Posts by elitecpas

Does everybody really get a tax cut in 2018?

This is because the tax rates are less than in 2017 for every income bracket. Although there is always the exception the proves the general rule, here are the new reduced rates for tax year 2018. Existing clients are welcome to email us for an estimate of just how much savings you may realize.

Read MoreCommon sense year-end planning

7 last-minute tax moves for your business Postpone invoices. If your business uses the cash method of accounting, and it would benefit from deferring income to next year, wait until early 2019 to send invoices. Accrual-basis businesses can defer recognition of certain advance payments for products to be delivered or services to be provided next…

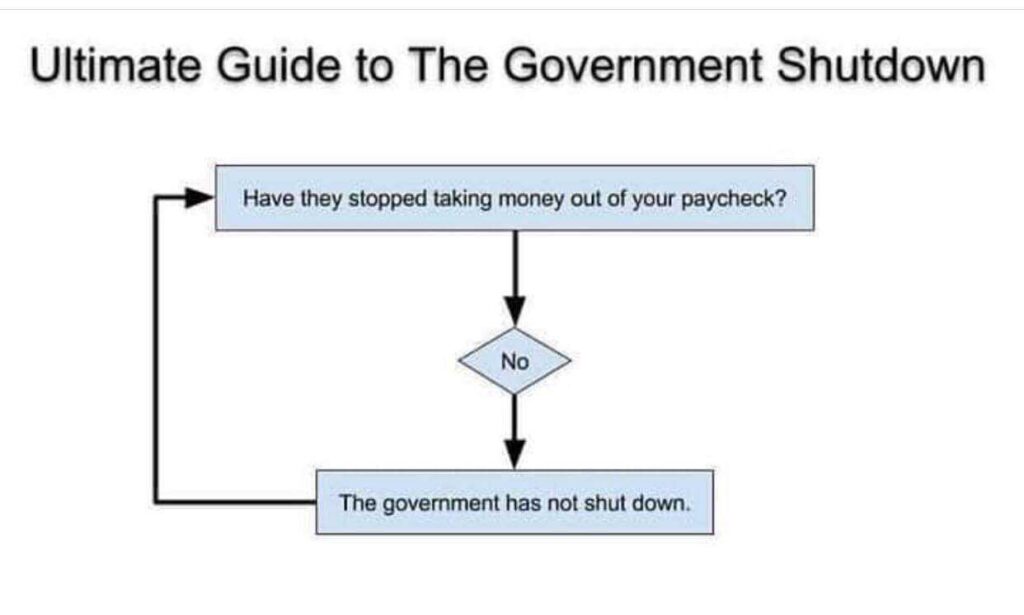

Read MoreThe one sure way to know if we’ll have a government shutdown

With all the stress of the holiday season, we thought you could use a little humor at Congress’ expense. Therefore, we have developed our infallible flow-chart to determine in the government has really shut down or not.

Read MoreTis the season to deduct Holiday gifts and parties

When holiday gifts and parties are deductible or taxable The holiday season is a great time for businesses to show their appreciation for employees and customers by giving them gifts or hosting holiday parties. Before you begin shopping or sending out invitations, though, it’s a good idea to find out whether the expense is tax…

Read MoreOut with the old – in with the new 2019 mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Read MoreQuestions from our clients on the new tax law

The following questions are ones that we get asked every week at this time of year. Below are the answers that factor in the new tax law that will affect the 2018 returns. Will I be able to save on taxes if I prepay my January 2019 mortgage bill before the end of the year in…

Read MoreFrom SCA to you

From SCA to you

Read MoreTax Reform in picture format

What happens when the heirs lose the Will?

What happens when you know there’s a will but no one can find it? Our thanks to attorney Ira Leff’s tax blog (we’ve included a download link at the bottom) for the information below. Here’s one family’s course of action when unable to produce the will of a widow with no children. For more estate and asset…

Read MoreIRS Amnesty Program ends September 28!

Warning- IRS penalty forgiveness for foreign bank accounts is about to expire! Although most clients are aware that earnings from a foreign bank account are reportable on a US citizen’s tax return they may not realize the danger of non-disclosure of foreign accounts – even if they produce no income! The various penalties run the gamut from 10,000…

Read More