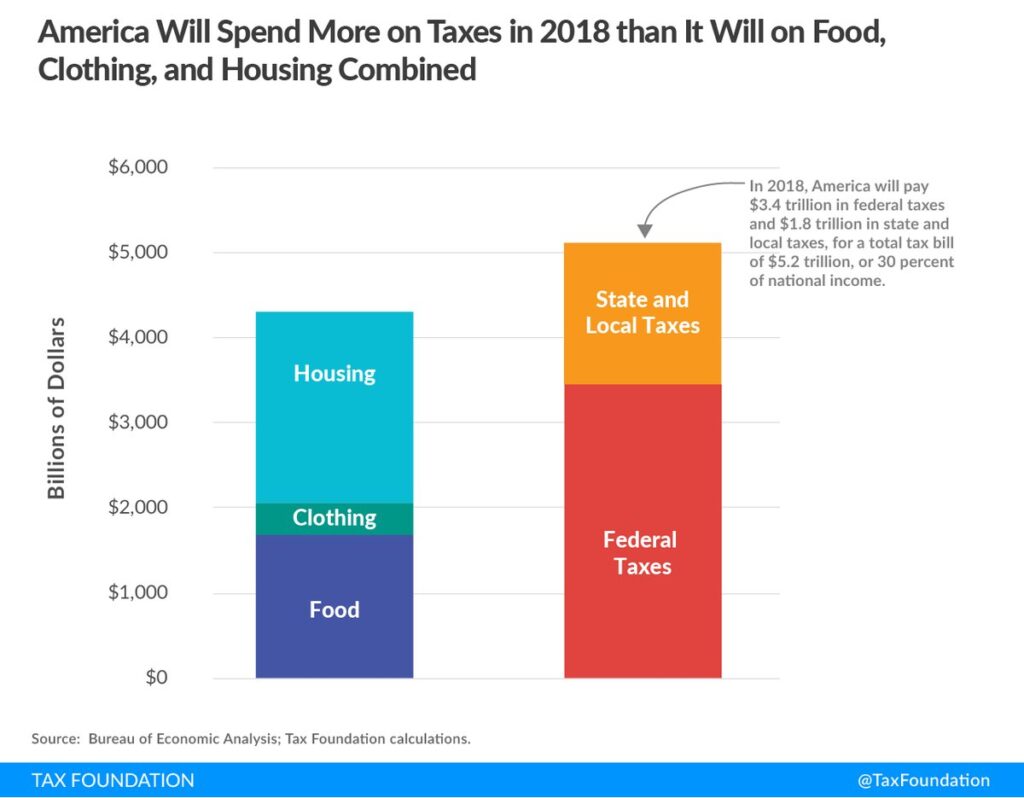

Where your money really goes!

I’m putting this under the category of tax humor but, arguably, it’s not that funny. There used to be a cliche that nothing has changed due to technology and that we still spend most of our income on food, clothing, and shelter. There is something that has grown faster than real estate costs or inflation. That’s the…

Read MoreGuarding your ID

Guard your ID carefully. Here are some tips.

