Answers – at a fraction of the regular cost!

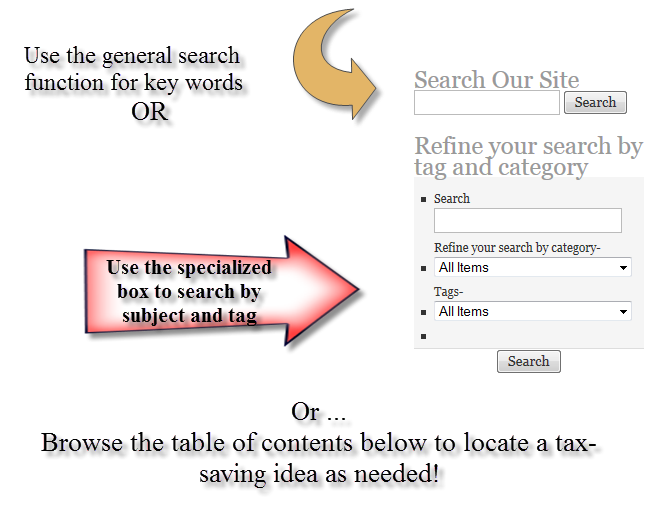

Answers – It’s what clients pay for and it’s what makes your customers happy as well. We’ve designated this page to help you get answers and, when necessary, the knowledge to determine if you need to ask more detailed questions. We suggest that, in addition to your search terms, you pick an item from the “Tags” of the search sidebar on your right. We’ve tried to make the tags similar to the words a client would use (i.e. Obamacare, capital gain savings, etc.). But, there is still a problem to overcome. You may get the general knowledge of how capital gains are affecting the sale of your business, but you still need to know how the tax law specially affects the sale of your type of company.

Our Solution – Jack and I are compiling memos from our vast experience of advising clients on very specific tax problems. These memos range from how to structure a business sale to methods of setting up payment plans and offers of compromise with the IRS. Clients with these specific problems have paid $175 per hour for this advice, but we’re willing to make this library of memoranda available to you at a fraction of our normal billing rate with a one-time charge. Just one use of the library will pay this fee many times over and you’ll have unlimited use for 1 year. Be sure to subscribe to our E-Mail List on the Home Page, and we’ll keep you posted when this service is ready.

Let’s do a demo so you can see just how effective this can be in getting ideas for your tax planning. Type in “investment” (without the quotes) as the search term [ Be sure to type in the search box at the top right of this screen and not on the image below] and scroll down to the tag labeled Medicare (You can also just click on any tag, then start typing the word medicare – our search engine will jump to the word). You’ll have an executive video summary of the new Medicare Investment tax effective this year!

Editor’s note – We’re really big on free samples of what we can do to help your business. Click Here or here for a look at the type of memo described above for a client who wanted to spin off a division of his business and how we enhanced the savings by using a C Corp. (As always, check with us before utilizing any ideas as the current tax law may have changed since this memo was written.)

Master Table of Contents (all blog posts)

[cleanarchivesreloaded]