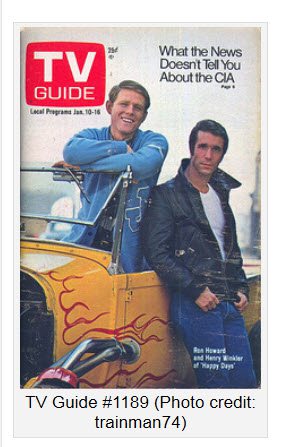

Can the “Fonz” drive in reverse?

Henry Winkler (a/k/a “The Fonz” on the Happy Days TV series) can be currently seen on television advertising for senior citizens to sign up for a reverse mortgage. Before you can make a financial decision on anything, you need to know:

Henry Winkler (a/k/a “The Fonz” on the Happy Days TV series) can be currently seen on television advertising for senior citizens to sign up for a reverse mortgage. Before you can make a financial decision on anything, you need to know:

- How does it work, and

- How does it help (or hurt) me financially?

How the reverse mortgage concept works:

A reverse mortgage permits a homeowner to withdraw equity from his home.

It does not involve a sale of the home, so ownership is never given up.

Most reverse mortgages are written through a Home Equity Conversion Mortgage (HECM), regulated by the federal Department of Housing and Urban Development (HUD) and available only through an approved Federal Housing Administration (FHA) lender. To qualify for a HECM reverse mortgage, you must:

1) Be at least age 62. If the property is owned jointly, the youngest titleholder must be at least 62.

2) The property must be a single-family dwelling, an approved FHA condo, or a multiple family home which contains at least two, but not more than four, units.

3) The home must be the primary residence of, and occupied by, the homeowner.

4) If the home is leveraged, the equity in the home must be sufficient to pay off all mortgages, liens or legal obligations against the property.

5) The owner must reside in the home for at least 183 days per year and confirm this by signing an Annual Occupancy Certificate. If this is a problem due to the homeowner’s health or work situation, the homeowner must notify his Servicer. If the homeowner is out of the home for 12 consecutive months, the loan could be in default.

6)You can’t rent the property, as it would no longer be considered your primary residence; and the loan would be in default. Also, the homeowner must continue to pay insurance and property taxes and maintain the property in accordance with FHA requirements.

What you get from a reverse mortage:

Money received from a reverse mortgage is considered to be a loan, and as such, is not subject to income tax. In addition, the maximum amount a homeowner may receive from an HECM reverse mortgage is based primarily on the appraised value of the home, age of the individual (or couple), prevailing interest rates, and government-imposed lending limits.

- paid out over the owner’s lifetime,

- paid out in fixed monthly amounts,

- treated as you would a line of credit, or

- treated as a combination of the above.

What happens if:

- you die, or

- are forced to live in a nursing home?

As noted above, you must occupy the house as your residence. Since the above would place you in violation of the loan agreement, the bank would force a sale of your home.

Upon the sale, the bank debt is paid and your heirs will receive the balance. If the sales price isn’t enough to pay off the bank, then the lender requests the difference from the FHA. No other personal assets are involved.