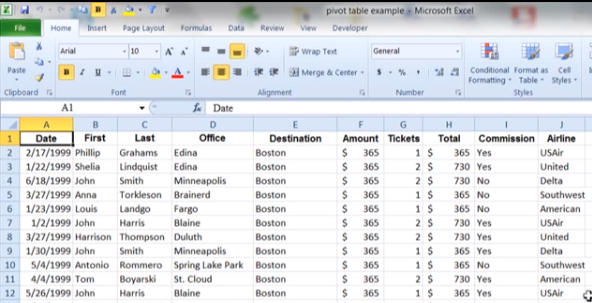

Simple in Six – Excel Pivot Tables Part I

Learn to use Excel Pivot Tables Part I

Read MoreIRS magic tricks – Deductions that will disappear on December 31!

Certain deductions are scheduled to vanish in 2014!

Read MoreHidden traps in Obamacare for 2013

We show you how to avoid pitfalls and traps in Obamacare.

Read MoreHave under 50 employees? You still have an Obamacare deadline October 1!

With just one employee you could have an Obamacare report due!

Read MoreMore tax deductions that you may have missed

Since our first post on deductions that you may have missed, several more items have come to mind that we find clients tend to forget or just don’t know that they’re existent. Most clients either volunteer for some charity work, serve on the boards of private or public foundations, help out at a shelter,…

Read MoreCan IRS make you pay someone else’s tax 10 years later?

Just ask Maureen Mangiardi. Ten years after her father passed away the IRS came to the door asking for her IRA.

Read MoreThis post is rated PG (Public Guidance & Oversight for IRS Abuses).

How IRS’ misuse of a credit card affects your tax planning

Read MoreWhat’s in a name? Let’s ask IRS!

Figures don’t lie but IRS Commissioners do.

Read MoreIdentity theft – IRS posts thousands of social security numbers on its website!

We give you the steps to combat the ever-present danger of ID Theft

Read MoreWhy many cities are going broke

Detroit is in the news since their bankruptcy filing, but the bigger question that we should be asking is why large cities are having problems.

Read More