Posts Tagged ‘2013’

The fiscal cliff in graphic form

Hollywood’s Friday the 13th and Freddy Kruger can’t begin to compare to how scary this picture promises to be. Coming to a country (very) near you on January 1, 2013. Clients can E-mail us for a special video presentation with specific details on what’s involved. We’ve also compiled a listing of helpful articles which can…

Read MoreBreaking tax news for 2013!

IRS just announced the new (and higher) limits on 401(k) plans etc. Here’s a summary for use in 2013 tax planning. The inflation-adjustments for 2013 include: Gift Tax Exemption: $14,000 (up $1,000 from 2012) Contribution Limit for 401(k)/403(b)/457 Plans: $17,500 (up $500 from 2012) Catch-Up Contribution Limit (Age 50+) for 401(k)/403(b)/457 Plans: $5,500 (same as 2012)…

Read MoreThe Anti-Investment tax of 2013! We explain how and when it applies.

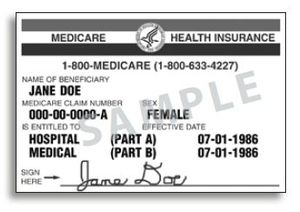

CPA gives 3 minute summary of the new Medicare tax

Read MoreA tutorial for business owners on the new Medicare tax

An individual is liable for Additional Medicare Tax if the individual’s wages, other compensation, or self-employment income

(together with that of his or her spouse if filing a joint return) exceed the threshold amount for the individual’s filing status:

Some folks will see a 74% increase in the tax rates in 2013-(from the WSJ)

We’re not kidding about the higher part as the new capital gain rates (remember the “capital” in capitalism). Just put your mouse over the picture to see proof that capital gains could go as high as 25% in 2013 ( a 67% increase)! The Wall St Journal says it best in their July 2, 2012…

Read More