Update on Corporate inversions – President blames accountants!

[Editor’s note:] To fully understand why accountants react strongly to being blamed for corporate inversion, please read Part I – Corporate Inversion the new buzz word of the statist.

Well,well,well. It seems like Washington is keeping their buck-passing deceptive skills honed to a sharp edge. The President has gone so far as to blame CPAs and accountants for this problem.

Author Ayn Rand wisely said, “Contradictions do not exist. Check your premises and you’ll find one of them to be incorrect.”

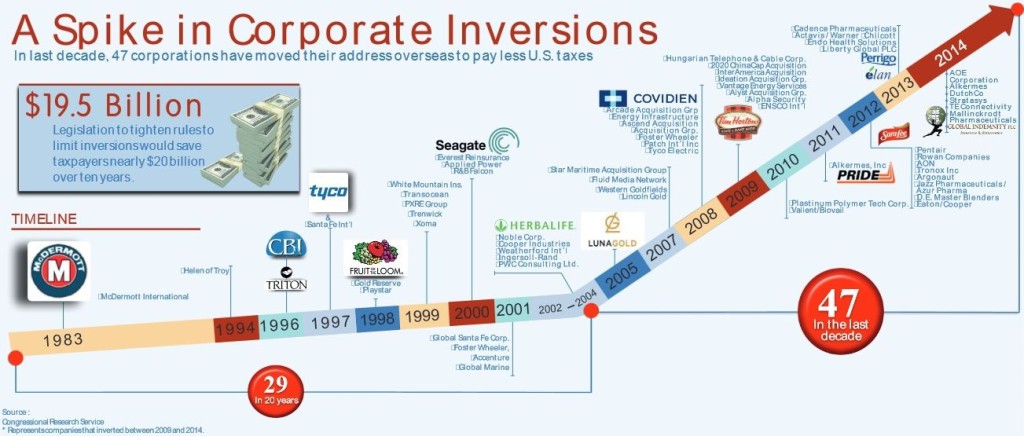

Let’s help our friends in Washington to take Mrs. Rand’s advice and check their premises. The chart below (click for an enlarged version) demonstrates that inversions (a completely legal strategy at this point) are happening at a record pace. To condemn the practice of inversion without asking the root question of why they’re increasing is to commit a logical fallacy known as “begging the question.”

When we check the premises of the crowd in Washington, we find one of them to be that paying only the tax that the law requires equals unpatriotic behavior.

Let’s see how consistent and valid this premise is – shall we?

When certain corporations (that “coincidentally” contributed large amounts to the politicians quoted above), used existing tax law to pay zero tax on 14.2 billion of profits, we heard nothing from the above-quoted politicians. Looks like the flawed premise is that our friends in Washington only consider it unpatriotic to pay less tax when you don’t donate to their election efforts!

We could list dozens of examples like the links above from The Huffington Post, The New York Times, and Forbes, but Washington’s true premise is revealed – “Donate to us and you won’t be criticized for paying less tax.”

Congress and the President fail to mention (False premises often leave out vital information,) that a corporate inversion doesn’t let the company escape from tax on its American operations. It just prevents the USA from taxing the worldwide profits.

