Can you guess what’s coming next?

Laura Saunders has a great exercise in predictive logic in the tax section of the Wall Street Journal.

Most clients’ largest tax benefit may soon be under attack if she’s right!

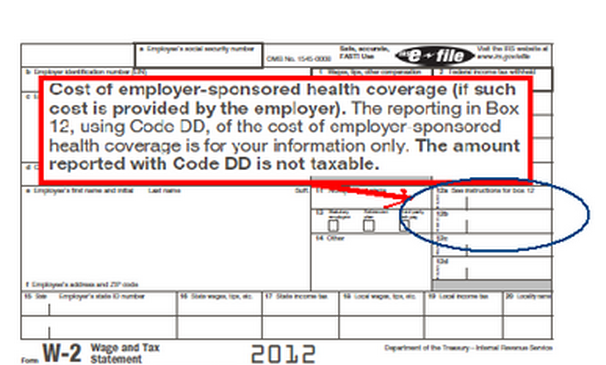

” When you receive your W-2 for 2012, pay attention to a surprising new number on the form, especially if you are an upper-income-bracket taxpayer. The figure could threaten one of your most valuable tax breaks.

The new number appears in Box 12 after the symbol “DD.” It shows the cost of your employer-sponsored health plan, if you have one. The number includes the combined amount paid by the company and the employee for coverage, but not worker contributions to flexible spending accounts or health-savings accounts—or additional copayments or reimbursements.

Companies that prepare 250 or more W-2s have to report this figure to workers for 2012, as do many government agencies and nonprofits. Smaller employers have longer to comply with the requirement.The new number, mandated by Congress as part of the 2010 health-care overhaul, shines a light on an important but little-understood benefit. In most cases, health-plan costs are “excluded” from income, which means they are tax-free. But most workers have been unaware of how large this benefit is because they haven’t seen it on their tax returns.

For many people, the health-plan tax break is more valuable than the highly popular mortgage-interest deduction on Schedule A, says Kelly Davis, an employee-benefits specialist at accounting firm CliftonLarsonAllen.

For example, the first-year deduction on a $400,000, 30-year mortgage with a fixed rate of 3.75% is $14,874, says Keith Gumbinger, a mortgage analyst at HSH.

In comparison, the average health-insurance premium last year was $16,427 per family at firms with many higher-paid workers (earning $55,000 or more), according to a survey by the Kaiser Family Foundation. In New York City, health insurance can cost $20,000 or more per family.”

Now – let’s be honest. Is there anyone who doesn’t think that the next step is going to be to tax the largest single fringe benefit for working Americans?

For those living in this dreamland, I’d suggest reading last year’s proposed budget. President Obama proposed putting a cap on the value of lots of tax benefits. Can you guess which one (hint: see above picture) he wants to limit?

What is the lesson to be learned here? Tax planning, especially compensation planning, is more important than ever for every business owner in America.

Congress’ next attack on your earnings may be just around the corner. Call us or E-Mail us today for help.