Posts Tagged ‘charity’

Donor-Advised Funds -they are easier than you think

Donor-Advised Funds: A Tax Planning Tool for Church and Charity Donations Do you give money to your church? Do you get a tax benefit from those donations? How about your donations to other charities? Recent changes in the tax code have done much to destroy your benefits from church and other tax-deductible 501(c)(3) donations. But…

Read MoreChristmas giving and tax deductions

In the case of non-cash charitable gifts you need to be careful not to fall into several tax traps that may limit your deduction.

Read MoreFreeloader Nation

Why you should work through a local charity

Read MoreNo good deed (or charitable donation) goes unpunished

In the case of non-cash charitable gifts you need to be careful not to fall into several tax traps that may limit your deduction.

Read MoreNo good deed (or charitable donation) goes unpunished

In the case of non-cash charitable gifts you need to be careful not to fall into several tax traps that may limit your deduction.

Read MoreMore tax deductions that you may have missed

Since our first post on deductions that you may have missed, several more items have come to mind that we find clients tend to forget or just don’t know that they’re existent. Most clients either volunteer for some charity work, serve on the boards of private or public foundations, help out at a shelter,…

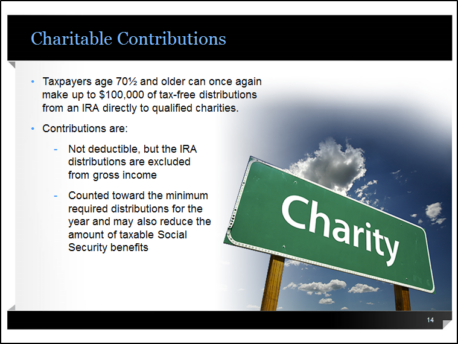

Read MoreTime running out for a do-over on your IRA distribution!

As our golfer friends say, time is running out for a mulligan on any IRA distributions that were required by 12/31/12. The fiscal cliff law signed by the President on January 2 has a retroactive provision that could help you out of a jam if you forgot to take a RMD (required minimum distribution) from…

Read More