For Individuals

Executive Summary of Timeline for Obamacare provisions

Editor’s Note: There have been substantial changes in the ACA law since we published this post. See our current newsletter for updated information. The Cliff Notes version (detailed explanation below) 2010 – 2011 Small business tax credit Adult dependent insurance coverage Return information disclosure Restrictions on use of HSA and FSA funds 2012 Information reporting…

Read MoreCan the “Fonz” drive in reverse?

Henry Winkler (a/k/a “The Fonz” on the Happy Days TV series) can be currently seen on television advertising for senior citizens to sign up for a reverse mortgage. Before you can make a financial decision on anything, you need to know: How does it work, and How does it help (or hurt) me financially? How…

Read MoreWhat our email footer really means!

IRS Circular 230 Disclosure – What Does all the legalese really mean? Our SCA team prides itself in looking after each client’s tax affairs as if they were our own. We leave no tax deduction aside you’re legally entitled to take. Reliance on professional advice has usually been the only thing required…

Read MoreWhen we say it’s secure – we mean it!

We talk a lot about the importance of keeping your data secure. Three years ago we offered our SCA secure portals which use a transparent 256bit encryption. The problem is that most of us don’t take our computer with us when we visit our banker or stockbroker. To fix this inconvenience for our clients, we’ve…

Read MoreWhen it’s OK to be average

Here are the average deductions, by level of income, based on the latest available IRS stats. The following are preliminary figures released by the IRS (their reports lag behind the current tax year because of the time needed to compile figures). These are averages only. [Editor’s note: Remember that there is no “average” amount that…

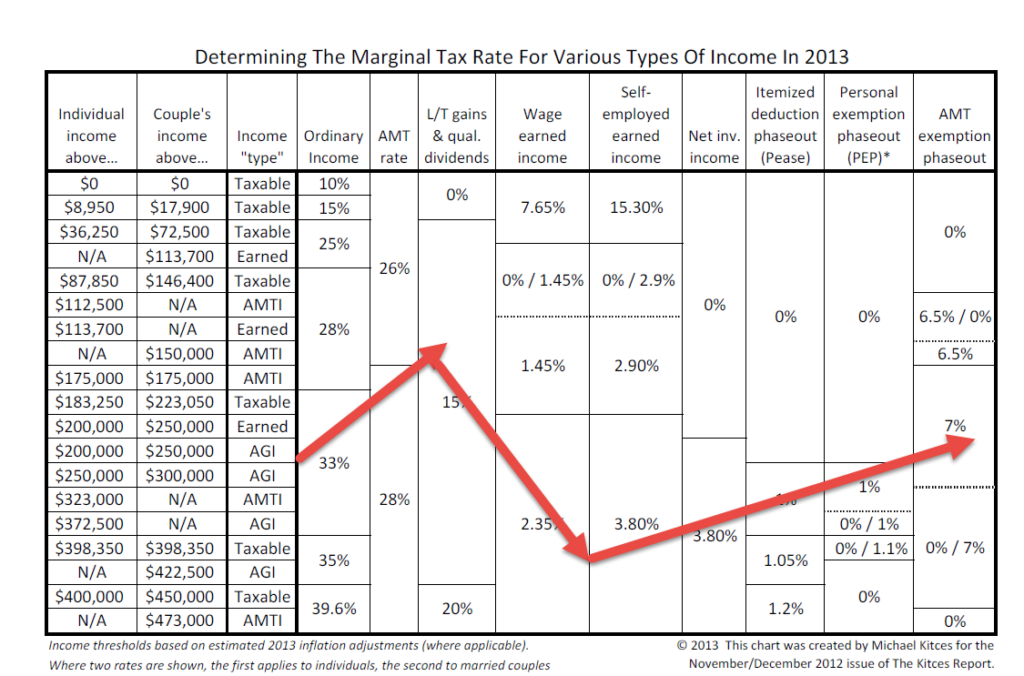

Read MoreWhat’s my tax rate? Here’s why that can be a hard question.

Clients are sometimes surprised that we need to call them back with an answer to the above question. The chart below explains why this can require some analysis to answer. On this client’s 2013 return, he has encountered no less than six rate structures. Since you can’t effectively plan without knowing your real marginal rate,…

Read MoreCan you deduct the cost of a Skybox used for business entertainment?

The answer is yes – for the most part. Here’s a letter we wrote to a client explaning how this works. Dear [name redacted] You’ve asked us to review the tax limitations on deducting the expenses of renting a skybox or other private luxury box at a sporting event. Skybox rentals are subject to…

Read MoreAreas for Tax Planning in 2014 & 2015

A visual summary of Tax Planning areas for 2014

Read MoreDIY tools and why you may not want to use them.

If you’re the DIY (do it yourself) type, here are the tools.

Read MoreSticker shock awaits many clients on their 2013 tax return

Many folks will get a severe case of sticker shock in 2013. Here’s why.

Read More