Posts Tagged ‘ira’

Are there exceptions to the 10% early withdraw Penalty?

Actually there are quite a few. Here’s a partial list.

Read MoreSummary of IRA deduction rules

Quick summary of IRA rules The maximum annual contribution limit is $6,000 in 2021 and 2022 ($7,000 if age 50 or older). Contributions may be tax-deductible in the year they are made. Investments within the account grow tax-deferred. Withdrawals in retirement are taxed as ordinary income. The IRS requires individuals to begin taking money out of…

Read MoreRoth vs Traditional IRA – Which is better

Roth IRA versus Traditional IRA: Which Is Better for You? I can’t think of a more heated tax debate than this topic has been over the years. This debate is akin to the feud between the Hatfields and McCoys, the Montague and Capulets, the Union and the South, etc. Accountants tend to be split…

Read MoreThe other tax date in April

The other tax date in April – this one can cost you 50%

Read MoreMeet the entire IRA family

The members of the IRA family are very different from each other.

Read MoreA Planning Tool for 2016 and beyond

Confused about the tax tools for retirement planning? Here’s some help.

Read MoreWays to get money out of your IRA

Need money from your IRA but want to avoid the 10% penlalty?

Read MoreYear-End Planning Information for 2014 & 1015

Here’s a complete list of qualified plan limitations, You may want to bookmark this page in your browser for use now and next year.

Read MoreWho gets your Roth-IRA money? (Part IV of Keeping it All in the Family)

Who gets the money from a ROTH-IRA?

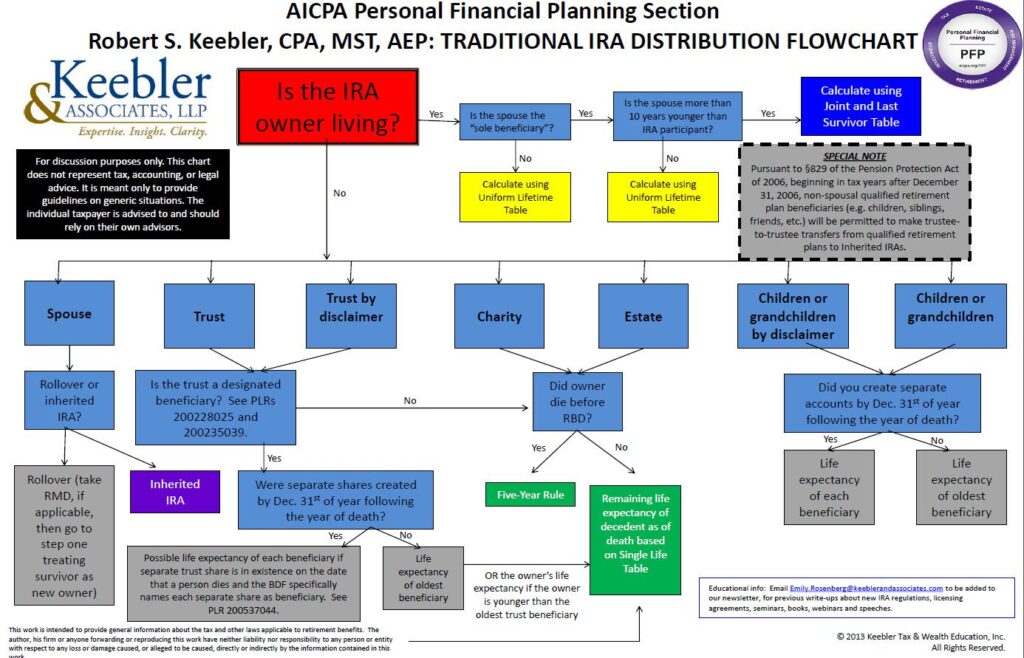

Read MoreWho gets your IRA? It’s not always a simple decision!

When does money have to be paid from an IRA? The answers may surprise you.

Read More