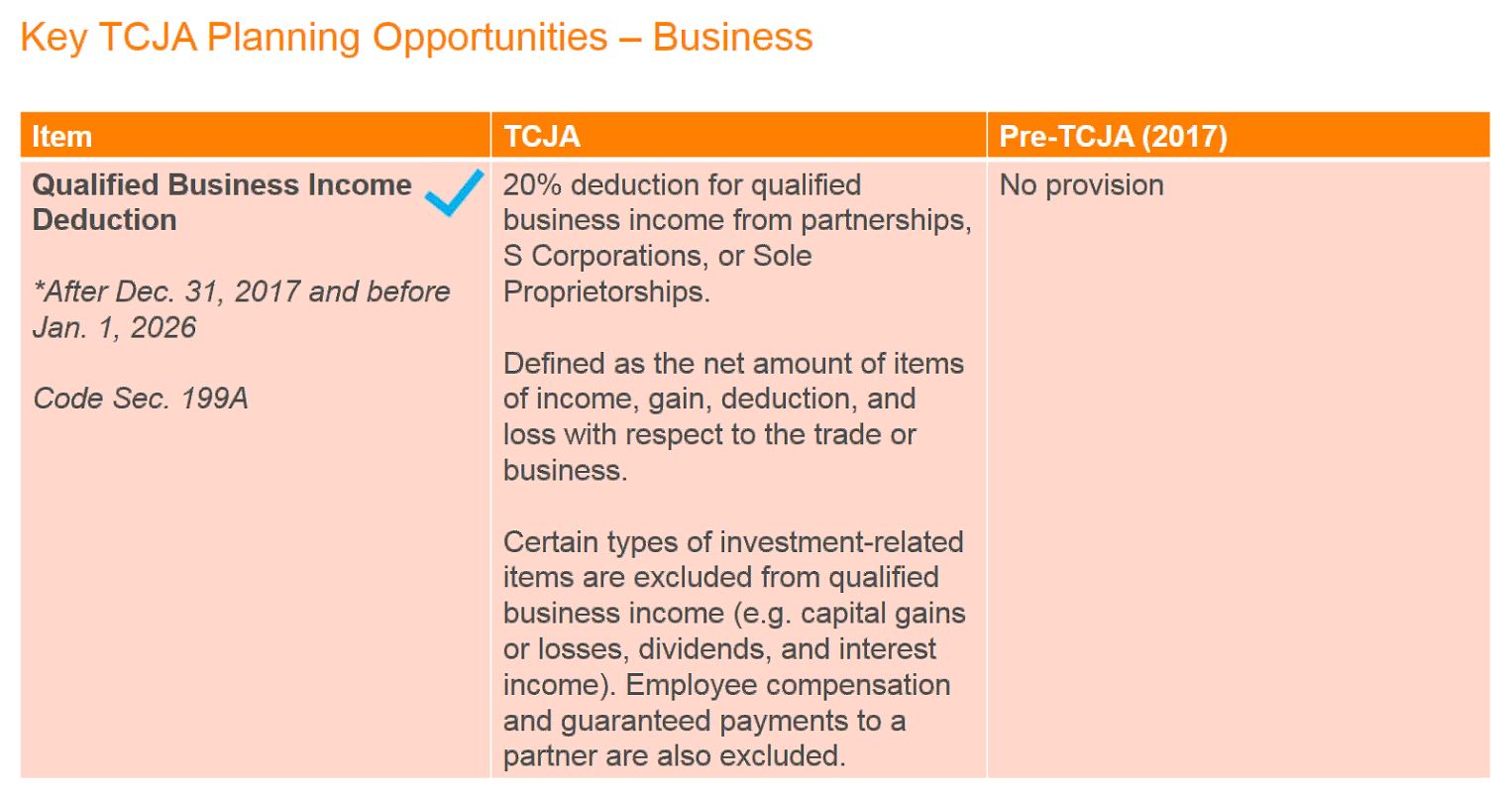

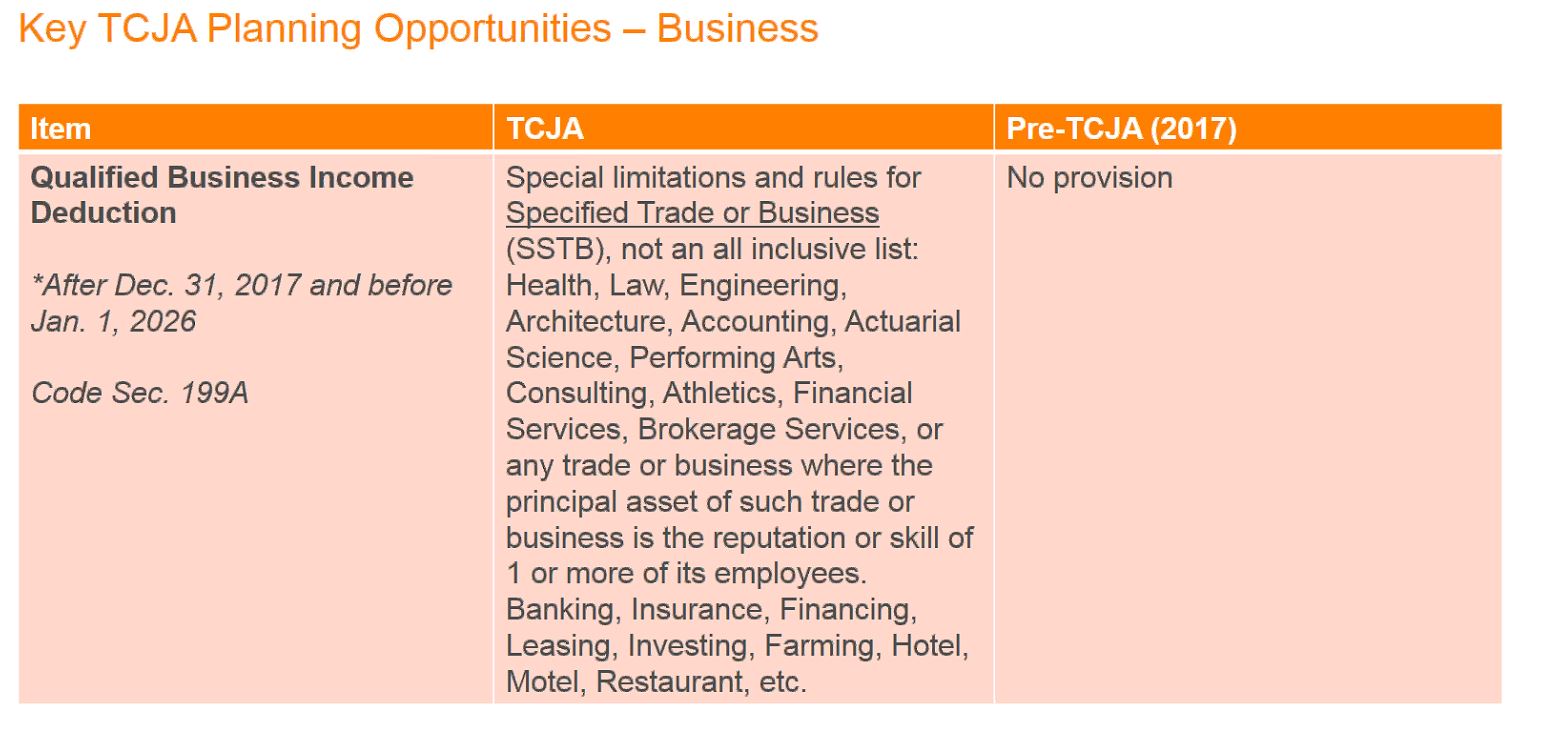

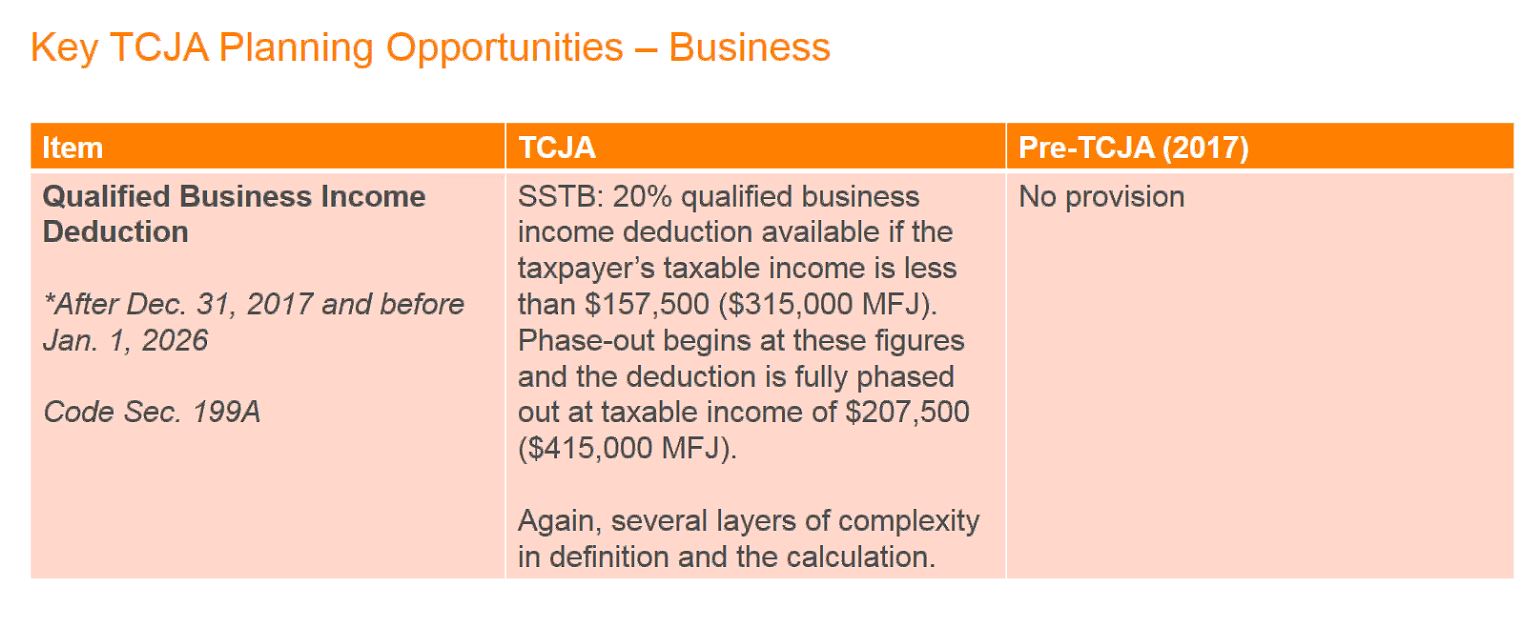

Most clients don’t really need to know all the aspects of Tax Reform. But a quick reference guide can be helpful. From the new rules on alimony to 529 plans to mortgage interest limitations to meals and entertainment and the new 20% business income deduction – here’s the tip sheet you’ll want to print and keep for reference. If you want to do a deep dive into the various code sections our prior post on charting tax reform can help.