Minimum Wage Changes for 2014

Here’s an update on the changes in the Minimum Wage amounts for the coming year.

Read MoreWhy tax year 2014 requires more work

In March, 2010. President Obama signed the Affordable Care Act. One provision of the Act required that in 2014 all Americans must have qualified health insurance or face a “Shared Responsibility Payment,” more commonly known as the Health Care Penalty. A lesser known amendment to the Act allowed insurance providers and large employers a one-year…

Read MoreOut with the old – in with the new mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Read MoreWorking outside the USA? Don’t forget about these IRS requirements!

You may still have to file a tax return if you live outside the United States and maintain your US citizenship.

Read MoreWhile you’re struggling with your budget . . .

We thought you’d like to know some of the things Washington is doing with your money.

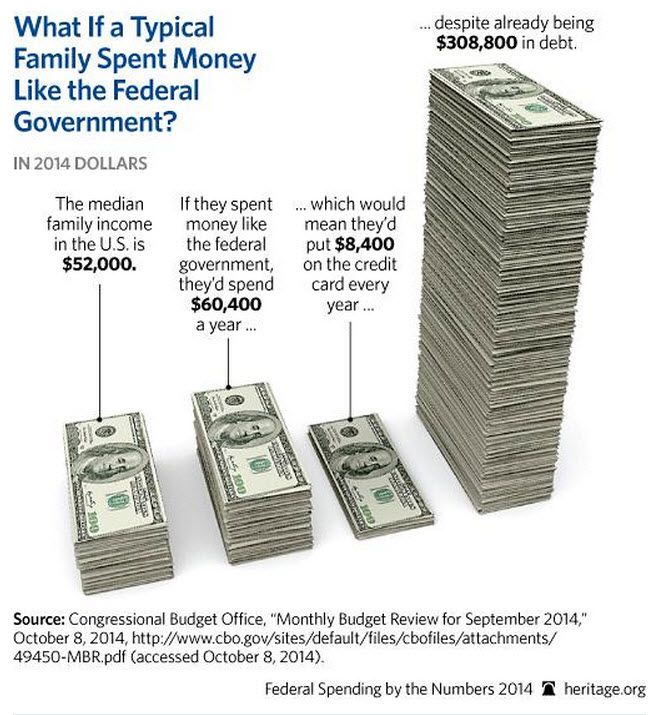

Read MoreWhat if you spent like the Federal government?

What if you spent like the Federal government?

Read MoreS-Corp Owners – IRS rules in your favor!

Here’s the good news – as of December 19, 2014, IRS has updated their website with specific instructions on this topic.

Read MoreOur Christmas gift to clients – more deductions for 2014!

Well . . . it’s technically not a “gift” but it will help you lower your taxable income for 2014.

Read MoreYear-End Planning Information for 2014 & 1015

Here’s a complete list of qualified plan limitations, You may want to bookmark this page in your browser for use now and next year.

Read MoreA Year-End tip that always helps in tax planning

All of our existing clients have access to our SCA Secure client portals at no additional charge.

Read More