For Individuals

Get a 30 Percent Tax Credit for Residential Solar Panels

Only a few months left to Claim a Tax Credit for Residential Solar Panels If you’ve decided that you want to go the Solar Energy route, here are some unique tax advantages to help pay for it. The 30 percent residential solar credit: drops to 26 percent for tax year 2020, drops to 22 percent…

Read MoreRoth vs Traditional IRA – Which is better

Roth IRA versus Traditional IRA: Which Is Better for You? I can’t think of a more heated tax debate than this topic has been over the years. This debate is akin to the feud between the Hatfields and McCoys, the Montague and Capulets, the Union and the South, etc. Accountants tend to be split…

Read MoreRed Alert – Data Breach

Two years ago, we published this alert about the Equifax data breach and the steps you should take. Today, it’s happened again! This time it’s about 100 million Capital One credit card application’s info that may be exposed. We’ll quote an article from PC World: “On Monday night, Capital One revealed that more than 100…

Read MoreNumbers that we should remember

There are many numbers (tax rates, investment percentages, etc.) that we like for clients to remember, but as we approach Independence Day, we ought to refocus on some numbers that are just as important. Our broker friends have provided them in the video below.

Read MoreThe US national debt

Should you be paying “your fair share”

How taxes really work

Read MoreCliff notes of the new tax law

Most clients don’t really need to know all the aspects of Tax Reform. But a quick reference guide can be helpful. From the new rules on alimony to 529 plans to mortgage interest limitations to meals and entertainment and the new 20% business income deduction – here’s the tip sheet you’ll want to print and keep…

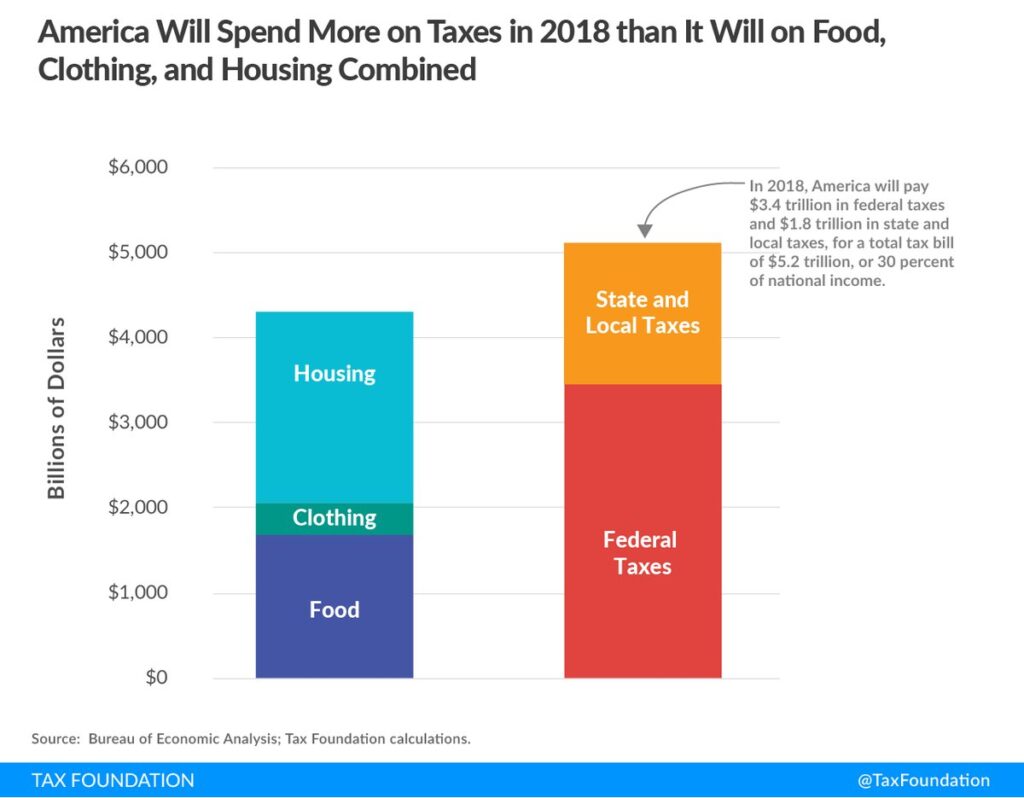

Read MoreWhere your money really goes!

I’m putting this under the category of tax humor but, arguably, it’s not that funny. There used to be a cliche that nothing has changed due to technology and that we still spend most of our income on food, clothing, and shelter. There is something that has grown faster than real estate costs or inflation. That’s the…

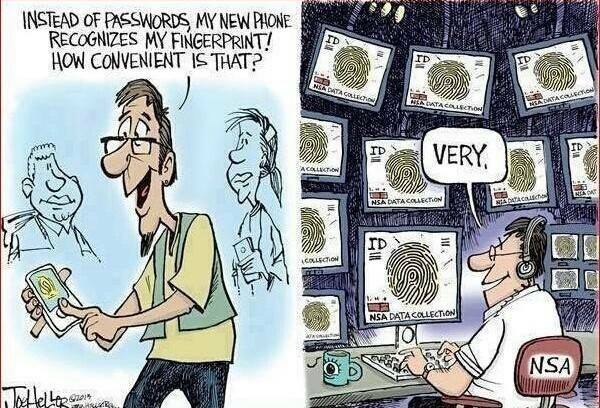

Read MoreGuarding your ID

Guard your ID carefully. Here are some tips.

Read MoreCharting the effects of tax reform on your return

Buckle your seat belt because the road to tax savings just got bumpier. We’ll be covering the major changes for tax year 2018 below. Existing clients can obtain a free detailed report on each area by clicking this link and referencing the phrase in the topic column in the subject line of your email.

Read More