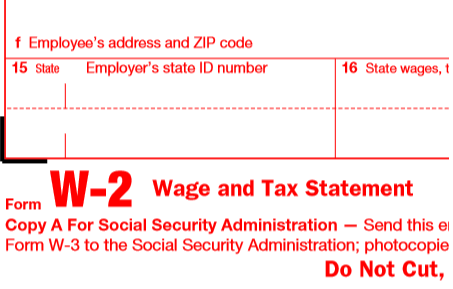

Half Truths about your W-2

Urban legends abound on this subject. Here are the current rules.

Read MoreGet remote support instantly with ScaSecure.

Got a problem with your accounting software. Get remote support instantly!

Read MoreIRS approves April 2015 deduction on your 2014 return:

Donations to slain Police Officer’s families can be backdated to 2014.

Read MoreAre you a “real estate professional”?

During tax season, we get a lot of questions about the deductibility of rental real estate losses. There is not a single “sound bite” type of answer as it can depend upon your income level, type of property, and the degree to which you share in the management responsibilities.

Read More“To Sell or Not to Sell -that is the question.” – William Shakespeare [edited]

Although we don’t give investment advice, we thought a simple math formula that helps you maximize your stock gains might be useful.

Read MoreIRS allows a “mulligan” on Obamacare penalties

Occasionally IRS will surprise you and do something that actually makes common sense for our small business clients.

Read MoreHow to E-Sign your individual tax return

How to E-Sign your individual tax return

Read MoreMyths about Taxable Income

My Social Security benefits aren’t taxable. Depending on the amount of other income that a taxpayer has to report, their benefits may be taxable – but the maximum amount of Social Security benefits that must be included is 85 percent. I don’t need to report stock sales if I bought other stocks with the proceeds.…

Read MoreRepair Expenses

New IRS regs add time and expense to every business’ depreciation calculation.

Read MoreWhat happens if the Net Neutrality law is approved.

Fairness and neutrality sure sound like good ideas, but when they’re administrated by Washington – here’s what’s likely to happen:

Read More