Posts by elitecpas

Tax breaks of C Corporations

Income splitting. The government taxes the first $50,000 of corporate profits at a lower rate than the individual owners’ tax rates. Therefore, you one should split your C corporation’s income between yourself (or your S Corp) and the C corporation. This allows you to pay taxes on the salary you pay yourself at your individual…

Read MoreUS Treasury indicates about 70% of millionaires to be hit with new tax are small business owners.

Depending on which definition you choose of what defines a “small business owner,” any new “millionaire tax” is going to disproportionately affect the group that creates the most new jobs in our country. A new US Treasury study indicates that over 70% percent of so-called millionaires hit with this type of tax are small business owners. Almost every business…

Read MoreWhat’s in your wallet …(or on your copier)?

I’ve always liked the Capital One credit card commercial that closes with the line “What’s in your wallet?” We’re asking, “What’s on your copier?” The amount of confidential data that’s stored forever on your business copier might surprise and come back to haunt you. Need proof? Check out this video.

Read MoreLand of the free and home of the subsidized?

Under the “department of statistics that really scare me” , here are some charts that show the rapid growth of Americans on the government dole. Here’s the same information showing which departments are the most culpable.

Read MoreCan you use your 401(k) to start a business?

The answer is a very qualified yes. However, it’s not as simple as writing a check from your IRA. This Wall Street Journal article gives some basic guidelines. As the article clearly states, don’t do this on your own. Call us for professional help.Article excerpt “There are ways to use IRA and 401(k) funds to finance…

Read MoreWhat you can learn by adding (and subtracting) 8 zeros

Putting things into perspective by removing 8 zeros It’s amazing what simple math can show: An analysis of the numbers below reveals why the average household budget is far better managed than the budget in Washington! -Why S&P downgraded the US credit rating • U.S. Tax revenue: $2,170,000,000,000 • Fed budget: $3,820,000,000,000 •…

Read MoreHow to determine your “real” yield- a free spreadsheet

Things are rarely what they appear to be in the financial markets.Sometimes your real yield is what is left after the taxes have been paid. E-mail us for the free spreadsheet below to determine the effective yield ofa tax-free investment vs one that is fully taxable.

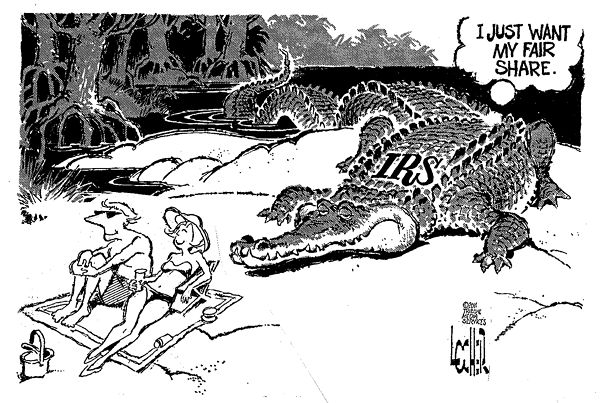

Read MoreBeware who defines “your fair share.”

Beware whom you permit to define what is your “fair share.” The definition will always be dependent on just how hungry the croc is when he finds you and your wallet.

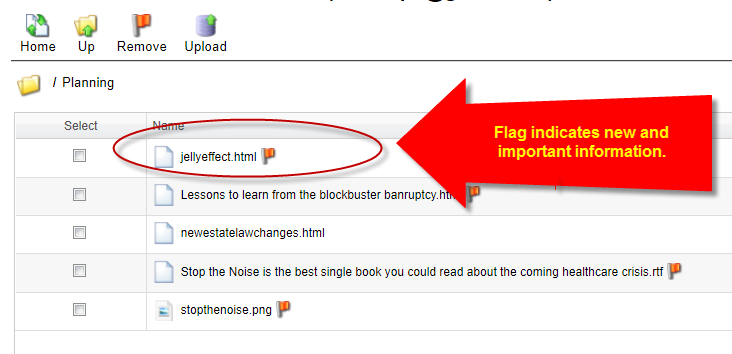

Read MoreNo time for professional reading? We can help!

As we find useful articles on marketing your company, etc., we’ll post a review on your individual portal. Here’s a sample of a great book I recently read on common sense marketing [See this Link]. You’ll receive an email from us telling you that we added information to your portal and a Flag (like the…

Read MoreSmall business bookkeeping tool

For the small business, this one tool will track present a financial picture of all checks, deposits, wire transfers, and balance of your business accounts. Use this link. [Requires Excel 2007 or greater.]Small Business Record Keeping

Read More