For Individuals

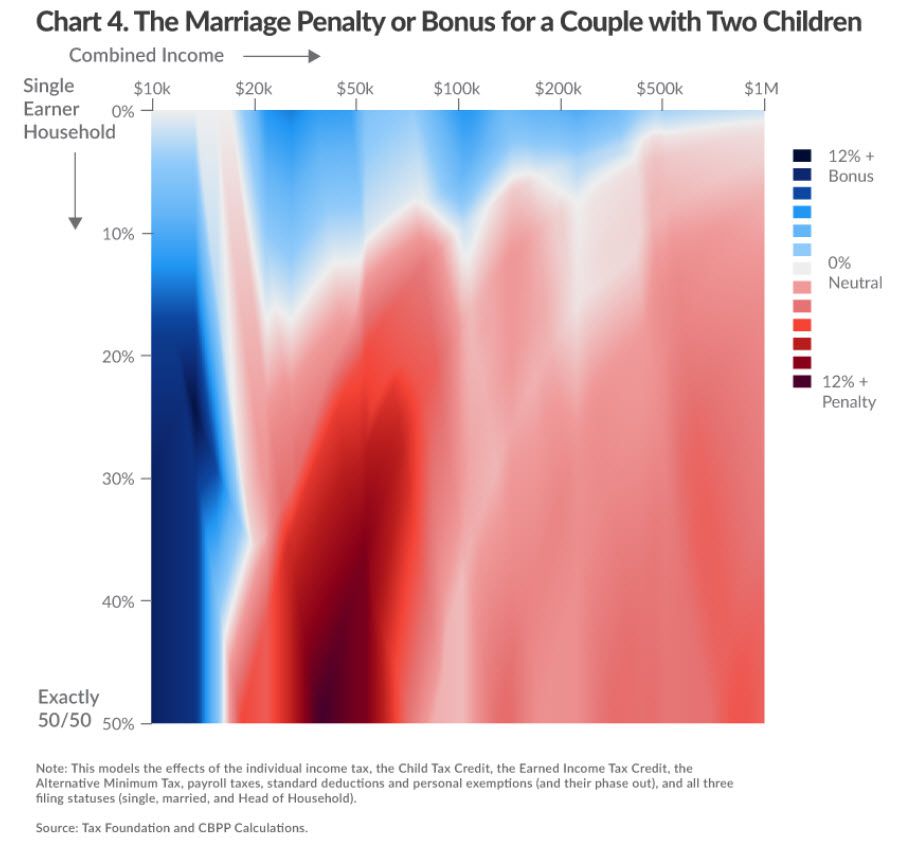

May-June marriages can bring April tax bills

Combining two incomes may more than double your tax bill! Here’s how to fight back.

Read MoreIf you paid a penalty for no insurance coverage in 2014

Expect Obamacare penalties to get worse next year.

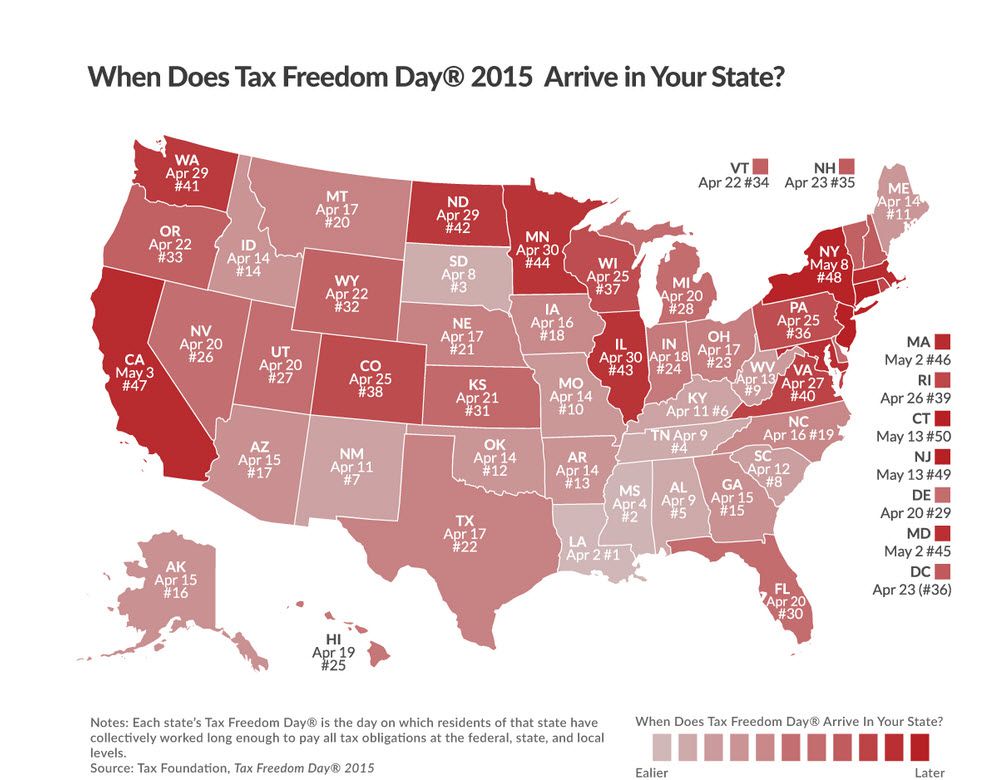

Read MoreFree at last! Free at last!

Just how free are you? It may depend on where you live.

Read MoreIRS-Based Scams

[icon image=”megaphone” align=”left” width=”45″] [alert style=”danger” close=”false”] [Editor’s Note] Update – All the information below the next parargraph is from an older post with examples of IRS-based scams. The newest breach of your tax return data from the IRS’ computers is detailed by CNN Money at this link. I’m just guessing, but I suspect the…

Read MoreIRS approves April 2015 deduction on your 2014 return:

Donations to slain Police Officer’s families can be backdated to 2014.

Read MoreAre you a “real estate professional”?

During tax season, we get a lot of questions about the deductibility of rental real estate losses. There is not a single “sound bite” type of answer as it can depend upon your income level, type of property, and the degree to which you share in the management responsibilities.

Read More“To Sell or Not to Sell -that is the question.” – William Shakespeare [edited]

Although we don’t give investment advice, we thought a simple math formula that helps you maximize your stock gains might be useful.

Read MoreHow to E-Sign your individual tax return

How to E-Sign your individual tax return

Read MoreMyths about Taxable Income

My Social Security benefits aren’t taxable. Depending on the amount of other income that a taxpayer has to report, their benefits may be taxable – but the maximum amount of Social Security benefits that must be included is 85 percent. I don’t need to report stock sales if I bought other stocks with the proceeds.…

Read MoreWhy tax year 2014 requires more work

In March, 2010. President Obama signed the Affordable Care Act. One provision of the Act required that in 2014 all Americans must have qualified health insurance or face a “Shared Responsibility Payment,” more commonly known as the Health Care Penalty. A lesser known amendment to the Act allowed insurance providers and large employers a one-year…

Read More