Posts by elitecpas

Where there’s a Will . . .

. . .there are usually some opportunities for tax and estate planning. Most people don’t appreciate the importance of a will, especially if they think their estate is below the level of the estate tax exemption. Even people who recognize the need for a will often don’t have one, perhaps due to procrastination or the lack of…

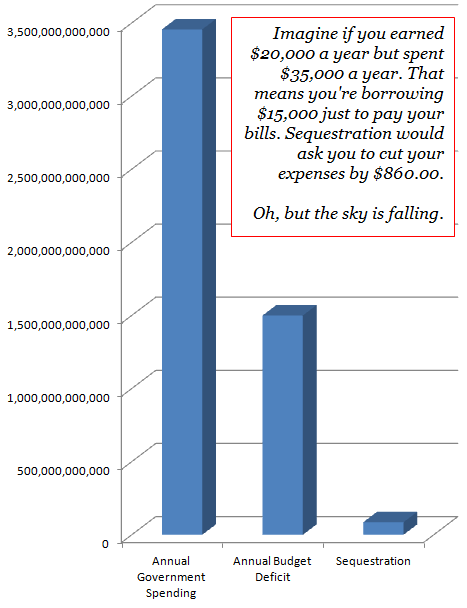

Read MoreSequestration – Numbers show the truth

Hover your mouse over the chart for a long-term analysis.

Read MoreSimple in Six – How to enter Excel data just one time!

Do you ever get frustrated formatting a yearly spreadsheet and then entering data in 12 tabs for monthly projections, budgets,etc? What’s really irritating is when something has to be added and you’re faced with 12 tabs to update. Thanks to Excel expert Tom Fragale (@PhillyTom), we have a way to enter your data just once…

Read MoreWhy your 401(k) is only the beginning!

A 401(k) is just the beginning of the good things that you can do for your employees and for yourself. Take a look at the data below.

Read MoreTax Advice for Valentine’s Day

This is one of our older posts, but it’s still good advice!

Read MoreSimple in Six – Excel Tables

Arguably, one of the most powerful features in Excel 2007 & 2010 is the new table formatting option. You can learn the basics in less than 5 minutes with the tutorial below.

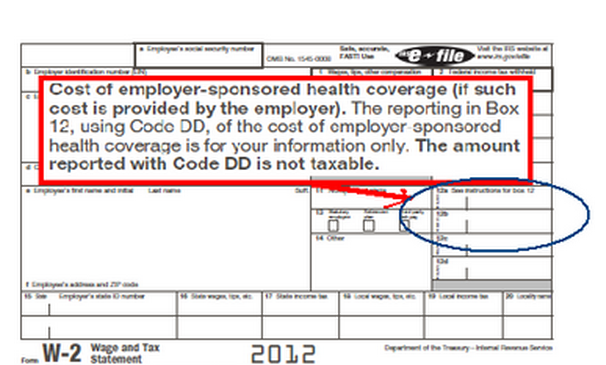

Read MoreCan you guess what’s coming next?

Laura Saunders has a great exercise in predictive logic in the tax section of the Wall Street Journal. Most clients’ largest tax benefit may soon be under attack if she’s right! ” When you receive your W-2 for 2012, pay attention to a surprising new number on the form, especially if you are an upper-income-bracket taxpayer.…

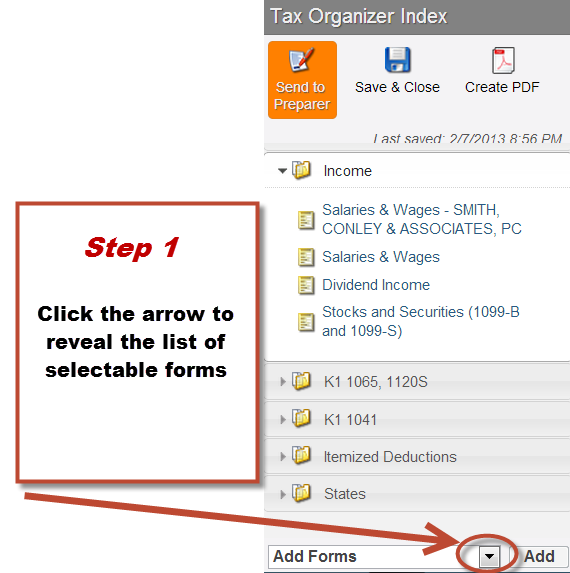

Read MoreHow to add forms to your tax organizer

I’ve always liked being able to substitute items on a restaurant menu. That way you get exactly what you want. Why should your tax organizer be any different? Although the organizer is customized based upon your prior year return, things can often change from last year. If you switched jobs, opened a new brokerage account, opened a new Health…

Read MoreWhen does it pay to be average?

Sometimes being average is not a bad thing. The data below (for illustrative purposes only) shows what the IRS has calculated as average deductions by income level. When a tax return varies too far from the average, something called a DIF ( Discriminant Income Function) score flags the return for audit. However, IRS uses more…

Read More5 Benefits from the new tax law

There actually are some helpful things that emerged from the midnight-hour law signed by President Obama on January 2. Here’s our pick of the top 5.

Read More