Christmas gifts and the Federal Gift Tax

During the season of giving, you can (tax-wise) accomplish some effective giving as well.

Read MoreThanksgiving Items

Our clients are some of the most grateful people we know. It seems appropriate on this holiday to document the things that we’re most thankful for and the persons responsible for them. We’re always thankful for you, our clients, and look forward to serving you in 2015! Feel free to use our form below to…

Read MoreNo good deed (or charitable donation) goes unpunished

In the case of non-cash charitable gifts you need to be careful not to fall into several tax traps that may limit your deduction.

Read MorePivot Table and Reports

Do you have the concept of Excel Pivot Tables but need help in creating reports? This video can help.

Read MoreHaven’t filed a return for a few years? Here’s some options that you can use.

Haven’t filed a return for a few years? Here’s how to start.

Read MoreWho gets your Roth-IRA money? (Part IV of Keeping it All in the Family)

Who gets the money from a ROTH-IRA?

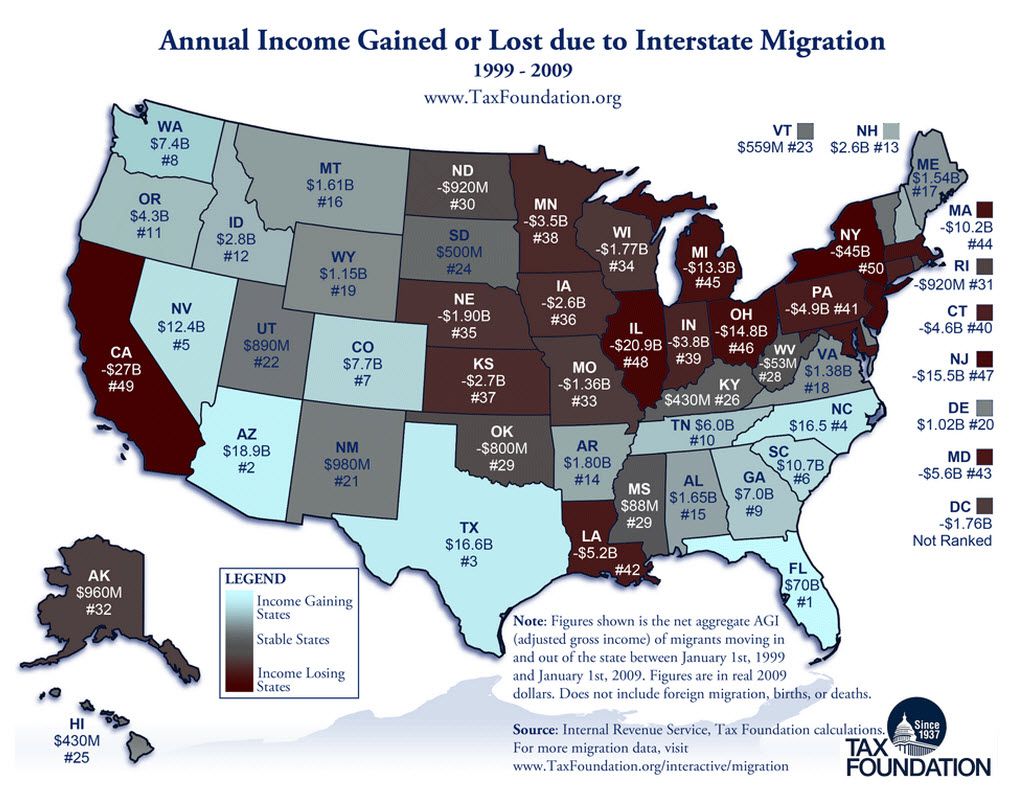

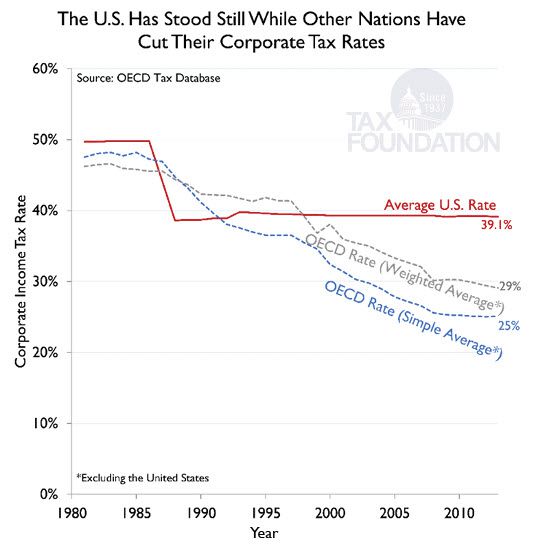

Read MoreUpdate on Corporate inversions – President blames accountants!