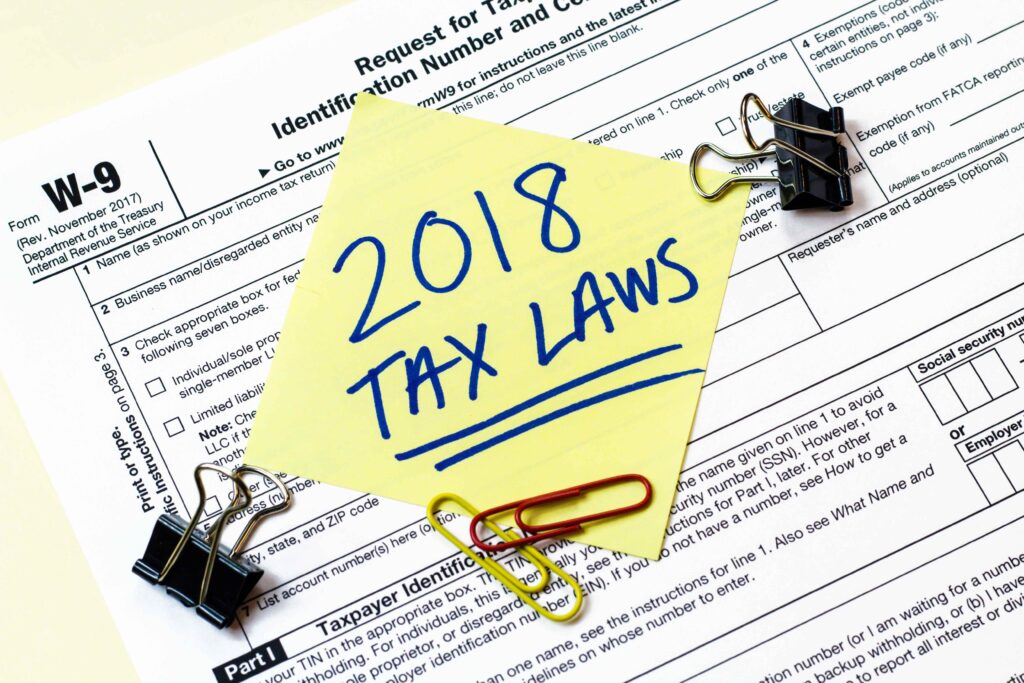

Read MoreCharting the effects of tax reform on your return

Buckle your seat belt because the road to tax savings just got bumpier. We’ll be covering the major changes for tax year 2018 below. Existing clients can obtain a free detailed report on each area by clicking this link and referencing the phrase in the topic column in the subject line of your email.

Read MoreThe biggest no-brainer for 2019 tax planning

We’re in the new year now. and it’s never too early to start saving taxes. The reason we call this the “no-brainer” of tax planning is simple. Amounts that are timely contributed to your Simple-IRA, 401(k), SEP-IRA, etc. are fully deductible, These amounts enjoy tax-deferred growth (the 8th wonder of the financial…

Read MoreWhat a difference a name makes!

How you define “Real Estate Investor” and “Real Estate Dealer” can make a huge difference in your taxes. Let’s take a look at how big a difference you can make in the tax bite. Say you have a $90,000 profit on the sale of a property. • Dealer taxes could be as high as $46,017. •…

Read MoreIs it too late to accrue a bonus for last year?

Is there still time to pay 2018 bonuses and deduct them on your 2018 return? [Editor’s note: This post pertains to bonuses paid to your employees and non-owners. Special rules apply to related parties, so be sure to contact us before venturing into that area. That said, let’s discuss how to reward your team members…

Read MoreDoes everybody really get a tax cut in 2018?

This is because the tax rates are less than in 2017 for every income bracket. Although there is always the exception the proves the general rule, here are the new reduced rates for tax year 2018. Existing clients are welcome to email us for an estimate of just how much savings you may realize.

Read MoreCommon sense year-end planning

7 last-minute tax moves for your business Postpone invoices. If your business uses the cash method of accounting, and it would benefit from deferring income to next year, wait until early 2019 to send invoices. Accrual-basis businesses can defer recognition of certain advance payments for products to be delivered or services to be provided next…

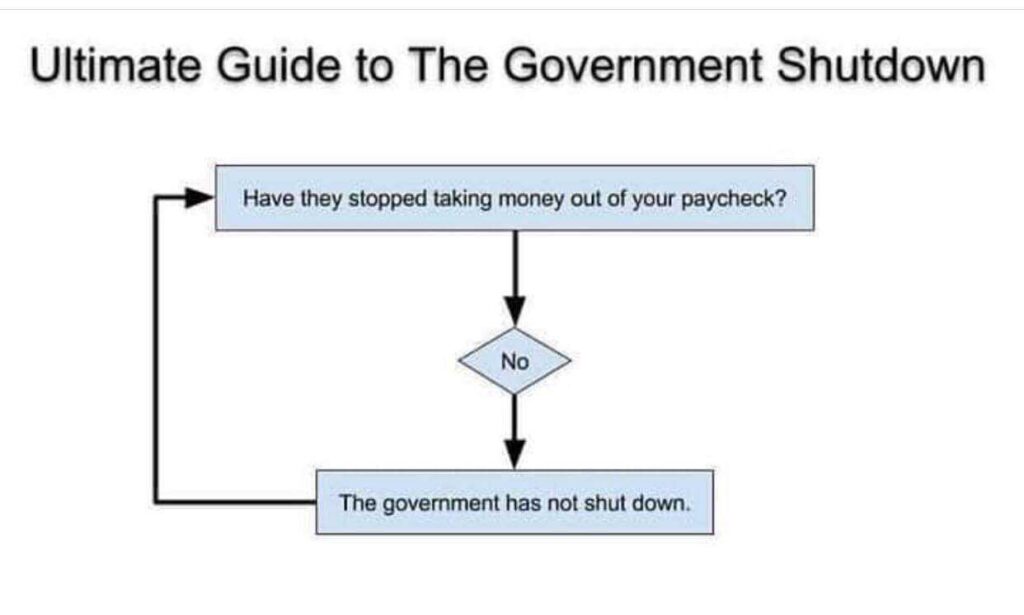

Read MoreThe one sure way to know if we’ll have a government shutdown

With all the stress of the holiday season, we thought you could use a little humor at Congress’ expense. Therefore, we have developed our infallible flow-chart to determine in the government has really shut down or not.

Read MoreTis the season to deduct Holiday gifts and parties

When holiday gifts and parties are deductible or taxable The holiday season is a great time for businesses to show their appreciation for employees and customers by giving them gifts or hosting holiday parties. Before you begin shopping or sending out invitations, though, it’s a good idea to find out whether the expense is tax…

Read More