For Business

Barter – Yes, it’s taxable

Bartering: A taxable transaction even if your business exchanges no cash It’s good to read the above sentence a couple of times before proceeding to the rest of this post. A small local business may find it beneficial to barter for goods and services instead of paying cash for them. If your business engages in…

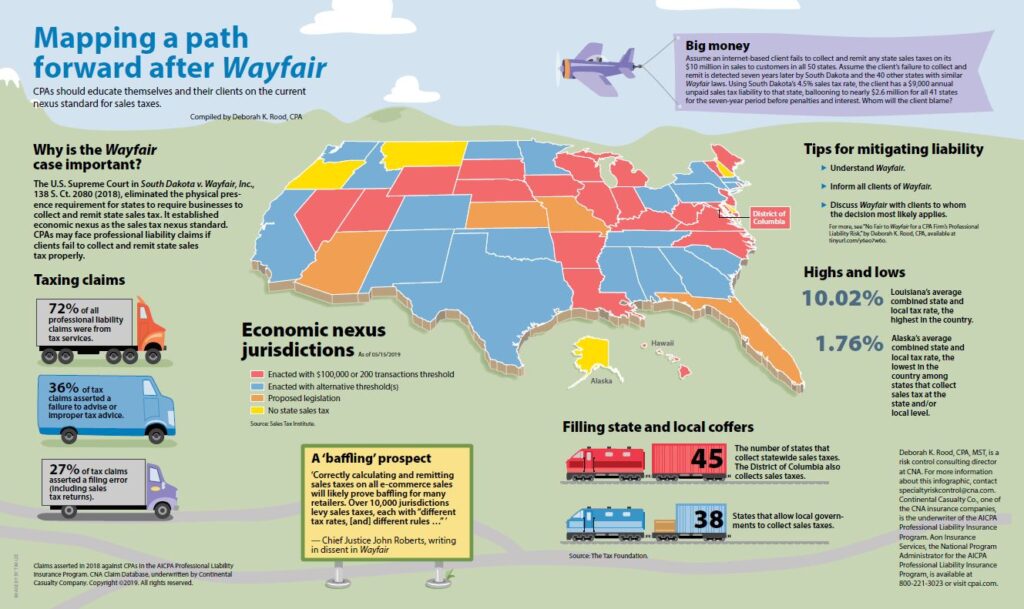

Read MoreWayfair-you’ve got just what I don’t need

I doubt there’s a more common question that I get from business owners that sell a product than -“How does the Supreme Court Wayfair decision affect me collecting sales tax from the products that I sell outside of Georgia?” Books have been written on this, but the short version is that until the recent Supreme…

Read MoreKnow your enemy’s plan- Read his audit guide

In chess (as in business), it’s good to be able to think three moves ahead. This is especially true when dealing with IRS auditors. Wouldn’t it be nice if you could read the plan on how they’ll review your books weeks before they came for their appointment? Well wish no more – this information…

Read MoreMethods of Asset Protection

We ought to be always learning about most everything in life. But it’s especially important to keep current on ways to protect the assets that you’ve worked so hard for over the years. It today’s litigious climate you can’t be too careful. The audio podcast below describes how to do this. Although intended for Doctors,…

Read MoreTax Reform’s effect on meal deductions

We’ve published a lot of this topic but sometimes less is more. On the chart below, we take 12 different types of business meals and show how tax reform affects your tax deduction. Remember, you still need to document the 5 W’s to make the deduction withstand IRS scrutiny: Who What (dollar amount and…

Read MoreCliff notes of the new tax law

Most clients don’t really need to know all the aspects of Tax Reform. But a quick reference guide can be helpful. From the new rules on alimony to 529 plans to mortgage interest limitations to meals and entertainment and the new 20% business income deduction – here’s the tip sheet you’ll want to print and keep…

Read MoreThe biggest no-brainer for 2019 tax planning

We’re in the new year now. and it’s never too early to start saving taxes. The reason we call this the “no-brainer” of tax planning is simple. Amounts that are timely contributed to your Simple-IRA, 401(k), SEP-IRA, etc. are fully deductible, These amounts enjoy tax-deferred growth (the 8th wonder of the financial…

Read MoreWhat a difference a name makes!

How you define “Real Estate Investor” and “Real Estate Dealer” can make a huge difference in your taxes. Let’s take a look at how big a difference you can make in the tax bite. Say you have a $90,000 profit on the sale of a property. • Dealer taxes could be as high as $46,017. •…

Read MoreIs it too late to accrue a bonus for last year?

Is there still time to pay 2018 bonuses and deduct them on your 2018 return? [Editor’s note: This post pertains to bonuses paid to your employees and non-owners. Special rules apply to related parties, so be sure to contact us before venturing into that area. That said, let’s discuss how to reward your team members…

Read MoreCommon sense year-end planning

7 last-minute tax moves for your business Postpone invoices. If your business uses the cash method of accounting, and it would benefit from deferring income to next year, wait until early 2019 to send invoices. Accrual-basis businesses can defer recognition of certain advance payments for products to be delivered or services to be provided next…

Read More