For Individuals

IRS Funding under fire

The IRS was in damage control mode Tuesday after an audit revealed that it paid bonuses to employees who were in trouble over tax issues themselves.

Read MoreA tax break for Seniors

Sometimes Congress actually gets something right! This happens so rarely that I wanted to write a special blog post on it. Clients who have followed our advice over the years tend to retire with no mortgage debt and few out-of-pocket medical expenses. This leaves their charitable contributions as the main source of itemized deductions to…

Read MoreA tax shelter like no other

The only tax shelter that you can deduct contributions and not be taxed on distributions.

Read MoreFreedom in Georgia declines by 25%

Just how free are you? It may depend on where you live.

Read MoreDid you think the 50% tax rate was gone?

The other tax date in April – this one can cost you 50!

Read MoreDon’t let your deduction get washed out

How the “wash sale” rules can cancel your current year write-off

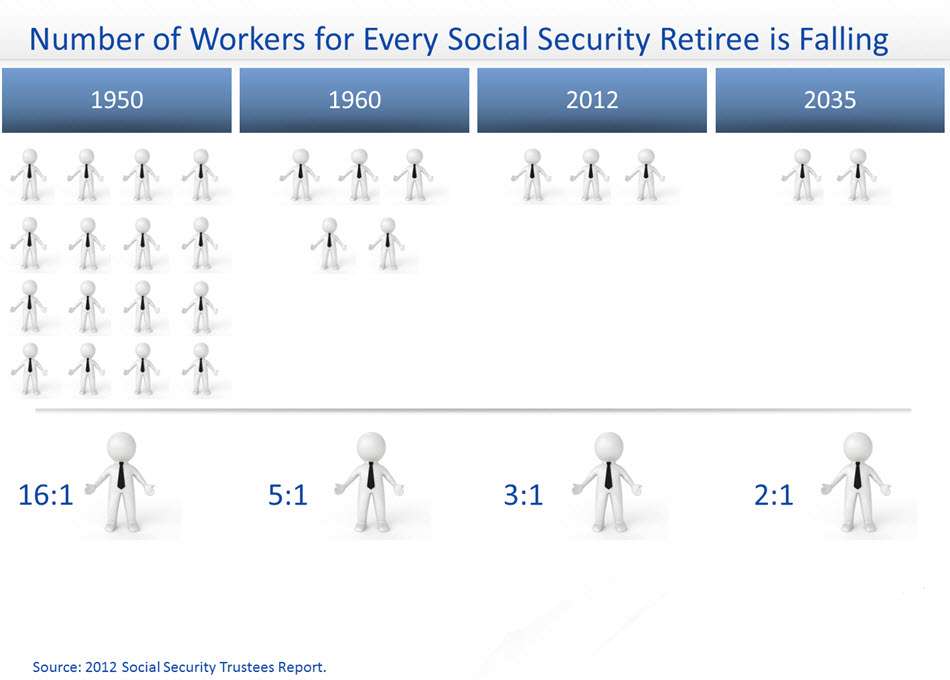

Read MoreWhat simple math can tell you about Social Security

You don’t have to be a genius to know what simple math ratios indicate is happening to social security. Just take a look at the chart below, and you’ll know why you can’t trust Social Security exclusively for your retirement. [lightbox link=”https://elitecpatax.com/wp-content/uploads/2016/01/numberssworkers.jpg” thumb=”https://elitecpatax.com/wp-content/uploads/2016/01/numberssworkers-940×673.jpg” width=”940″ align=”left” title=”numberssworkers” frame=”true” icon=”image” caption=””] Planning now is always better than…

