Posts Tagged ‘Estate planning’

Estate Planning under the Biden Administration

The following article is from The National Law Review (Feb 13, 2021 issue by Jacqueline Messler) and does a great job of summarizing the (possible) coming changes in estate tax law. “Over the past twenty years, there has been a dramatic change in the Estate tax laws. Given the Democratic control established in Washington, D.C.…

Read MoreEstate Tax Rates for 2013 and beyond

The zero-hour fiscal cliff law raised the top estate tax rates to 40 percent.

Here’s a table with the new rates for 2013 and beyond.

Where there’s a Will . . .

. . .there are usually some opportunities for tax and estate planning. Most people don’t appreciate the importance of a will, especially if they think their estate is below the level of the estate tax exemption. Even people who recognize the need for a will often don’t have one, perhaps due to procrastination or the lack of…

Read MoreIf you read nothing else this year . . .

be sure to read our letter to clients on how to plan for 2013. This link will take you there. See the effect on your family in 2013 (Click Here) or use our fiscal cliff calculator with the numbers from your 2011 return.

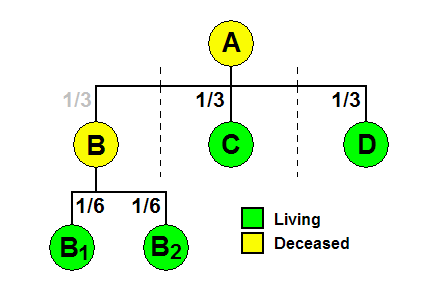

Read MoreTwo words that can change your child’s inheritance

Knowing a little Latin can save you a lot of money. In this case, a little Latin in not a short resident of Greece, but an important legal term that you may see in your will. The term per stirpes, along with its legal cousin, per capita, refers to how an estate is passed along…

Read MoreThe worst state(s) to die in. . .

For estate tax purposes, there are some terrible states to die in this coming year (2013). Hover over the selected states in the map below and you’ll see what we mean.

Read More