For Business

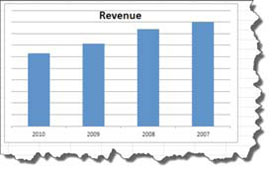

Why budgets have no value

You heard us right-they have no value. Jack Welch the brilliant CEO of General Electric agrees with me (don’t confuse him with the current clown at the head of GE). Welch did away with all the wasted weeks of the budget process and focused on creating projections instead. He then held the departments accounting to the projection of income and expense that they participated in creating.

Read MoreHidden provisions in the Extended Payroll Tax Cut

Payroll Tax Cut Extended for All of 2012 On February 22, 2012, the Temporary Payroll Tax Cut Continuation Act of 2011 was permanently extended for all of 2012. This extends the two percentage point payroll tax cut for employees, continuing the reduction of their social security tax withholding rate from 6.2 percent to 4.2…

Read MoreIndependent Contractor vs. Employee – IRS throws a bargaining chip into the mix

The IRS has launched a new program that may help employers to resolve past worker classification issues (Independent Contractor vs. Employee) at a relatively low tax cost by voluntarily reclassifying their workers. As regular readers know, IRS’ attitude on this issue has been less than helpful in the past. Personally, I do not know of…

Read MorePeachtree users – Here’s how to add the owner’s health insurance to the W-2

Clients with S-Corps – Don’t forget that you cannot deduct your health insurance costs without loading them onto your W-2. Here’s how to do it. [gview file=”https://elitecpatax.com/images2/peacthreeW-2Health.pdf”]

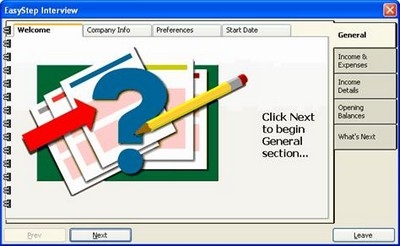

Read MoreIRS targets Quickbooks and Peachtree users and makes outrageous demands!

We’ve known for some time of the IRS’ stated intent to educate at least one member of every audit team with advanced knowledge of Quickbooks and Peachtree Accounting. Given that these two programs have over 80% of the small business software market, one could understand this goal. The unsettling news is that IRS intends to…

Read MoreThe one place that you should never borrow money from

Here’s some good advice from the iowabiz.com site about the worst place to borrow money. [The 2% IRS penalty referred to below is equal to an APR of about 25% on a 30 day loan!] by Joe KristanDecember 1, 2011 Every entrepreneur struggling to stave off hungry creditors has probably taken a wistful look…

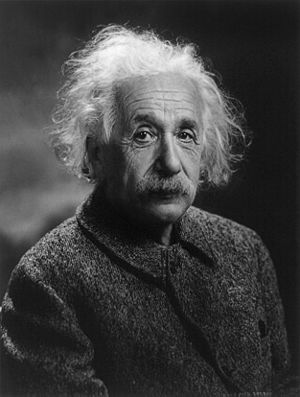

Read MoreThe theory of relativity is in the tax code

This is not the theory discovered by Einstein, but the one that states that certain tax advantages may be disallowed if you sell an asset to someone (or a company) that the tax code calls a “related party.” Simply put, selling a capital asset at a loss to any of the following entities will cause the loss…

Read MoreNew tax credit for hiring vets

President Obama has signed into law increased tax credits for hiring certain veterans. The credits are part of the Work Opportunity Credit, which requires that employers certify through state jobs agencies that employees qualify for the credits. The credit rules, effective for veterans hired as new employees: – A maximum $4,800 credit (40% of the…

Read MoreWhy most clients are in violation of their Quickbooks license and don’t even realize it!

As if the IRS wasn’t enough to deal with, now Quickbooks owners have another hidden trap that Intuit is just waiting for you to stumble into. The trap centers around the wording in the licensing agreement. Simply put, it’s not a per user license like most multi-user software. Instead, it’s a per person license. Let…

Read MoreTax breaks of C Corporations

Income splitting. The government taxes the first $50,000 of corporate profits at a lower rate than the individual owners’ tax rates. Therefore, you one should split your C corporation’s income between yourself (or your S Corp) and the C corporation. This allows you to pay taxes on the salary you pay yourself at your individual…

Read More