Posts Tagged ‘Capital gain’

What a difference a name makes!

How you define “Real Estate Investor” and “Real Estate Dealer” can make a huge difference in your taxes. Let’s take a look at how big a difference you can make in the tax bite. Say you have a $90,000 profit on the sale of a property. • Dealer taxes could be as high as $46,017. •…

Read More“To Sell or Not to Sell -that is the question.” – William Shakespeare [edited]

Although we don’t give investment advice, we thought a simple math formula that helps you maximize your stock gains might be useful.

Read MoreAreas for Tax Planning in 2014 & 2015

A visual summary of Tax Planning areas for 2014

Read MoreThe Anti-Investment tax of 2013! We explain how and when it applies.

CPA gives 3 minute summary of the new Medicare tax

Read MoreJust what a sagging stock market needs to recover

Let’s have a 289% increase on dividend earnings. That’ll really make people want to [sarcasm intended] buy into American business. Actually, there is nothing that will damage the market performance worse than this. If you own investments and would like them to increase in value, I’d make my voice known on this.

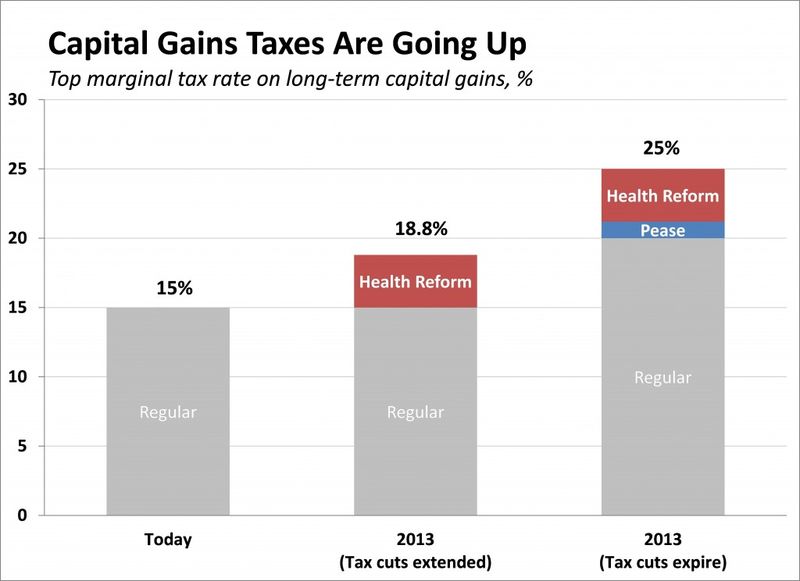

Read MoreSome folks will see a 74% increase in the tax rates in 2013-(from the WSJ)

We’re not kidding about the higher part as the new capital gain rates (remember the “capital” in capitalism). Just put your mouse over the picture to see proof that capital gains could go as high as 25% in 2013 ( a 67% increase)! The Wall St Journal says it best in their July 2, 2012…

Read MoreDon’t like the “rich” getting lower capital gain rates? Don’t worry; it’s going up 67%!

Before the anti-capitalists rejoice too much . . . Just remember that, in our capitalistic system, all economic benefits for both rich and poor are driven by the formation of capital. If it becomes harder to hang on to your capital, then there will be less fuel for the economy’s engine. That said, here’s where the highest capital gain…

Read More