Posts by elitecpas

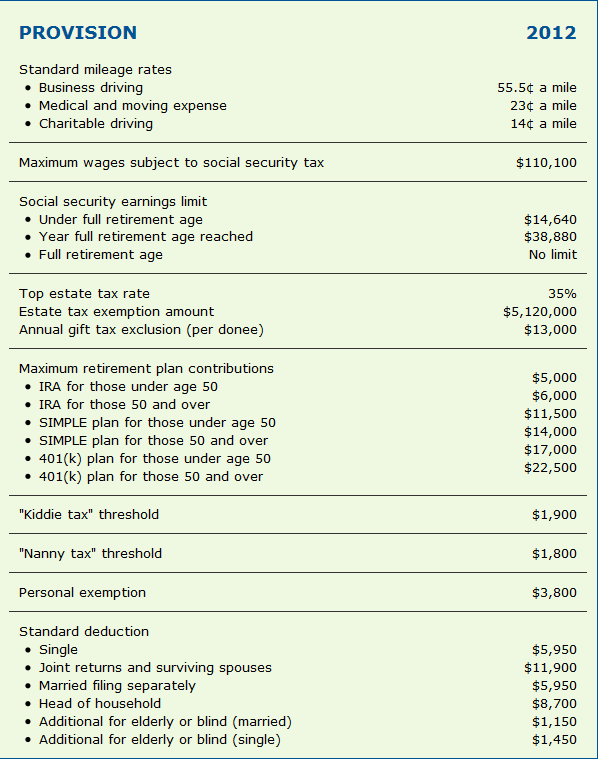

How to keep score in 2012

Congress has once again adjusted the dollar amount of allowabe mileage,social security limits,estate rates, and a host of other deductions. Here’s a handy scorecard for 2012.

Read MoreNew tax limits for retirement plans

It’s still early in 2012, but for our clients wanting to start their tax planning here are the updated numbers for this year. Retirement Plans Limits Plan Limit Limit with Catchup Simple 11,500 14,000 401(k) 17,000 22,500 Roth 401(k) 17,000 22,500 IRA 5,000 6,000 Roth IRA 5,000 6,000 403(b) 17,000 22,500 Roth 403(b) 17,000 22,500…

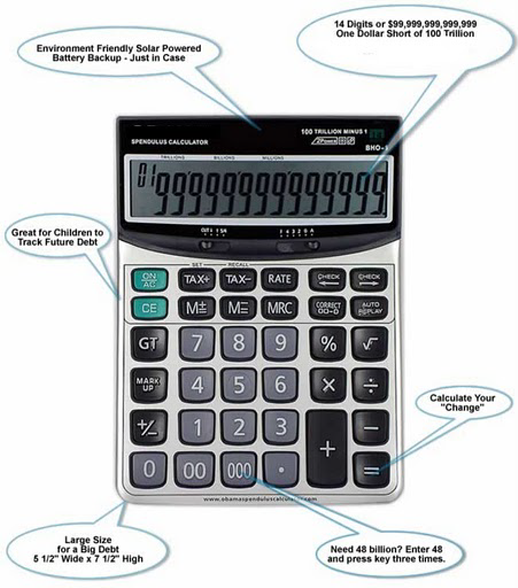

Read MoreCongressional Calculator only $9.99!

One of our clients is offering these retrofitted calculators. If you’ve followed the current budget -you’ll know why. Since the cash for clunker law was a disaster, maybe we could have calculators for Congress!

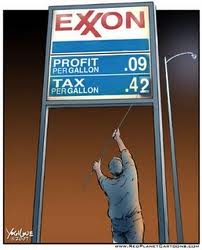

Read MoreAn example of evil greed

Who’s really being greedy here?

Read MoreAnother Peachtree tip for year-end accounting

When moving to the beginning of your tax year in Peachtree Accounting, be sure to adjust for the new state unemployment rate. This will insure the accuracy of Peachtree’s calculation of the amount you’ll pay at the end of the first quarter.

Read MoreHow to safely close the year in Peachtree Accounting

For our clients using Peachtree Accounting: If you own one of the Premium versions of Peachtree Accounting, you’ll get the following screen during the year-end close at period 24. By checking the Archive Company box, you’ll cause the system to create an extra company and preserve the ability to view all reports of prior…

Read MoreThis group fails their audit 92% of the time.

One way to determine the power of any organization is to take a look at their numbers. Without commenting on the good accomplished or the harm done, one has to grant the Unions are powerful forces in the social and political structure of America. Need some proof? Here are some convincing stats. Take special notice…

Read MoreThe worst state(s) to die in. . .

For estate tax purposes, there are some terrible states to die in this coming year (2013). Hover over the selected states in the map below and you’ll see what we mean.

Read MoreCustomer no-service from IRS gets even worse!

As if things weren’t bad enough, now the less-than-sterling level of IRS service just got worse. It’s not just my opinion, check out this eye-opening article from “Forbes.” IRS Gone Bad: Are Things About to Get Even Worse? The details aren’t all that important. Basically, I called the IRS to discuss a client’s tax…

Read MoreSpecial Tax Deductions for Special Education via the WSJ

This Wall Street Journal Article contains a good overview of the tax breaks available for special education costs. “More than six million children in the U.S. fall into the “special needs” category, and their ranks are expanding. The number of those affected by one developmental disability alone—autism—grew more than 70% between 2005 and 2010. The…

Read More