Simple in Six – Excel Tables

Arguably, one of the most powerful features in Excel 2007 & 2010 is the new table formatting option. You can learn the basics in less than 5 minutes with the tutorial below.

Read MoreCan you guess what’s coming next?

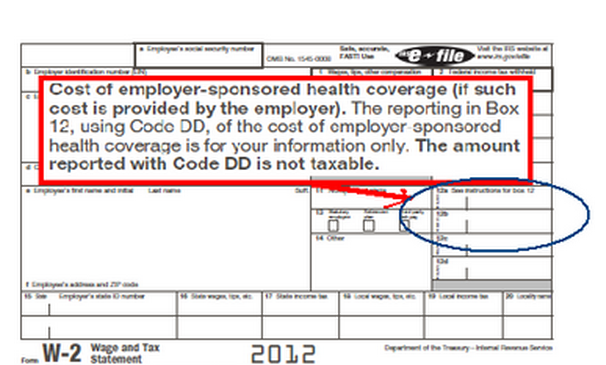

Laura Saunders has a great exercise in predictive logic in the tax section of the Wall Street Journal. Most clients’ largest tax benefit may soon be under attack if she’s right! ” When you receive your W-2 for 2012, pay attention to a surprising new number on the form, especially if you are an upper-income-bracket taxpayer.…

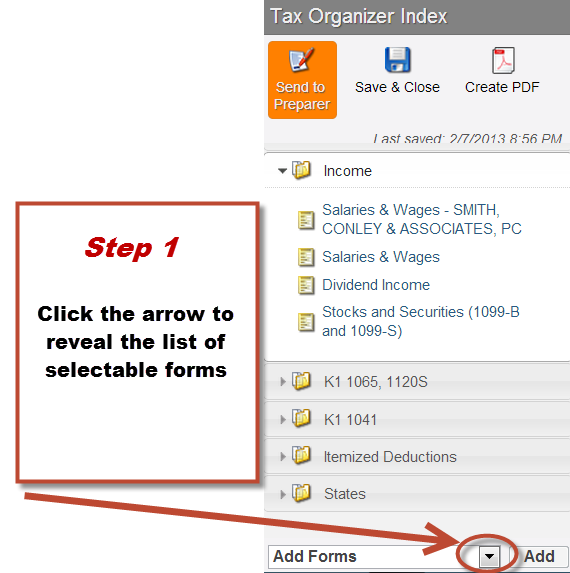

Read MoreHow to add forms to your tax organizer

I’ve always liked being able to substitute items on a restaurant menu. That way you get exactly what you want. Why should your tax organizer be any different? Although the organizer is customized based upon your prior year return, things can often change from last year. If you switched jobs, opened a new brokerage account, opened a new Health…

Read MoreWhen does it pay to be average?

Sometimes being average is not a bad thing. The data below (for illustrative purposes only) shows what the IRS has calculated as average deductions by income level. When a tax return varies too far from the average, something called a DIF ( Discriminant Income Function) score flags the return for audit. However, IRS uses more…

Read More5 Benefits from the new tax law

There actually are some helpful things that emerged from the midnight-hour law signed by President Obama on January 2. Here’s our pick of the top 5.

Read MoreTime running out for a do-over on your IRA distribution!

As our golfer friends say, time is running out for a mulligan on any IRA distributions that were required by 12/31/12. The fiscal cliff law signed by the President on January 2 has a retroactive provision that could help you out of a jam if you forgot to take a RMD (required minimum distribution) from…

Read MorePlanning or Just Playing Scrabble?

Retirement Planning – it’s more than a game of scrabble? Some of the 2013 retirement plan limits have changed. Good planning involves trying to max out these amounts every year. Stop playing a game of scrabble with your retirement and hoping for some lucky tiles to come your way. We can help you determine how much…

Read MoreUnlucky 4 digit numbers

Certain numbers can be unlucky for filing your tax return for 2012. Some of the 4 digits that are guaranteed to delay filing of your return until late February or even March are 3800, 4562, 5695 ,8582 to name just a few. We’re not getting these from a Chinese fortune cookie, but from the IRS website. Seems…

Read MoreBefore we get serious about 2013 . . .

With new changes coming on the home office deduction, reporting of savings accounts, how IRS has managed the new preparer requirements etc, perhaps we should have a quick bit of fun. There’s a lot of swearing in (and swearing at as well) of members of Congress and the President this month. Nothing strikes closer to…

Read MoreIRS releases revised E-File date

You may remember our post a few weeks ago where the IRS predicted that the fiscal cliff may cause filing delays until the end of March for complex returns. Due to a semi-solution by Congress, we now have IRS confirmation that January 30 is approved as the first day for E-Filing. Advanced returns will still be…

Read More