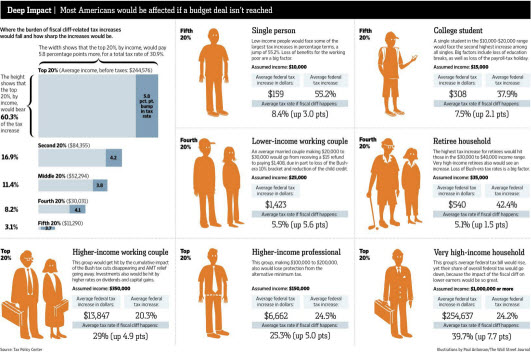

The fiscal cliff effect by age groups

Whether you are single, married, working your way through college, or settled in your career. This infographic from today’s Wall Street Journal shows the financial loss you’ll feel in 2013. Begin your tax planning now to avoid a painful new year. Be aware that these are averages. Your tax effect may be larger. [Be sure to click…

Read MoreLike what you see? Here’s how you can QR a friend.

If you’re seeing this, you already know how to reach our web site with its many free services. If you like what you’ve seen then forward this link to a friend who likes to save on taxes. Your friends can click the picture (for an enlarged view) and then scan the QR code to sign…

Read MoreThe new way to buy car insurance in 2013

5 Years to write off a $100 thumb drive? We’re not kidding on this one.

Now is the time to “repair” the deduction for repairs! You’ll have a hard time believing this one, but here are the facts. We’ve sent our business clients the following letter to help them understand the problem they face for 2012 taxes. To all business property owners: I am told the 2010 US Census reports…

Read MoreFor advanced clients only

For our clients who have advanced knowledge of the dangers starting January 1 (to join this group, Click Here and read the section of fiscal cliff articles) we offer a “Cliff Notes” version of the individual effects of the fiscal cliff. You can access this summary graphic by clicking this link. Remember there’s still plenty…

Read MoreThe fiscal cliff in graphic form

Hollywood’s Friday the 13th and Freddy Kruger can’t begin to compare to how scary this picture promises to be. Coming to a country (very) near you on January 1, 2013. Clients can E-mail us for a special video presentation with specific details on what’s involved. We’ve also compiled a listing of helpful articles which can…

Read MoreSpecific info on the Fiscal Cliff

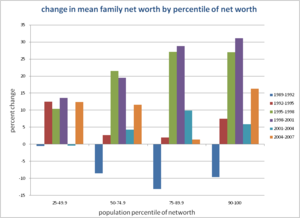

Detailed information of the peaks and valleys of the Fiscal Cliff Our last newsletter (see this link) contained general information and warnings about the financial and tax disaster referred to by the media as the “fiscal cliff.” We’ve been deluged with requests for more specific details on the effects of this scheduled legislation. Remember,…

Read MoreThe Dark Knight vs. H&R Block

Bruce Wayne (aka Batman) may be out to get Block (H & R), not the villainous Bain. Seems like H&R did a tax return comparison between the wealthy Mr. Wayne and a competing super-hero and made a 17- million- dollar mistake on his tax projection. In the first calculation (now pulled from their website) Block had Bruce Wayne reducing…

Read MoreIs there a way to deduct my political donation?

Is there a way to deduct a political donation? The answer may surprise you. More than most tax questions, the answer to this one really is – “It depends.” It depends upon whether the donation was given to: a social welfare group, a trade association, a PAC, a so-called Super PAC, or…

Read MoreBreaking tax news for 2013!

IRS just announced the new (and higher) limits on 401(k) plans etc. Here’s a summary for use in 2013 tax planning. The inflation-adjustments for 2013 include: Gift Tax Exemption: $14,000 (up $1,000 from 2012) Contribution Limit for 401(k)/403(b)/457 Plans: $17,500 (up $500 from 2012) Catch-Up Contribution Limit (Age 50+) for 401(k)/403(b)/457 Plans: $5,500 (same as 2012)…

Read More