Estate Planning

Why you should start a 529 Plan for your 2 year-old child

Start the 15-year clock! Open a 529 plan for each child today. It doesn’t take thousands of dollars or in some cases even hundreds of dollars-maybe as little as $100 to open this savings account. By opening it now the parent can start the 15-year savings clock so that all earnings in the account are…

Read MoreDonor-Advised Funds -they are easier than you think

Donor-Advised Funds: A Tax Planning Tool for Church and Charity Donations Do you give money to your church? Do you get a tax benefit from those donations? How about your donations to other charities? Recent changes in the tax code have done much to destroy your benefits from church and other tax-deductible 501(c)(3) donations. But…

Read MoreEstate Planning under the Biden Administration

The following article is from The National Law Review (Feb 13, 2021 issue by Jacqueline Messler) and does a great job of summarizing the (possible) coming changes in estate tax law. “Over the past twenty years, there has been a dramatic change in the Estate tax laws. Given the Democratic control established in Washington, D.C.…

Read MoreWhat happens when the heirs lose the Will?

What happens when you know there’s a will but no one can find it? Our thanks to attorney Ira Leff’s tax blog (we’ve included a download link at the bottom) for the information below. Here’s one family’s course of action when unable to produce the will of a widow with no children. For more estate and asset…

Read MoreHow to navigate the Medicare maze

Common pitfalls in applying for Medicare.

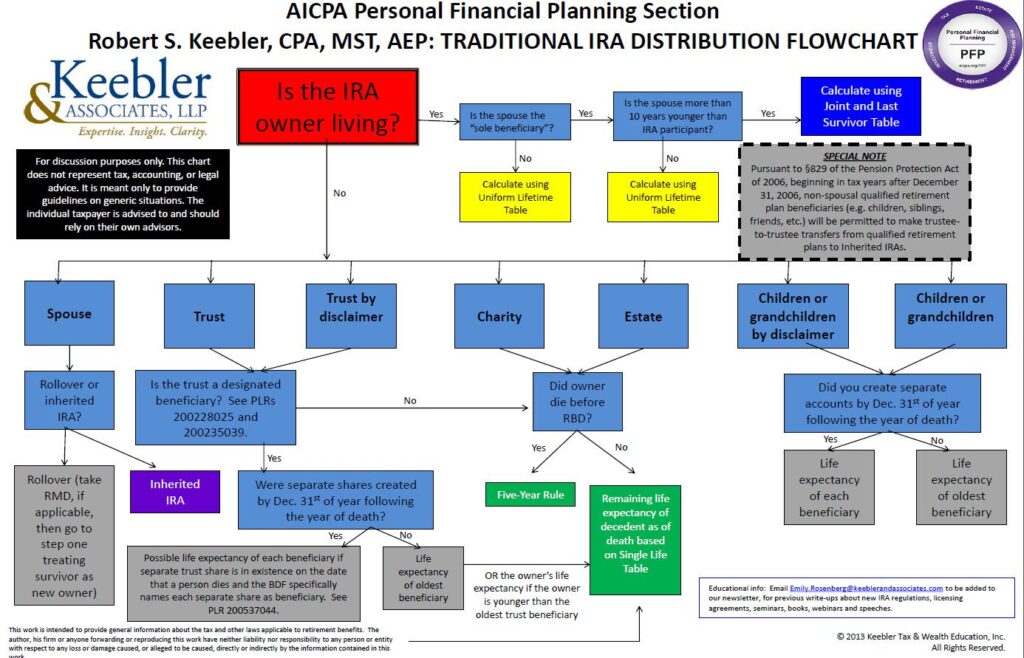

Read MoreWho gets your IRA? It’s not always a simple decision!

When does money have to be paid from an IRA? The answers may surprise you.

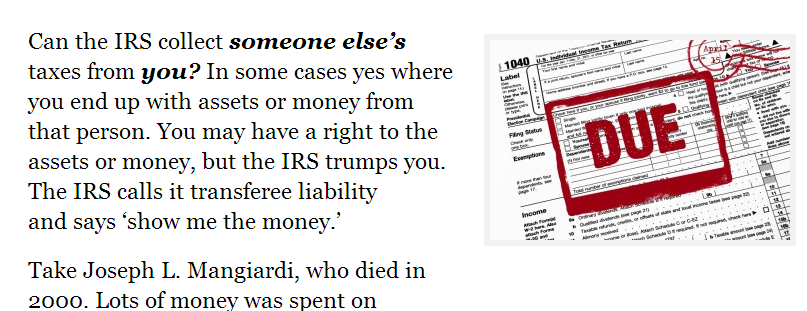

Read MoreCan IRS make you pay someone else’s tax 10 years later?

Just ask Maureen Mangiardi. Ten years after her father passed away the IRS came to the door asking for her IRA.

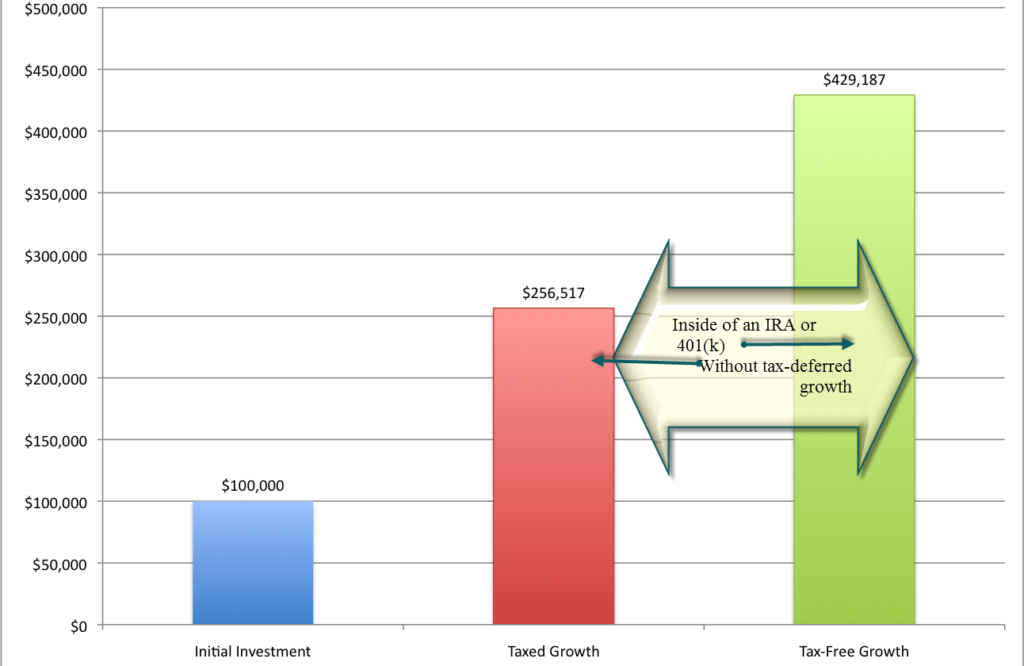

Read MoreWhy we recommend tax-deferred growth!

This is the reason we recommend tax-deferred growth for your Investments.

Read MoreThe best reason to do Financial Planning-leaving a positive legacy.

It’s not just about you and me. Planning is about leaving a positive legacy for our children. This tongue-in-cheek video shows one very sound reason why you’d want to do this. Concerned about your financial goals? Contact us for help. (Click here if your screen doesn’t show the video.)

Read MoreEstate Tax Rates for 2013 and beyond

The zero-hour fiscal cliff law raised the top estate tax rates to 40 percent.

Here’s a table with the new rates for 2013 and beyond.