Posts Tagged ‘2012’

Can you guess what’s coming next?

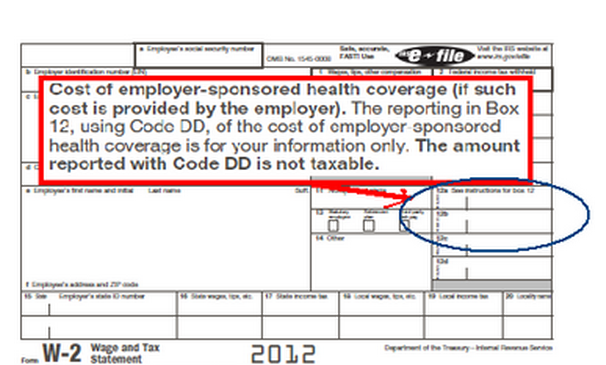

Laura Saunders has a great exercise in predictive logic in the tax section of the Wall Street Journal. Most clients’ largest tax benefit may soon be under attack if she’s right! ” When you receive your W-2 for 2012, pay attention to a surprising new number on the form, especially if you are an upper-income-bracket taxpayer.…

Read MoreIRS releases revised E-File date

You may remember our post a few weeks ago where the IRS predicted that the fiscal cliff may cause filing delays until the end of March for complex returns. Due to a semi-solution by Congress, we now have IRS confirmation that January 30 is approved as the first day for E-Filing. Advanced returns will still be…

Read MoreA Tale of Two Tax Plans

With apologies to Charles Dickens, here’s an easy to understand graphic of how the upcoming tax plans measure up. Source: www.backtaxeshelp.com

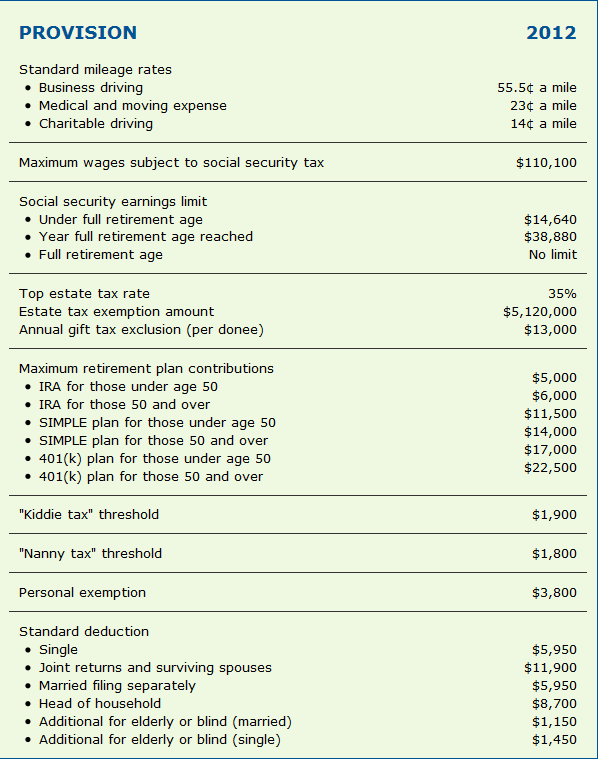

Read MoreHow to keep score in 2012

Congress has once again adjusted the dollar amount of allowabe mileage,social security limits,estate rates, and a host of other deductions. Here’s a handy scorecard for 2012.

Read More