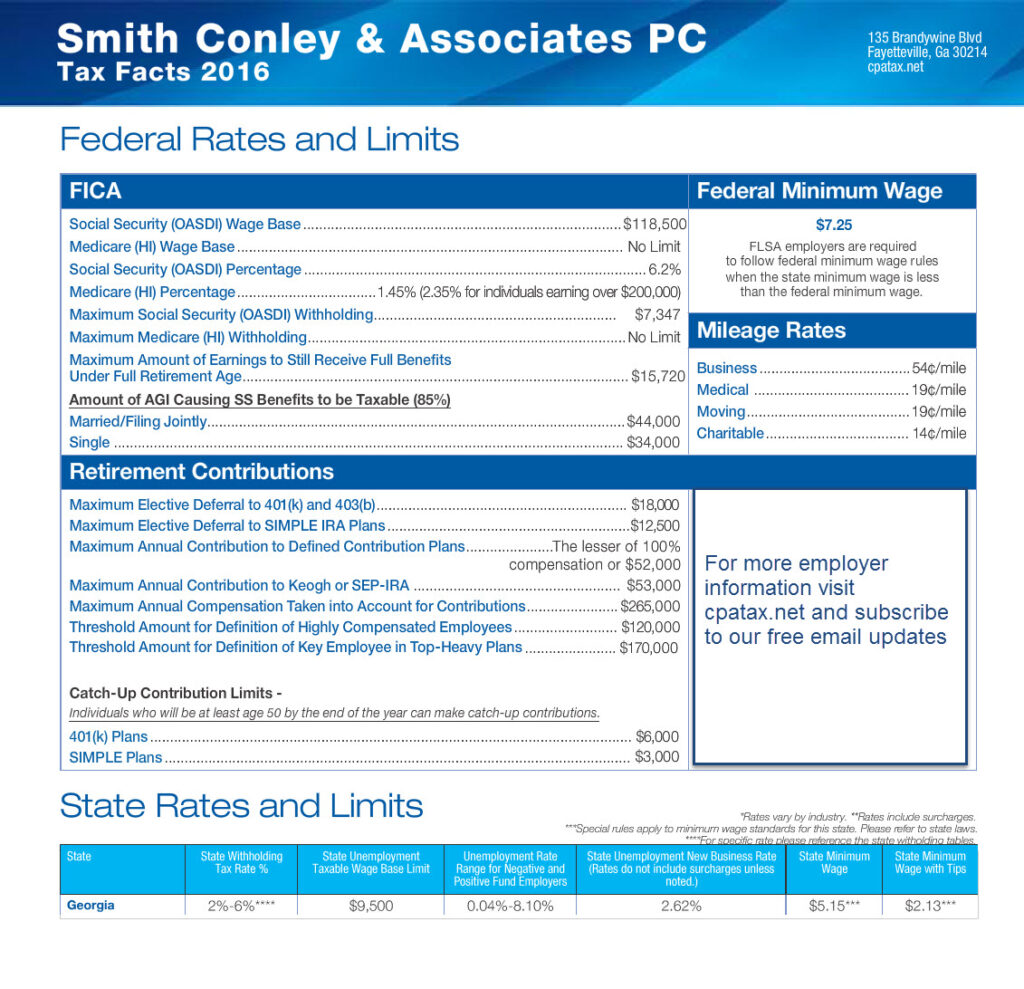

Quick Tax Facts for 2017

Quick Tax Facts for 2017

Read MoreSafe harbors from the IRS storm

These are your personal “safe zones” from the tax man when you use depreciation.

Read MoreA primer on basic economics in starting a business

Guest Editor Dr. Walter Williams’ commentary on starting a business

Read MoreTax Credits for Employers

How to save taxes by smart hiring.

Read MoreID Theft and the IRS

If you’ve been inconvenienced with the IRS assigning you a PIN you’ll be encouraged to know . . .

Read MoreTax credits for small businesses

Tax credits reduce tax liability dollar-for-dollar, making them particularly valuable. One of them might not be available after 2017.

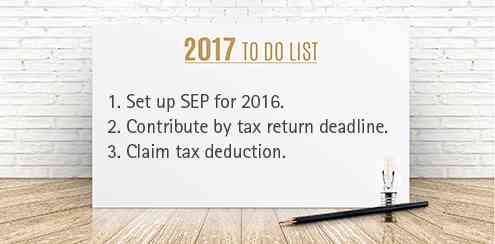

Read MoreRetro-active tax planning after the year ends

SEPs are sometimes regarded as the no-brainer for high-income small-business owners who don’t currently have tax-advantaged retirement plans.

Read MoreMeet the entire IRA family

The members of the IRA family are very different from each other.

Read MoreThis month’s featured client

Hacking the code – what the 2016 tax law changes mean to you

What the 2016 tax law changes mean to you.

Read More