A tutorial for business owners on the new Medicare tax

When: Effective 2013

What: An additional payroll tax of .9%

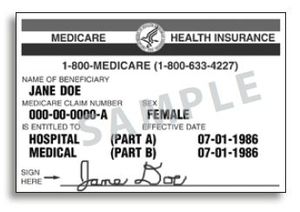

English: Centers for Medicare and Medicaid Services – Medicare & You 2010, official government handbook. (Photo credit: Wikipedia)

An individual is liable for Additional Medicare Tax if the individual’s wages, other compensation, or self-employment income

(together with that of his or her spouse if filing a joint return) exceed the threshold amount for the individual’s filing status:

| Filing Status | Threshold Amount |

|---|---|

| Married filing jointly | $250,000 |

| Married filing separately | $125,000 |

| Single | $200,000 |

| Head of household (with qualifying person) | $200,000 |

| Qualifying widow(er) with dependent child | $200,000 |

Do employers have to match this extra Medicare like they do with the normal Medicare withholding?

In a word -NO. Special rules apply here. The likely result is to drive companies that write the software for payroll out of

their minds.

When does this required withholding begin for an employee?

Once their wages exceed the amounts in the above table. In addition, it’s only on the amount that exceeds

the thresholds in the table (see IRS mandated exception below).

Does it apply to non-cash taxable fringe benefits?

In a word,YES.

Regardless of the above table, does an employer have to withhold this tax for all wages over $200,000 regardless of whether they are single, married, etc.?

In a word (you guessed it), YES!

Wait a minute! What if it’s withheld and employee winds up not owing the tax?

The 1040 is being modified to reflect a tax credit for folks in this situation.

What happens if:

one spouse earns $210,000 and the other spouse earns $25,000, and the couple files a joint return. Although the employer would be required to withhold on the higher earner’s wages to the extent they exceed $200,000, the couple would not be liable for the additional Medicare tax

because their combined income is less than the applicable $250,000 threshold.

Answer – the excess additional Medicare tax withheld will be credited against the total tax liability shown

on the employee’s personal income tax return.

Source:IRS website