Posts by elitecpas

IRS begins a “Hiring Frenzy”

See the second video if you still believe it’s possible to administer the health care debacle. Here’s just how easy it is to calculate.

Read MoreThe Anti-Investment tax of 2013! We explain how and when it applies.

CPA gives 3 minute summary of the new Medicare tax

Read MoreDo corporations have to issue 1099s?

As with most tax questions it depends. Although (as a general rule) corporations are exempt from this requirement, there are some exceptions. See the list below and be sure to E-Mail us if questions. Reportable payments to corporations. The following payments made to corporations generally must be reported on Form 1099-MISC. Medical and health care payments…

Read MoreA tutorial for business owners on the new Medicare tax

An individual is liable for Additional Medicare Tax if the individual’s wages, other compensation, or self-employment income

(together with that of his or her spouse if filing a joint return) exceed the threshold amount for the individual’s filing status:

Just what a sagging stock market needs to recover

Let’s have a 289% increase on dividend earnings. That’ll really make people want to [sarcasm intended] buy into American business. Actually, there is nothing that will damage the market performance worse than this. If you own investments and would like them to increase in value, I’d make my voice known on this.

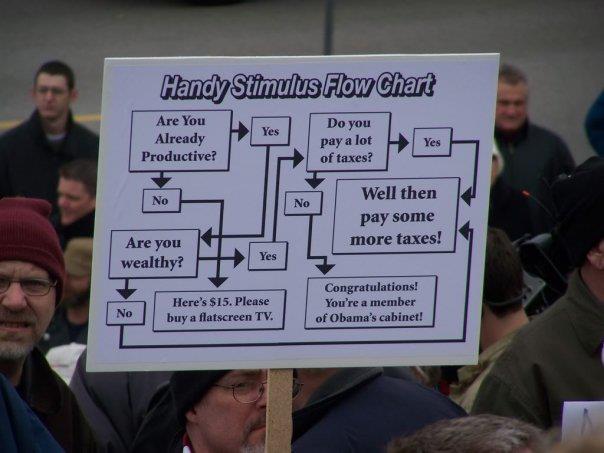

Read MoreHow to understand the stimulus tax bill

Knowing tax law can be difficult to read, we offer the following visual aid.

Read MoreWho really pays their “Fair Share” -Part II

Looks like the argument for the rich paying their “fair share” is getting weaker and weaker. Hover your mouse over the chart to see the graphic proof of who really pays their fair share-Part I. Facts are stubborn things and the fact is that the top 5% of earners have gone from shouldering about 28%…

Read MoreWho really pays the Income Tax?

I get asked this question almost every week. Here’s some helpful stats from our friends at the National Taxpayer’s Union. Remember this question. If a quarter of the income paying almost 90% of the tax bite is not “Fair”, then what is Fair? 98%? 115% Pro-rata cuts benefit all taxpayers equally – and that’s as…

Read MoreThink your CD rates are bad? How about a French T-Bill with negative interest?

We always like to look at the positive side of things. As bad as CD rates in the US are for investors, you could have to deal with French T-Bills which sell at a negative interest rate! I know that’s hard to believe, but here’s the AP news release: “. . . France, the No.…

Read MoreSome folks will see a 74% increase in the tax rates in 2013-(from the WSJ)

We’re not kidding about the higher part as the new capital gain rates (remember the “capital” in capitalism). Just put your mouse over the picture to see proof that capital gains could go as high as 25% in 2013 ( a 67% increase)! The Wall St Journal says it best in their July 2, 2012…

Read More