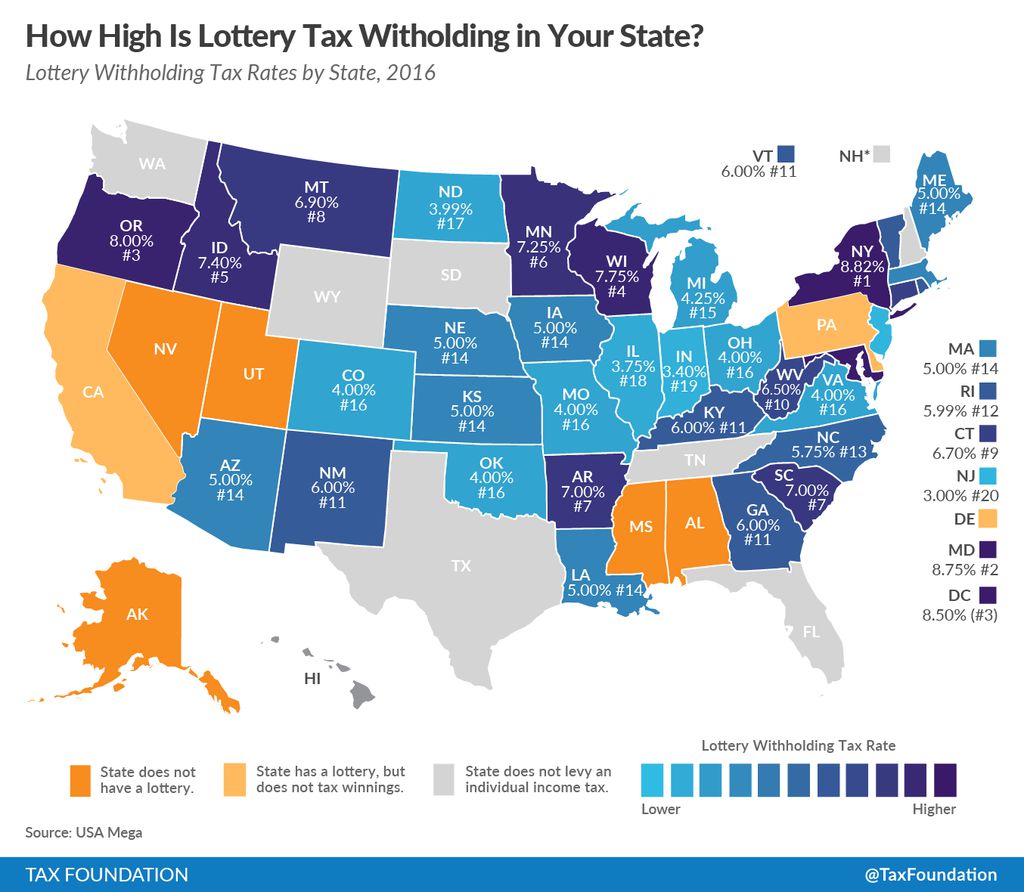

Read MoreIf you win the powerball lottery . . .

If you win the powerball . . . how much state tax is due?

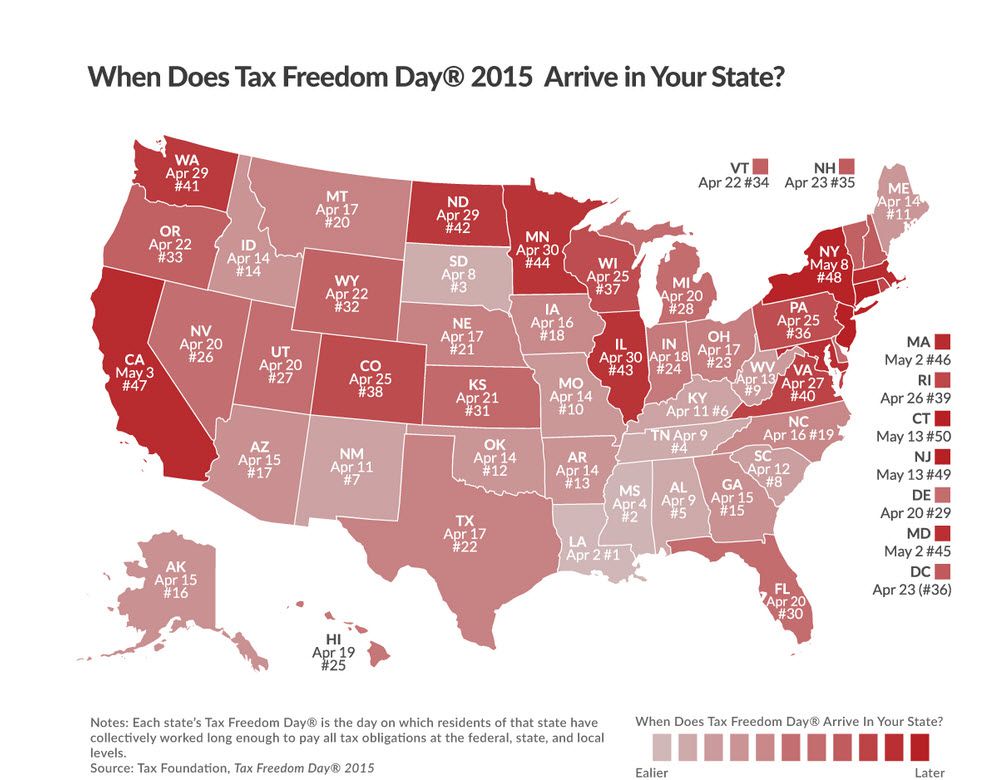

Read MoreThe long, long, arm of Uncle Sam

How the government redistributes your income

Read MoreDoes it ever pay to be just average?

Here are the average tax deductions by income level according to the IRS

Read More