Posts by elitecpas

Get a 30 Percent Tax Credit for Residential Solar Panels

Only a few months left to Claim a Tax Credit for Residential Solar Panels If you’ve decided that you want to go the Solar Energy route, here are some unique tax advantages to help pay for it. The 30 percent residential solar credit: drops to 26 percent for tax year 2020, drops to 22 percent…

Read MoreRoth vs Traditional IRA – Which is better

Roth IRA versus Traditional IRA: Which Is Better for You? I can’t think of a more heated tax debate than this topic has been over the years. This debate is akin to the feud between the Hatfields and McCoys, the Montague and Capulets, the Union and the South, etc. Accountants tend to be split…

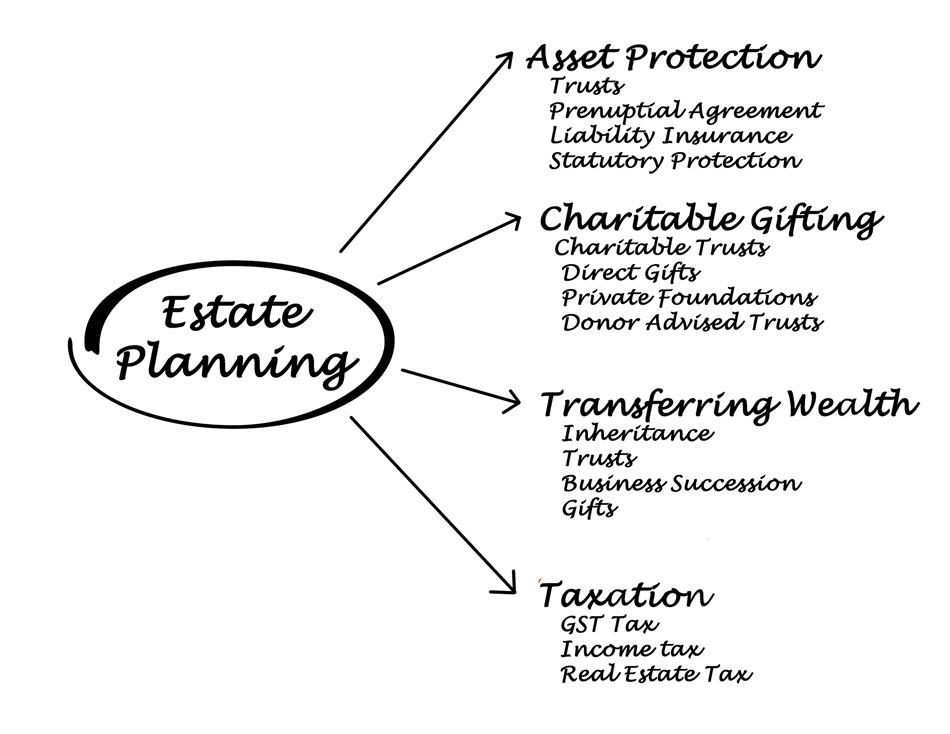

Read MoreOther firms give you a list but we give you a tool

A list of your assets is great for estate planning but, in addition, what your heirs will appreciate is a map to find the items they need after you’re gone. This downloadable form (see the link at the bottom of the page) will not only make sure you have the vital estate documents but will…

Read MoreBarter – Yes, it’s taxable

Bartering: A taxable transaction even if your business exchanges no cash It’s good to read the above sentence a couple of times before proceeding to the rest of this post. A small local business may find it beneficial to barter for goods and services instead of paying cash for them. If your business engages in…

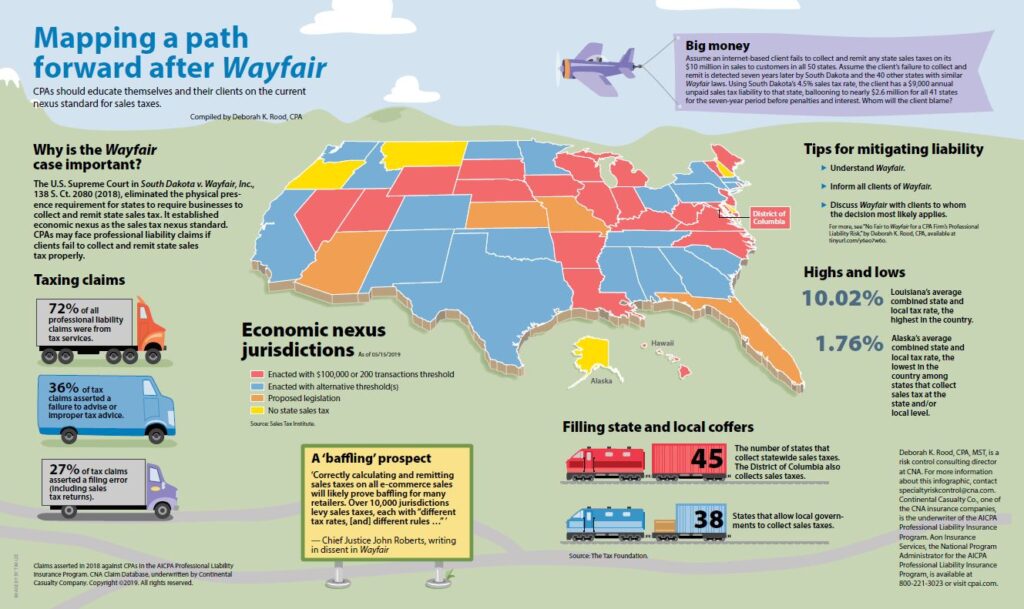

Read MoreWayfair-you’ve got just what I don’t need

I doubt there’s a more common question that I get from business owners that sell a product than -“How does the Supreme Court Wayfair decision affect me collecting sales tax from the products that I sell outside of Georgia?” Books have been written on this, but the short version is that until the recent Supreme…

Read MoreKnow your enemy’s plan- Read his audit guide

In chess (as in business), it’s good to be able to think three moves ahead. This is especially true when dealing with IRS auditors. Wouldn’t it be nice if you could read the plan on how they’ll review your books weeks before they came for their appointment? Well wish no more – this information…

Read MoreRed Alert – Data Breach

Two years ago, we published this alert about the Equifax data breach and the steps you should take. Today, it’s happened again! This time it’s about 100 million Capital One credit card application’s info that may be exposed. We’ll quote an article from PC World: “On Monday night, Capital One revealed that more than 100…

Read MoreMethods of Asset Protection

We ought to be always learning about most everything in life. But it’s especially important to keep current on ways to protect the assets that you’ve worked so hard for over the years. It today’s litigious climate you can’t be too careful. The audio podcast below describes how to do this. Although intended for Doctors,…

Read MoreNumbers that we should remember

There are many numbers (tax rates, investment percentages, etc.) that we like for clients to remember, but as we approach Independence Day, we ought to refocus on some numbers that are just as important. Our broker friends have provided them in the video below.

Read More