Posts by elitecpas

Out with the old – in with the new 2023 mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

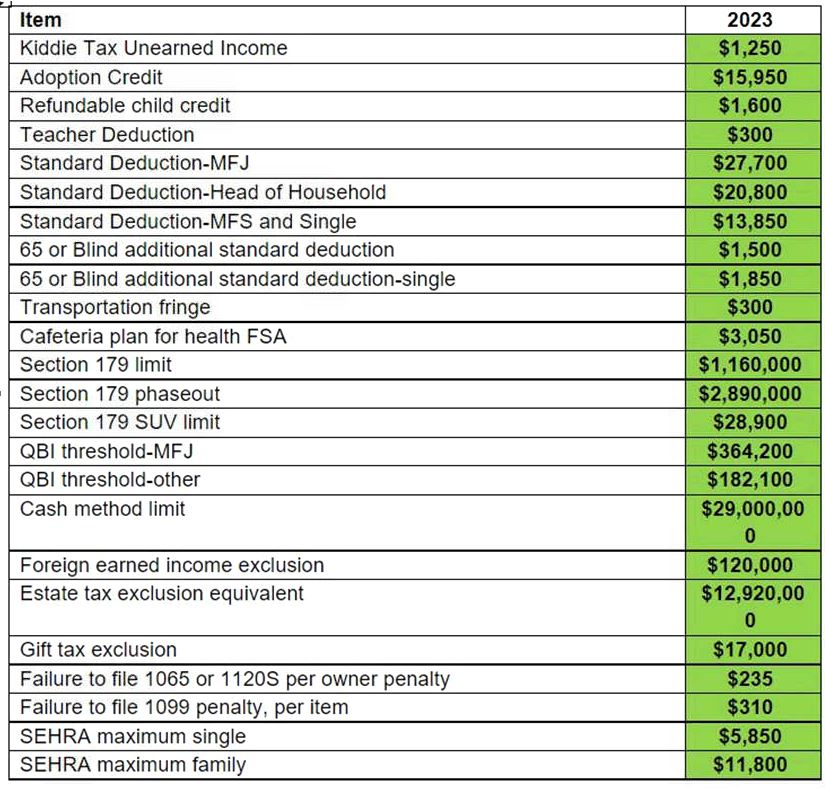

Read MoreInflation adjustments to tax items

With inflation at a 40-year high, inflation-adjusted tax amounts have kicked into place. Here are the increased amounts for 2022 and 2023.

Read MoreIRS grants penalty relief!

This is a rare gift from the imperial IRS. Check the article below for details.

Read MoreMMDA- Making meals deductible again

Have you missed partying and having business meals with your prospects, customers, and employees? Well, get ready to start again. Soon, COVID-19 will be behind us, we can get back to normal. To help you get ready, check the table below for what you can do in 2021 and 2022 as the law stands now:…

Read MoreIRS changes gears with new mileage rate July 1, 2022

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Read MoreTax-Deductible Retirement Plans for 2022

For the small business owner: Options when you are self-employed with no employees (Chart 1 below) Options when you are the only employee of your corporation (Chart 2 below)

Read MoreDonor-Advised Funds -they are easier than you think

Donor-Advised Funds: A Tax Planning Tool for Church and Charity Donations Do you give money to your church? Do you get a tax benefit from those donations? How about your donations to other charities? Recent changes in the tax code have done much to destroy your benefits from church and other tax-deductible 501(c)(3) donations. But…

Read MoreHSA for Seniors on Medicare?

From our friend and elder-law attorney Ira Leff (used with permission). 32 million Americans currently maintain Health Spending Accounts (HSAs). These accounts provide three types of tax benefits: contributions are tax-deductible, earnings are tax-free, and withdrawals are not subject to taxation if they are used to pay qualified medical expenses. As of the end of…

Read MoreSEP vs 401(k)

We get a lot of questions (especially from self-employed business owners) on how the SEP IRA and the solo 401(k) retirement plans stack up in a head-to-head comparison. What they have in common: Both plans -create tax deductions for the money you invest in the plan, -grow tax-deferred inside the plan, and -suffer taxes only…

Read MoreGeorgia makes a common-sense move on taxes!

March 23, 2022, 5:03 PM Georgia will be sending $1.1 billion in refund checks to taxpayers in the coming weeks after Gov. Brian Kemp signed legislation Wednesday designed to help families cope with the recent surge in inflation. Kemp, first-term Republican seeking reelection in November, signed H.B. 1302, which offers an income tax credit to…

Read More