Understanding the Free Market=Business Success

If you understand how the free markets should work, you’ll tend to do a lot better in business. Here’s one of the greatest living speakers on the subject – Dr. Walter Williams.

Read MoreIRS offers a clean slate for the past. . .

Last year’s tax returns included two new questions. They both pertain to 1099 payments and, if unanswered, prevented you from E-Filing. If you’ve worried about 1099 vs employee problems with the IRS, there’s now a chance to wipe the slate of the past clean and start over. IRS is willing to forgo the audit of…

Read MoreA Cliff Notes Summary of the Fiscal Cliff Law

We’ve reviewed the 157 page sorry excuse for a err I mean problem-solving bill Congress passed last night. Sorry that it is (raises taxes, but no spending cuts to speak of), we at least have an idea of what’s coming in 2013. Here are the main (but not all) areas that will effect your return…

Read MoreThe AMT monster is coming! See video below.

If you read nothing else this year . . .

be sure to read our letter to clients on how to plan for 2013. This link will take you there. See the effect on your family in 2013 (Click Here) or use our fiscal cliff calculator with the numbers from your 2011 return.

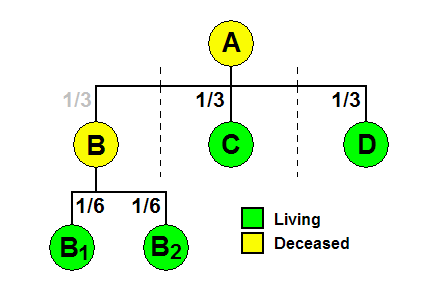

Read MoreTwo words that can change your child’s inheritance

Knowing a little Latin can save you a lot of money. In this case, a little Latin in not a short resident of Greece, but an important legal term that you may see in your will. The term per stirpes, along with its legal cousin, per capita, refers to how an estate is passed along…

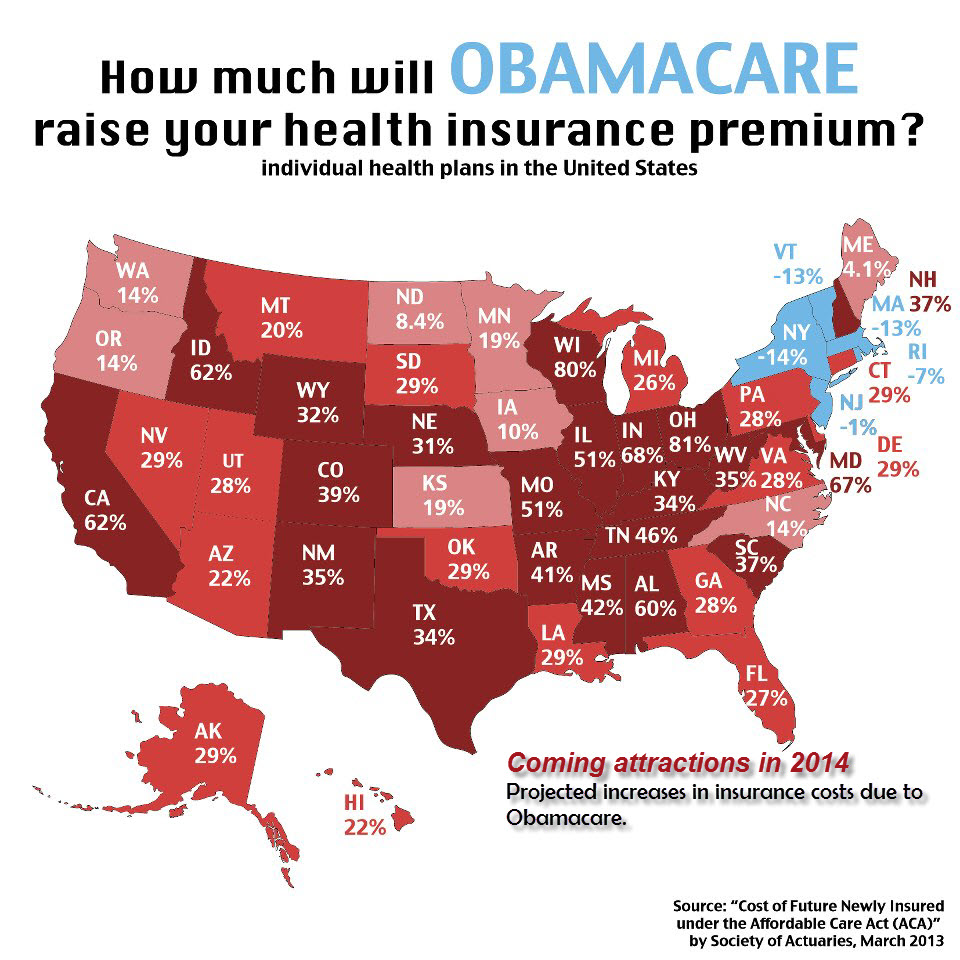

Read MoreDoing business away from your home state? Here’s a handy tool for all 50 states,

Did you ever wish that when you do business in another state, you could quickly check the forms, filing requirements, etc. for that state with one click? The tool below should be just what you need. Using the scroll bars, find the state you wish to check and then click on it. You’ll be linked…

Read MoreIRS to Washington – Get your act together or no returns processed until March

You have to admire one thing about acting IRS Director Steve Miller. As the head of IRS, he warned Congress that certain tax returns will not be processed until March of 2013. Why make this threat? Because twice in the past when the AMT patch has expired, it has been reinstated retroactively. The IRS made…

Read MoreSmall business dodges an IRS bullet

It might be more appropriate to say that we small business owners dodged a boomerang because this issue is coming back in 2014. Our regular readers know that we sent a red alert out a few weeks ago about the most harmful tax regs that we’ve seen in a long time. You can refresh your…

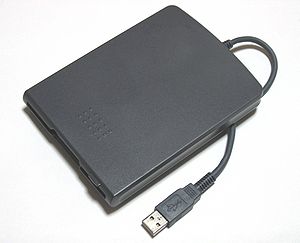

Read MoreWill your Key Data survive a disaster?

By Guest Editor Rick Viall rviall@viallins.com A good friend of mine who is a claims adjuster is seeing it over and over. People have lost their business data in hurricane Sandy. Even if they can dry out their place of business and get restocked they will not be able to file a tax return and…

Read More