Estate Planning

Where there’s a Will . . .

. . .there are usually some opportunities for tax and estate planning. Most people don’t appreciate the importance of a will, especially if they think their estate is below the level of the estate tax exemption. Even people who recognize the need for a will often don’t have one, perhaps due to procrastination or the lack of…

Read More5 Benefits from the new tax law

There actually are some helpful things that emerged from the midnight-hour law signed by President Obama on January 2. Here’s our pick of the top 5.

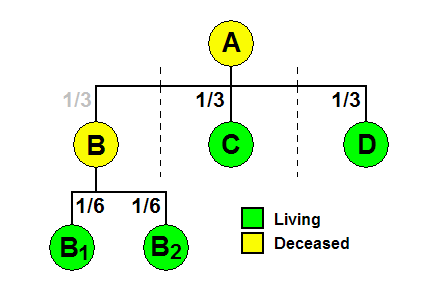

Read MoreTwo words that can change your child’s inheritance

Knowing a little Latin can save you a lot of money. In this case, a little Latin in not a short resident of Greece, but an important legal term that you may see in your will. The term per stirpes, along with its legal cousin, per capita, refers to how an estate is passed along…

Read MoreThe worst state(s) to die in. . .

For estate tax purposes, there are some terrible states to die in this coming year (2013). Hover over the selected states in the map below and you’ll see what we mean.

Read MoreThe theory of relativity is in the tax code

This is not the theory discovered by Einstein, but the one that states that certain tax advantages may be disallowed if you sell an asset to someone (or a company) that the tax code calls a “related party.” Simply put, selling a capital asset at a loss to any of the following entities will cause the loss…

Read MoreThe state of estate tax

The “state” of the Estate Tax is … … in a state of confusion and that’s putting it mildly! Originally, for those dying in 2010, there was no estate tax. Then Congress thought you might not be happy with this arrangement. So they created two methods of taxing estates and determining the basis of…

Read More