For Individuals

Special Tax Deductions for Special Education via the WSJ

This Wall Street Journal Article contains a good overview of the tax breaks available for special education costs. “More than six million children in the U.S. fall into the “special needs” category, and their ranks are expanding. The number of those affected by one developmental disability alone—autism—grew more than 70% between 2005 and 2010. The…

Read MoreWhy annuities may not be a good fit for senior citizens

This article highlights difficulties that some senior citizens have had with annuities. Arizona seniors lost millions in annuity fees, lawsuits say Lawsuits highlight risks for elderly of investment choices by Robert Anglen – Nov. 7, 2011 12:00 AM-The Arizona Republic Hundreds of Arizona senior citizens cashed in their retirement investments and paid millions of dollars in unnecessary fees,…

Read MoreThe theory of relativity is in the tax code

This is not the theory discovered by Einstein, but the one that states that certain tax advantages may be disallowed if you sell an asset to someone (or a company) that the tax code calls a “related party.” Simply put, selling a capital asset at a loss to any of the following entities will cause the loss…

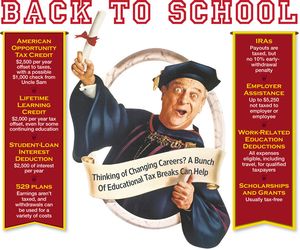

Read MoreEven Rodney may need an advanced degree to understand this.

Not only are there several different types of tax credits and deductions for education, but they can vary according to status within college (Freshman,Senior, etc.) and your level of income. This article from the Wall Street Journal gives a basic overview of what’s available. As always, contact us before acting on this or any tax credit. …

Read MoreWhat you can learn by adding (and subtracting) 8 zeros

Putting things into perspective by removing 8 zeros It’s amazing what simple math can show: An analysis of the numbers below reveals why the average household budget is far better managed than the budget in Washington! -Why S&P downgraded the US credit rating • U.S. Tax revenue: $2,170,000,000,000 • Fed budget: $3,820,000,000,000 •…

Read MoreWhat could happen without a Will?

Sadly, this could be the legacy you leave to your heirs. Think about the results this would produce and then email us for some solutions. What Happens With No Will? LAST WILL AND TESTAMENT OF JOHN DOE (WHO DIED WITHOUT A WILL) I, John Doe, of Nimrod, Missouri, hereby do make, publish and declare this…

Read MoreThe one time that it’s good to be average

Here are the average deductions, by level of income, based on the latest available IRS stats. Average Itemized Deductions Adjusted Gross Income Medical Expenses Taxes Interest Charitable Contributions $15,000 to $30,000 $7,074 $3,147 $9,245 $2,189 $30,000 to $50,000 $6,153 $3,830 $9,055 $2,189 $50,000 to $100,000 $7,102 $6,050 $10,659 $2,693 $100,000 to…

Read MorePlanning for the unexpected in the chess game of Life

A Will to Live by It’s never too early to make a living will. Have you started one? By Rosemary Carlson • Bankrate.com [Breaking news- The Georgia State Bar has made available a free sample medical directive for your use. E-mail us for a free copy.] It could happen at any time. Walk across the street and…

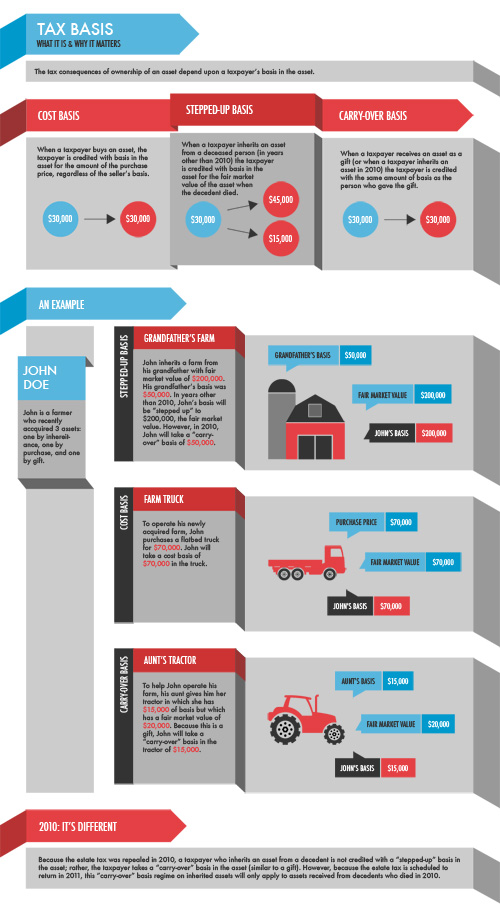

Read MoreCan you deduct more than you paid for something?

Most of the time we’re stuck with tax cost being what we paid for a stock, asset, real estate, etc… but sometimes this can change.

Read More