For Business

Understanding the Free Market=Business Success

If you understand how the free markets should work, you’ll tend to do a lot better in business. Here’s one of the greatest living speakers on the subject – Dr. Walter Williams.

Read MoreIRS offers a clean slate for the past. . .

Last year’s tax returns included two new questions. They both pertain to 1099 payments and, if unanswered, prevented you from E-Filing. If you’ve worried about 1099 vs employee problems with the IRS, there’s now a chance to wipe the slate of the past clean and start over. IRS is willing to forgo the audit of…

Read MoreDoing business away from your home state? Here’s a handy tool for all 50 states,

Did you ever wish that when you do business in another state, you could quickly check the forms, filing requirements, etc. for that state with one click? The tool below should be just what you need. Using the scroll bars, find the state you wish to check and then click on it. You’ll be linked…

Read MoreSmall business dodges an IRS bullet

It might be more appropriate to say that we small business owners dodged a boomerang because this issue is coming back in 2014. Our regular readers know that we sent a red alert out a few weeks ago about the most harmful tax regs that we’ve seen in a long time. You can refresh your…

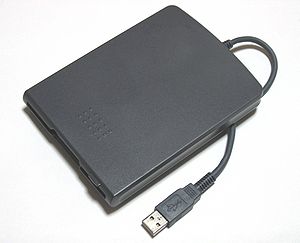

Read MoreWill your Key Data survive a disaster?

By Guest Editor Rick Viall rviall@viallins.com A good friend of mine who is a claims adjuster is seeing it over and over. People have lost their business data in hurricane Sandy. Even if they can dry out their place of business and get restocked they will not be able to file a tax return and…

Read More5 Years to write off a $100 thumb drive? We’re not kidding on this one.

Now is the time to “repair” the deduction for repairs! You’ll have a hard time believing this one, but here are the facts. We’ve sent our business clients the following letter to help them understand the problem they face for 2012 taxes. To all business property owners: I am told the 2010 US Census reports…

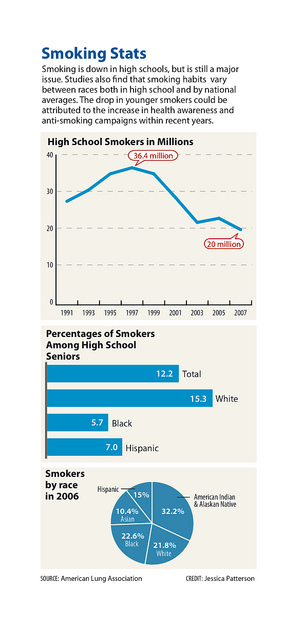

Read MoreYour Cheating Chart (from the Journal of Accountancy)

To paraphrase the country western song, your cheating chart is going to tell on you! Fellow CPA Carlton Collins shows common ways that data presentation via charts can be unethically manipulated to change the reader’s conclusions Don’t be fooled by government (or other) data that sounds too good to be true. Learn to be discerning…

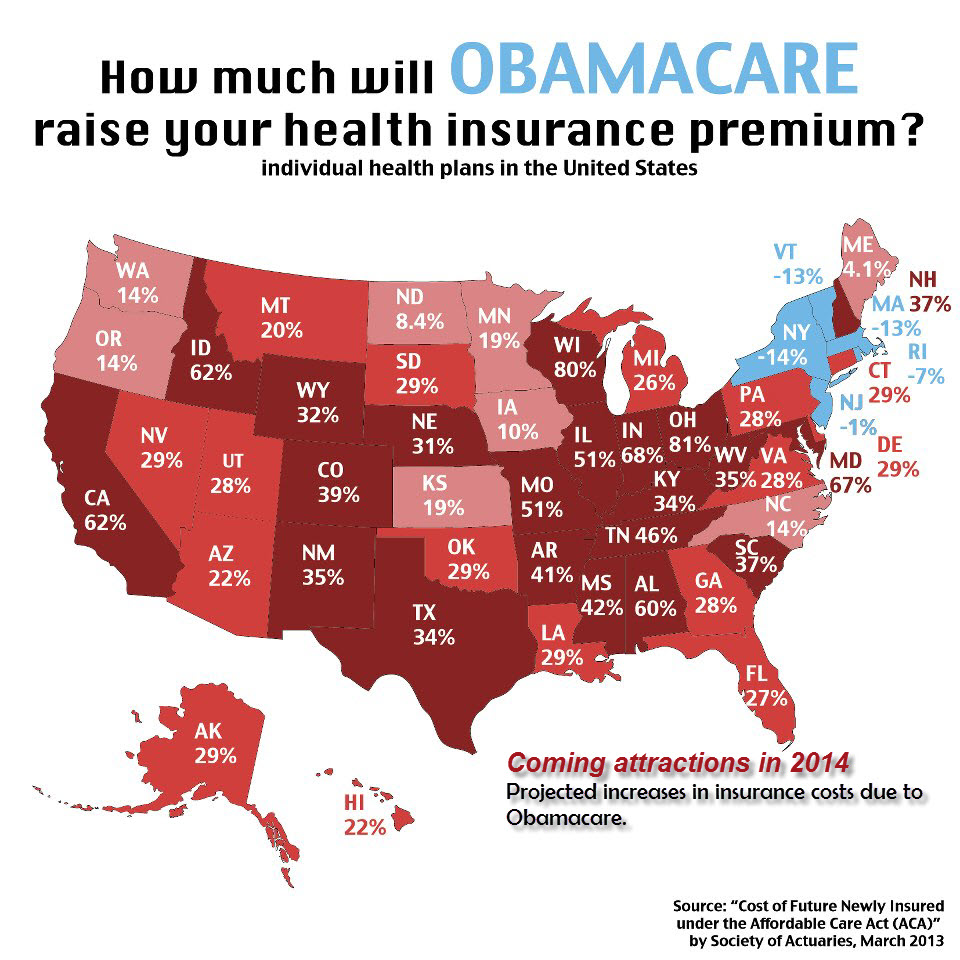

Read MoreIRS begins a “Hiring Frenzy”

See the second video if you still believe it’s possible to administer the health care debacle. Here’s just how easy it is to calculate.

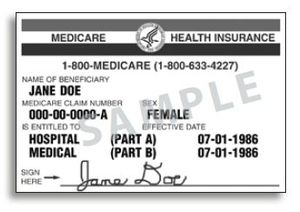

Read MoreA tutorial for business owners on the new Medicare tax

An individual is liable for Additional Medicare Tax if the individual’s wages, other compensation, or self-employment income

(together with that of his or her spouse if filing a joint return) exceed the threshold amount for the individual’s filing status:

Hire a Vet? Time is running out for tax credit.

Employers Need to Act Soon to Get Expanded Credit for Hiring Vets Special Edition Tax Tip 2012-11 Employers that hired unemployed veterans during late 2011 and early 2012 had an expanded period to request the required certification for claiming the expanded Work Opportunity Tax Credit (WOTC). That expanded period ends on Tuesday, June…

Read More