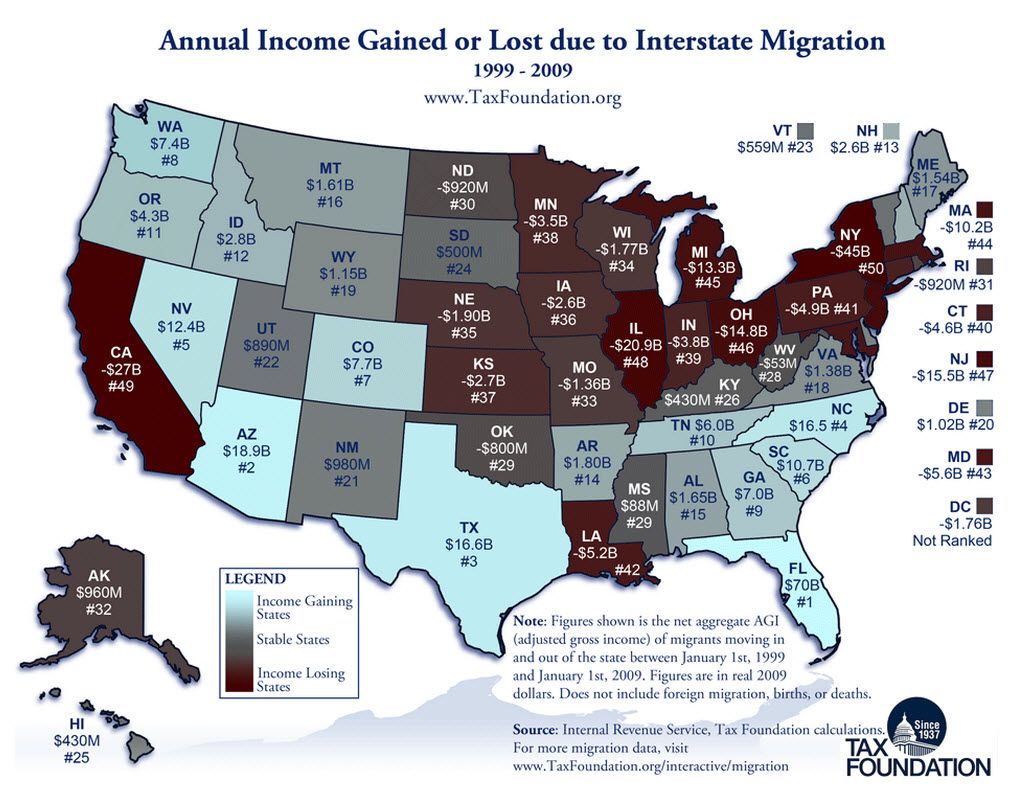

Statist-inclined politicians often fail to notice that taxpayers of America have been doing their own version of corporate inversion for over 10 years! The chart below (click for a larger easier-to-read version) shows how individuals have left in droves states that have high taxes and relocated to areas with an overall lower rate. Funny how this trend has not been criticized by Washington and the White House, but individuals can vote and corporations cannot.

Of course it’s always interesting what the courts might have to say on how much tax it’s patriotic to pay.

“Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes. Over and over again the courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.”Judge Learned Hand,U. S. Court of Appeals

Scott Adair, president of the New York State Society of CPAs, may have said it best for the client-serving accountants caught in the middle of this mess.

Scott Adair-New York Society of CPAs

“As President of the New York State Society of Certified Public Accountants, I believe President Obama should be aware that U.S. corporations hire accountants for their distinct ability and expertise in seeing that clients fulfill their tax obligations as required by the laws adopted by Congress,” he said. “In fact, it is a CPA’s unique ability to legally navigate an extraordinarily complex tax code that makes CPAs’ services so valuable to their individual and corporate clients.

“If President Obama wants to point fingers, perhaps he should point them at Congress for creating the very loopholes he vilifies,” Adair added. “Sustainable corporate tax reform is the elephant in this room. President Obama’s goals would be best served by looking to his fellow lawmakers if he wants a solution to this problem. The accounting profession stands ready to help.”

As far as a solution – it’s pretty simple, although not easy, to implement with the present Congress:

- Eliminate provisions of the tax code that favor one industry or one specific business (i.e., the enormous tax credit without which the Chevy Volt would have been unsalable) and let free markets determine the prices. Voters on the left and the right should be in agreement on dumping corporate welfare.

- Put the US corporate rates in line with (i.e., competitive with) other countries.

Given America’s superior workers, freedoms, standard of living, etc., you’d see companies fighting to come into the country rather than the mass exodus of businesses shown here.

Your opinions or comments are welcome. Use the area below if you’d like to speak out.