Posts by elitecpas

Why annuities may not be a good fit for senior citizens

This article highlights difficulties that some senior citizens have had with annuities. Arizona seniors lost millions in annuity fees, lawsuits say Lawsuits highlight risks for elderly of investment choices by Robert Anglen – Nov. 7, 2011 12:00 AM-The Arizona Republic Hundreds of Arizona senior citizens cashed in their retirement investments and paid millions of dollars in unnecessary fees,…

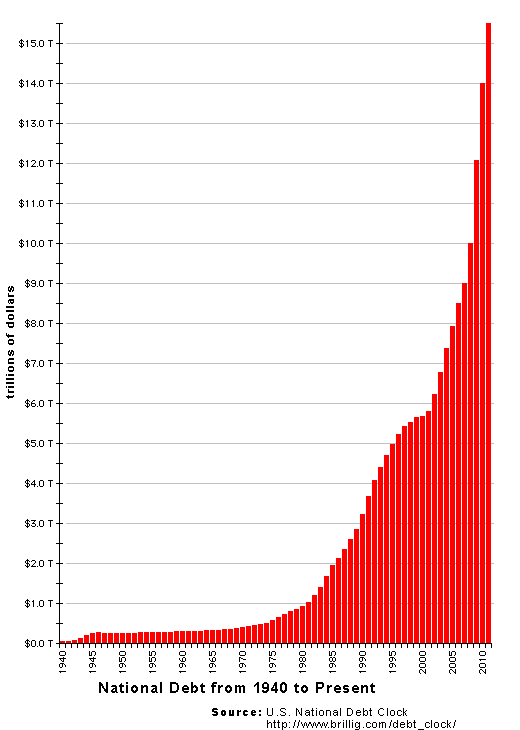

Read MoreWhen you do the math. . .

. . .You find the best argument you could ever desire for Federal term limits.

Read MoreThe one place that you should never borrow money from

Here’s some good advice from the iowabiz.com site about the worst place to borrow money. [The 2% IRS penalty referred to below is equal to an APR of about 25% on a 30 day loan!] by Joe KristanDecember 1, 2011 Every entrepreneur struggling to stave off hungry creditors has probably taken a wistful look…

Read More40 million dollars for a few less IRS agents? What a deal!

The problem is that it’s a deal for the government employees and not the taxpayers. An IRS early buyout program of up to $25,000 per individual will be offered to 5,400 employees with plans to accept about 1,600 individuals. Some may debate that fewer agents are worth the price tag, but I wonder if…

Read MoreThe theory of relativity is in the tax code

This is not the theory discovered by Einstein, but the one that states that certain tax advantages may be disallowed if you sell an asset to someone (or a company) that the tax code calls a “related party.” Simply put, selling a capital asset at a loss to any of the following entities will cause the loss…

Read MoreNew tax credit for hiring vets

President Obama has signed into law increased tax credits for hiring certain veterans. The credits are part of the Work Opportunity Credit, which requires that employers certify through state jobs agencies that employees qualify for the credits. The credit rules, effective for veterans hired as new employees: – A maximum $4,800 credit (40% of the…

Read MoreWhat do the letters IRS really stand for?

During tax season, one of the most oft asked questions is – What do the initials in IRS mean? We offer the following ideas. Feel free to send us your own.

Read MoreWhy most clients are in violation of their Quickbooks license and don’t even realize it!

As if the IRS wasn’t enough to deal with, now Quickbooks owners have another hidden trap that Intuit is just waiting for you to stumble into. The trap centers around the wording in the licensing agreement. Simply put, it’s not a per user license like most multi-user software. Instead, it’s a per person license. Let…

Read MoreThe state of estate tax

The “state” of the Estate Tax is … … in a state of confusion and that’s putting it mildly! Originally, for those dying in 2010, there was no estate tax. Then Congress thought you might not be happy with this arrangement. So they created two methods of taxing estates and determining the basis of…

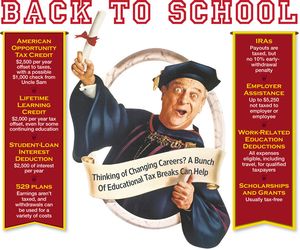

Read MoreEven Rodney may need an advanced degree to understand this.

Not only are there several different types of tax credits and deductions for education, but they can vary according to status within college (Freshman,Senior, etc.) and your level of income. This article from the Wall Street Journal gives a basic overview of what’s available. As always, contact us before acting on this or any tax credit. …

Read More