Posts Tagged ‘education’

Why you should start a 529 Plan for your 2 year-old child

Start the 15-year clock! Open a 529 plan for each child today. It doesn’t take thousands of dollars or in some cases even hundreds of dollars-maybe as little as $100 to open this savings account. By opening it now the parent can start the 15-year savings clock so that all earnings in the account are…

Read MoreHow to use your 529 Plan for private high school education costs

Tax Reform opens a new door for your child’s education

Read MorePaying for employee education

Reimbursing employees for education expenses can both strengthen the capabilities of your staff and help you retain them.

Read MoreSpecial Tax Deductions for Special Education via the WSJ

This Wall Street Journal Article contains a good overview of the tax breaks available for special education costs. “More than six million children in the U.S. fall into the “special needs” category, and their ranks are expanding. The number of those affected by one developmental disability alone—autism—grew more than 70% between 2005 and 2010. The…

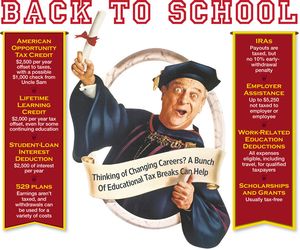

Read MoreEven Rodney may need an advanced degree to understand this.

Not only are there several different types of tax credits and deductions for education, but they can vary according to status within college (Freshman,Senior, etc.) and your level of income. This article from the Wall Street Journal gives a basic overview of what’s available. As always, contact us before acting on this or any tax credit. …

Read More