For Business

Great advice for every business owner

Great advice for every business owner

Read MoreHow a spouse-owned business can reduce your tax bill

In husband-wife businesses – who takes the money can make a big difference.

Read MoreHow to find the AFR. . .PDQ

How to use the AFR to save taxes.

Read MoreThe many faces of tax-based costs

The many faces of tax-based costs

Read MoreHelp from the last place you’d expect it

Most of us have heard about ransomware and the damage it can cause. The newest phishing malware purports to be a questionnaire from the IRS and FBI. Contrary to what you’d expect, the IRS’ website has a helpful description and warning which is reproduced below. WASHINGTON — The Internal Revenue Service today warned people to avoid a…

Read MoreHow to avoid (in some cases) the 50% reduction on meals.

How to “supersize” your deduction for meals

Read MoreLoans from your company

Are loans from your company a good idea?

Read MoreCyber security – is your network at risk

Is your business network at risk for a cyber attack?

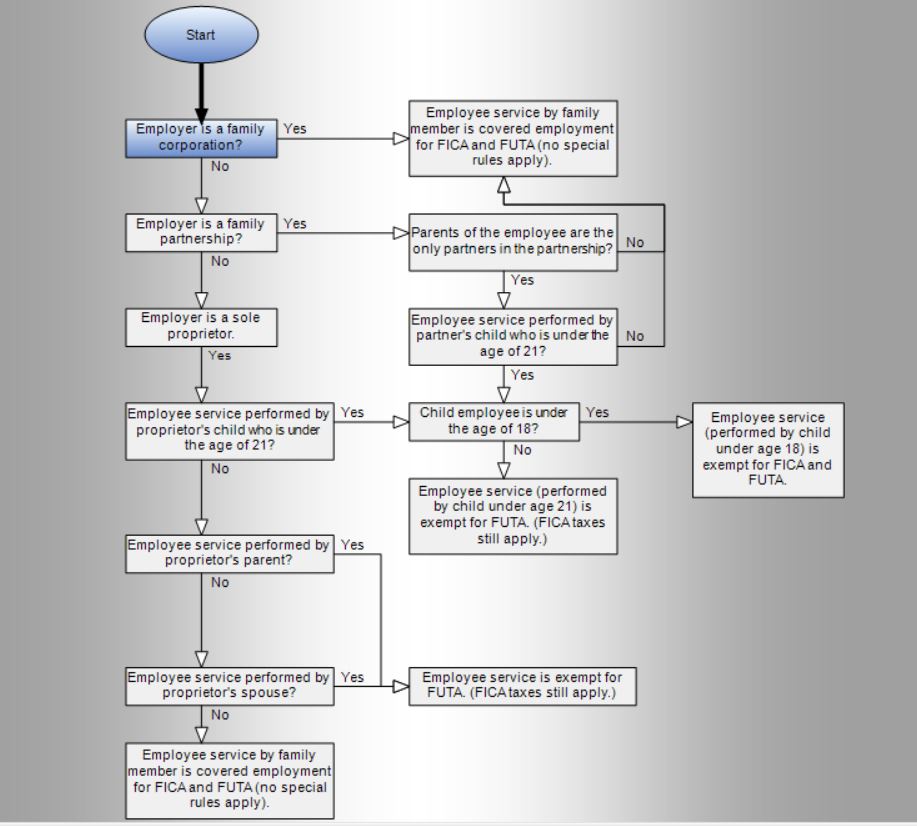

Read MoreHiring your children – Part II

Hiring family members may save your company some payroll taxes!

Read MoreKeeping it all in the family – Part 1

Hiring your children can save taxes for your business and your family

Read More