For Individuals

Now you see it . . .now you don’t

A magic trick by Congress!

Read MoreA Planning Tool for 2016 and beyond

Confused about the tax tools for retirement planning? Here’s some help.

Read MoreNo good deed (or charitable donation) goes unpunished

In the case of non-cash charitable gifts you need to be careful not to fall into several tax traps that may limit your deduction.

Read MoreChristmas gifts and the Federal Gift Tax

During the season of giving, you can (tax-wise) accomplish some effective giving as well.

Read MoreOur Christmas gift to clients – more deductions for year end!

Well . . . it’s technically not a “gift” but it will help you lower your taxable income for 2014.

Read MoreRemembering Veteran’s Day

Tax advantages just for veterans

Read MoreForget about Halloween: here’s something that’s truly scary!

One of the scariest things you’ll ever see.

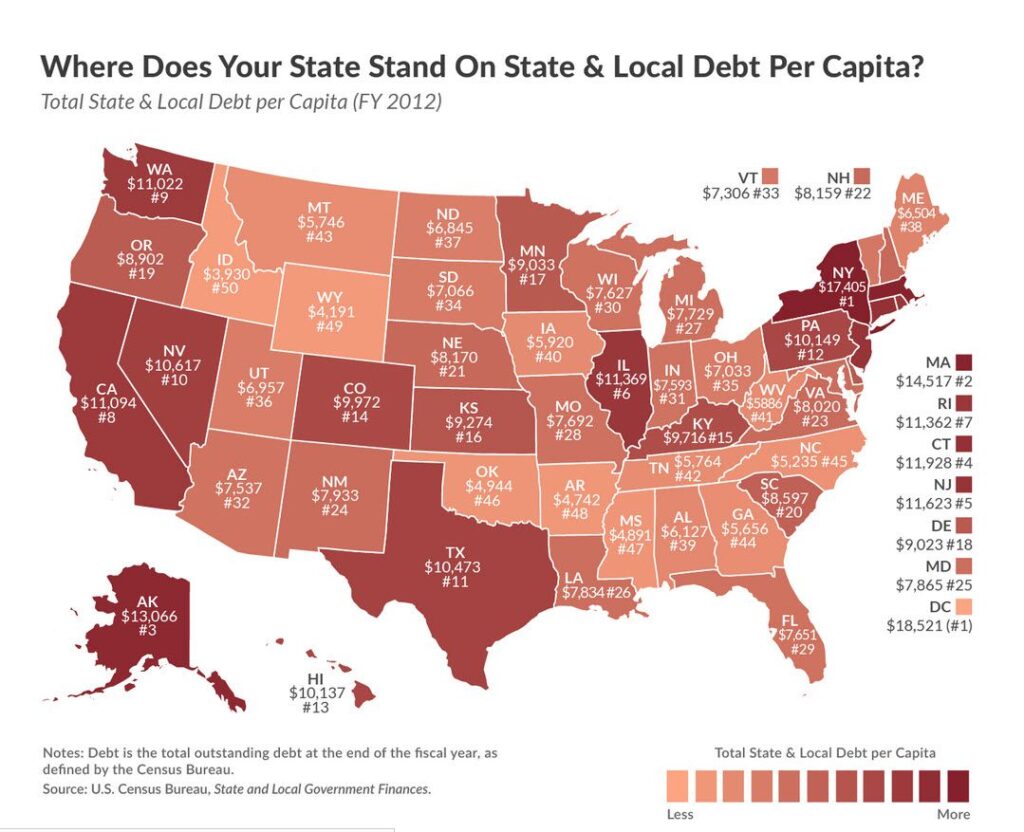

Read MoreWhy it’s good to be number 44 out of 50

Georgia ranks among the lowest in debt per capita

Read MoreYour most important job

It may be a speech for your product or service, or just to promote the goodwill of your company – but it’s important to do it well.

Read MoreWays to get money out of your IRA

Need money from your IRA but want to avoid the 10% penlalty?

Read More