[Editor’s note:] To fully understand why accountants react strongly to being blamed for corporate inversion, please read Part I – Corporate Inversion the new buzz word of the statist. Well,well,well. It seems like Washington is keeping their buck-passing deceptive skills honed to a sharp edge. The President has gone so far as to blame CPAs and…

Read MoreCorporate inversions – the new buzz word of the statist

Corporate inversions – the new buzz word of the statist

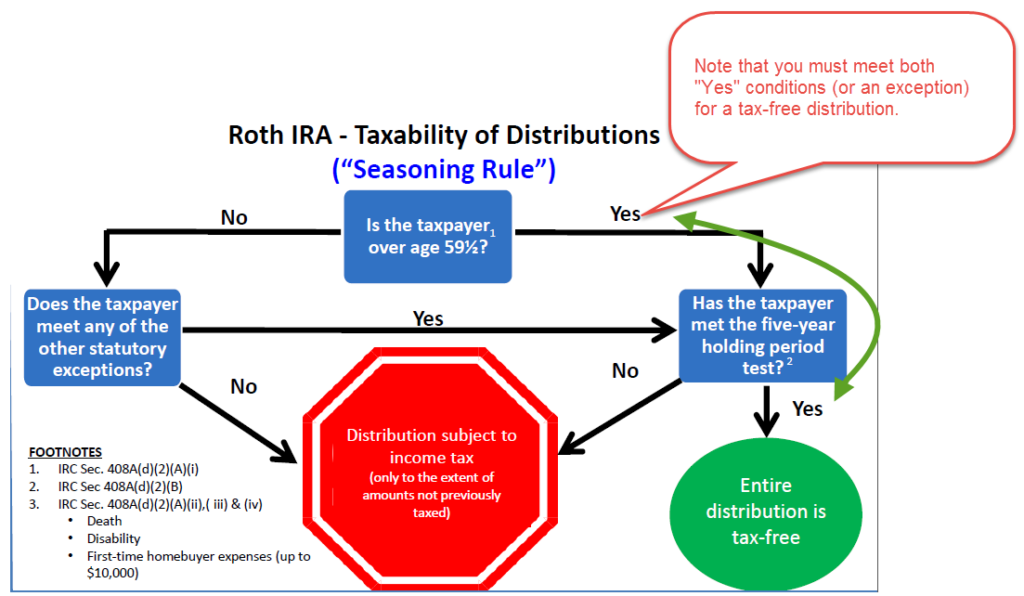

Read MoreRoth-IRAs demand equal time! (Keeping it all in the family Part III)

Here are the answers to the two most often asked questions we get on the subject of Roth accounts.

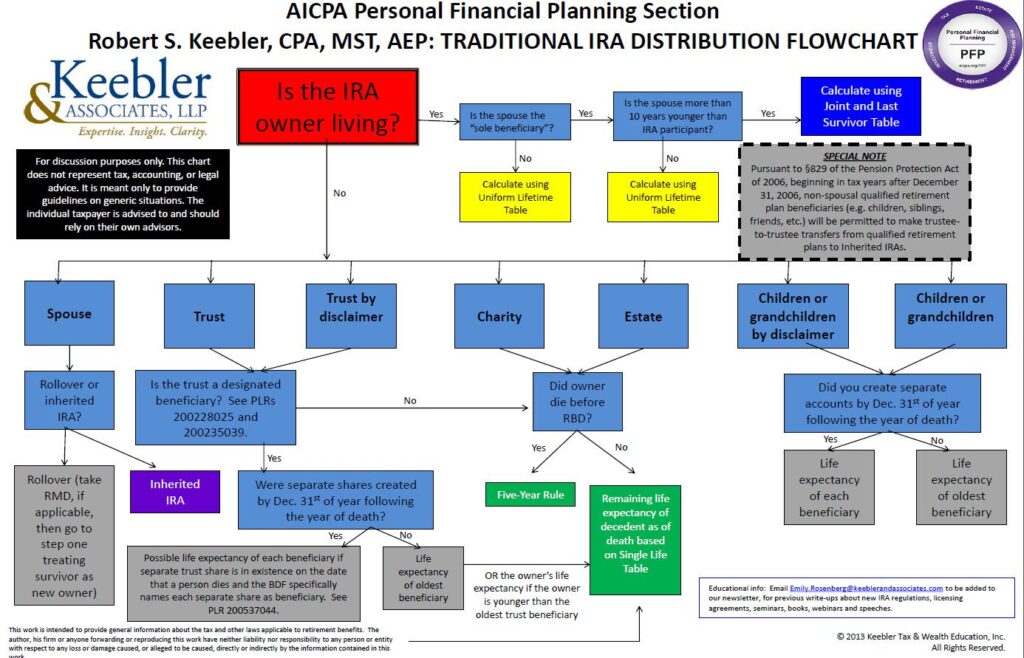

Read MoreWho gets your IRA? It’s not always a simple decision!

When does money have to be paid from an IRA? The answers may surprise you.

Read More