Christmas giving and tax deductions

In the case of non-cash charitable gifts you need to be careful not to fall into several tax traps that may limit your deduction.

Read MoreChristmas gifts and their tax benefits

Holiday parties and gifts can help show your appreciation and provide tax breaks With Thanksgiving behind us, the holiday season is in full swing. At this time of year, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good idea to understand…

Read MoreChrisley knows best — except for taxes

There have always been a number of things you can do to get on the IRS’ bad side and (in the Christmas vernacular) their “naughty list.” This article from Forbes is a great checklist of things you should never, ever, do when dealing with an IRS audit. Published by Tax Attorney Robert Wood in Forbes…

Read MoreHitting the target with the Business Income Deduction

The new deduction of 20% of qualified business income (QBI) has been a source of confusion for clients (and accountants as well). But given that this is a deduction that you can obtain without spending additional money from your business, it’s well worth some effort to understand. You can find what defines a SSTB (see…

Read MoreIf Alexa were made by Southerners . . .

Sometimes during the final deadlines of the 1040 tax season, you just need a good laugh. Thus, in the spirit of tax humor, we present – What if Alexa was built by Southern folks? To view, click on the play button, and the speaker icon for sound. If Alexa was Southern The future has arrived,…

Read MoreSell your C-Corp business and pay no tax?

Section 1202 allows you to sell qualified small business stock (QSBS) on a tax-free basis! Now, add to this no-tax-on-sale benefit to the 21 percent corporate tax rate from the Tax Cuts and Jobs Act, and you have a significant tax planning opportunity. Let’s just suppose the following: You sell your C corporation stock. The…

Read MoreGet a 30 Percent Tax Credit for Residential Solar Panels

Only a few months left to Claim a Tax Credit for Residential Solar Panels If you’ve decided that you want to go the Solar Energy route, here are some unique tax advantages to help pay for it. The 30 percent residential solar credit: drops to 26 percent for tax year 2020, drops to 22 percent…

Read MoreRoth vs Traditional IRA – Which is better

Roth IRA versus Traditional IRA: Which Is Better for You? I can’t think of a more heated tax debate than this topic has been over the years. This debate is akin to the feud between the Hatfields and McCoys, the Montague and Capulets, the Union and the South, etc. Accountants tend to be split…

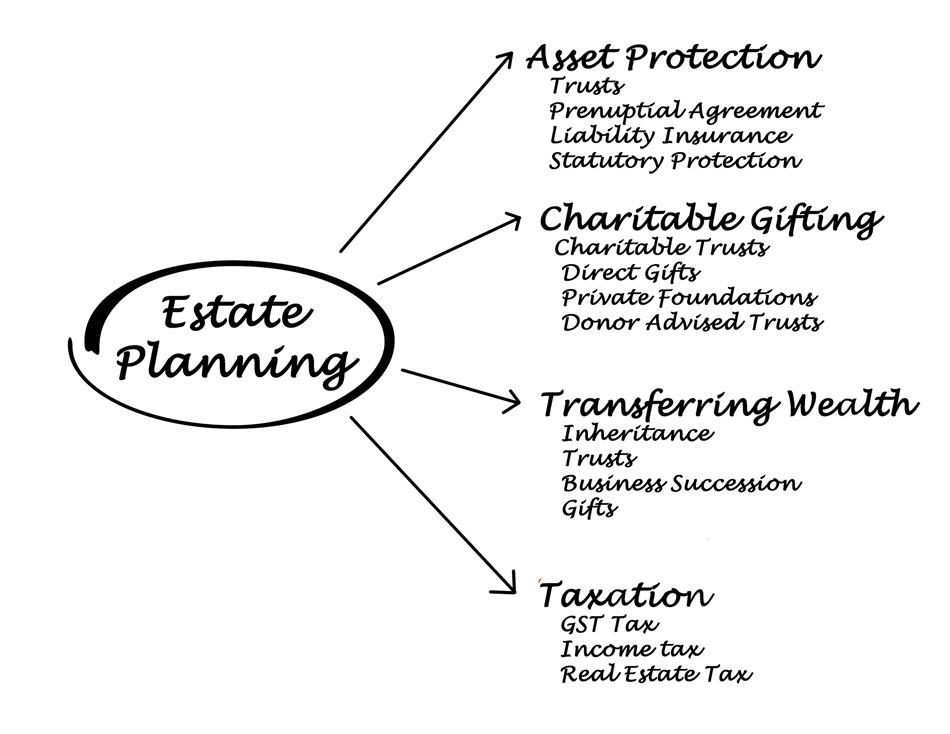

Read MoreOther firms give you a list but we give you a tool

A list of your assets is great for estate planning but, in addition, what your heirs will appreciate is a map to find the items they need after you’re gone. This downloadable form (see the link at the bottom of the page) will not only make sure you have the vital estate documents but will…

Read MoreBarter – Yes, it’s taxable

Bartering: A taxable transaction even if your business exchanges no cash It’s good to read the above sentence a couple of times before proceeding to the rest of this post. A small local business may find it beneficial to barter for goods and services instead of paying cash for them. If your business engages in…

Read More